Inflation Drives Up Spending, Anxiety for Retail’s Busy Back-to-School Shopping Season

Parents’ concerns over the affordability of the upcoming back-to-school season have spiked over the last month, with inflation driving up prices for essential household purchases and raising parents’ anticipated spending levels. While most parents will shop summer sales, this might not be enough to assuage their concerns.

View 2023 data on back-to-school spending budgets amid high inflation.

With inflation continuing to dominate headlines, parents’ stress about shopping for the upcoming school year has increased in tandem, rising 7 percentage points in the last two weeks. This is a big swing from 2021, when parents’ back-to-school excitement peaked compared with prior years due to the promise of a semi-normal school year.

While consumers plan to spend more on back to school this year than in previous years, dampened excitement and stretched budgets mean shoppers will be hypervigilant for deals, and that’s not good news for retailers struggling to stay competitive on price as their own costs increase. As consumers’ savings boost from the pandemic erodes, so does their ability to absorb increased costs of essentials. Right now the trade-offs are coming from large, durable goods like cars, furniture and personal electronics, but if current inflation rates persist, back-to-school categories like apparel and school supplies will be next to take a hit.

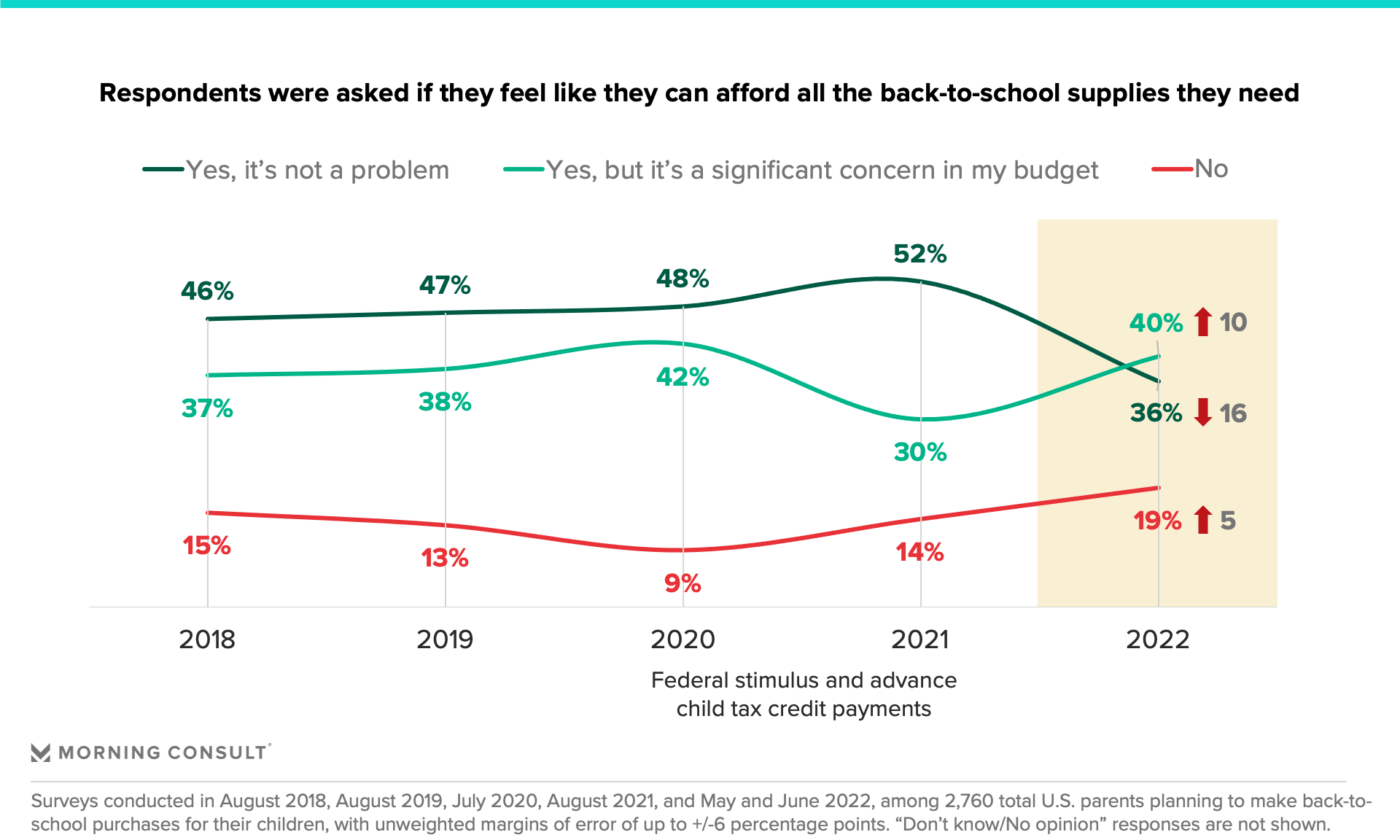

Parents worry about financial strain for this year’s back-to-school season

Back-to-school affordability in 2022 stands in sharp contrast to that of the last four years, with far fewer parents saying they can afford their kids’ back-to-school shopping without any issues (36% in 2022 versus 52% in 2021). In 2021, more families had the benefit of stimulus checks and advance child tax credit payments in their pockets, as well as pandemic savings from reduced service-sector spending — but now these savings are depleting as the burden of inflation gets heavier.

While higher-income households are absorbing increased prices, lower-income ones are making hard trade-offs. Parents who aren’t worried about affording this year’s back-to-school lists and new outfits are planning to spend more than in previous years, while those that are more worried are planning to spend less, given the pressure on families to afford essentials like gas and groceries.

Planned spending for 2022 back-to-school shopping shoots upward

Since early May, the share of back-to-school shoppers planning to spend more than $500 on their children’s supplies this season has increased from 11% to 25%. Just 7% of parents doing back-to-school shopping for the previous school year planned to spend more than $500. This is consistent with consumers’ ongoing expectations of high inflation, which will impact their decision-making through the summer months. In fact, parents who have already started shopping — and have seen what their kids’ lists will cost this year — are more likely to report that they’ll spend more than last year (34% of those who have started shopping versus 26% of those who have not).

Parents plan to spend the most on clothes this year compared with other back-to-school goods, with a plurality (45%) planning to spend between $101 and $250. Supplies like folders and backpacks come next, with books and electronic devices garnering smaller shares of budgets, as many schools provide these items for their students.

Of course, there’s variability in category spending data depending on grade level. College students will spend more on books, personal electronics, and home goods to outfit their dorms and apartments, while middle and high schoolers’ parents will spend more on school supplies and apparel.

Summer sales will help, but they won’t be enough to mitigate inflation pain

Parents’ planned overall spending levels are similar whether they feel they can afford back-to-school shopping this year or not, so retailers can expect families to shop in full force despite the financial stress. That likely means this year’s shopping will add to household debt, as we know that consumers are increasingly relying on credit cards.

Back-to-school shopping has yet to begin in earnest — 71% of parents planning on shopping haven’t started yet, and most will wait until late July or early August — but the Federal Reserve’s recent interest rate hike won’t drive down consumer prices in such a short time frame, so we can expect deferred discretionary spending to last through the back-to-school season.

Parents will deploy multiple shopping strategies to help mitigate costs. One is secondhand shopping, which is concentrated on schoolbooks (44%), clothes (26%) and electronics (23%). However, used items only represent a small portion of back-to-school shopping plans: Most parents say they only intend to buy a few used items.

The second, more popular solution is the usual summer sales from major retailers. Amazon’s recent announcement that Prime Day will be July 12-13 could pull spending forward — 45% of parents planning to do back-to-school shopping said they will take advantage of Prime Day sales, per June 12 data — and many retailers are following Amazon’s lead in timing their own July sales. State tax-free holidays are another popular sale event before the next school year starts. Parents who are less worried about affording back-to-school shopping — and more likely to be getting a head start on shopping — are planning to shop sales at slightly higher rates than those who are worried about affording school supplies. Ultimately, sales will help stretch budgets, but they are far from being a panacea.