Forget First-Class Seats and Penthouse Suites — Luxury Travel Is About Customer Service

Key Takeaways

Around 1 in 5 U.S. adults have an unfavorable impression of the word “luxury” as it relates to leisure travel.

Consumers most want to feel relaxed and comfortable and receive great customer service when they travel, and they also associate those factors with luxury.

Travel brands should focus on the experiential aspects of luxury to broaden their customer base and deliver memorable experiences.

Data Downloads

With robust sample sizes, Morning Consult’s public opinion data can be analyzed by specific demographics, such as gender, generation, political party, income, race and more. Please contact [email protected] to purchase this data.

When it comes to the term “luxury” in travel, perhaps Inigo Montoya from the classic film The Princess Bride said it best: “You keep using that word. I do not think it means what you think it means.”

For years, luxury travel has been positioned as expensive and exclusive, with first-class plane tickets and indulgent spa visits. But perceptions and definitions of luxury are evolving, and brands can capture a much wider audience by reframing their definition of luxury to more closely align with new traveler expectations.

Many adults have an unfavorable opinion of the word “luxury” in travel

Traditionally, luxury products and experiences have been positioned as aspirational. But as cultural preferences evolve, so do the things consumers aspire to. The Great Recession of the late aughts ushered in an era of austerity and caused consumers to rethink how they spent their hard-earned money. Simply being pricey for pricey’s sake fell out of fashion as people began to focus more on quality and usage — in other words, consumers were looking for value in their purchases. Now, amid ongoing economic uncertainties and concern for personal finances, spending scrutiny is once again heightened.

With this shift, the traditional definition of “luxury” has grown less enticing for consumers. In fact, 21% of U.S. adults have an unfavorable impression of the word “luxury” as it relates to travel. While the term’s net favorability (the share of those with a favorable impression minus the share with an unfavorable impression) is still positive at 46 percentage points, that number pales in comparison to the net favorability of other words that imply the value of a travel experience, such as “authentic,” “unique,” “personalized” and, above all, “relaxing.”

‘Luxury’ Is Less Appealing Than Other Travel Terms

The term’s favorability is slightly higher among people who fall into the traditional “luxury traveler” demographic: consumers in households earning at least $100,000 annually, as well as those who earn $100,000 or more and also have at least $50,000 in investments. However, “luxury” and related terminology like “high-end,” “premier” and “elite” tend to be less favorable than other terms for these groups as well. In fact, around two-thirds of consumers in both groups said they consider luxury travel “excessive,” suggesting that even the target market may be rethinking or scrutinizing its spending in the category.

These shifting perceptions represent an opportunity for travel brands to move away from tired, outdated language and use more accessible, familiar terminology that connects with both the affluent and the general public. Using words like “unique,” “personalized” and “authentic” to connote luxury experiences will capture the attention of the core luxury demographic and also expand the audience to include more participants.

The new definition of luxury travel is comfort and great service

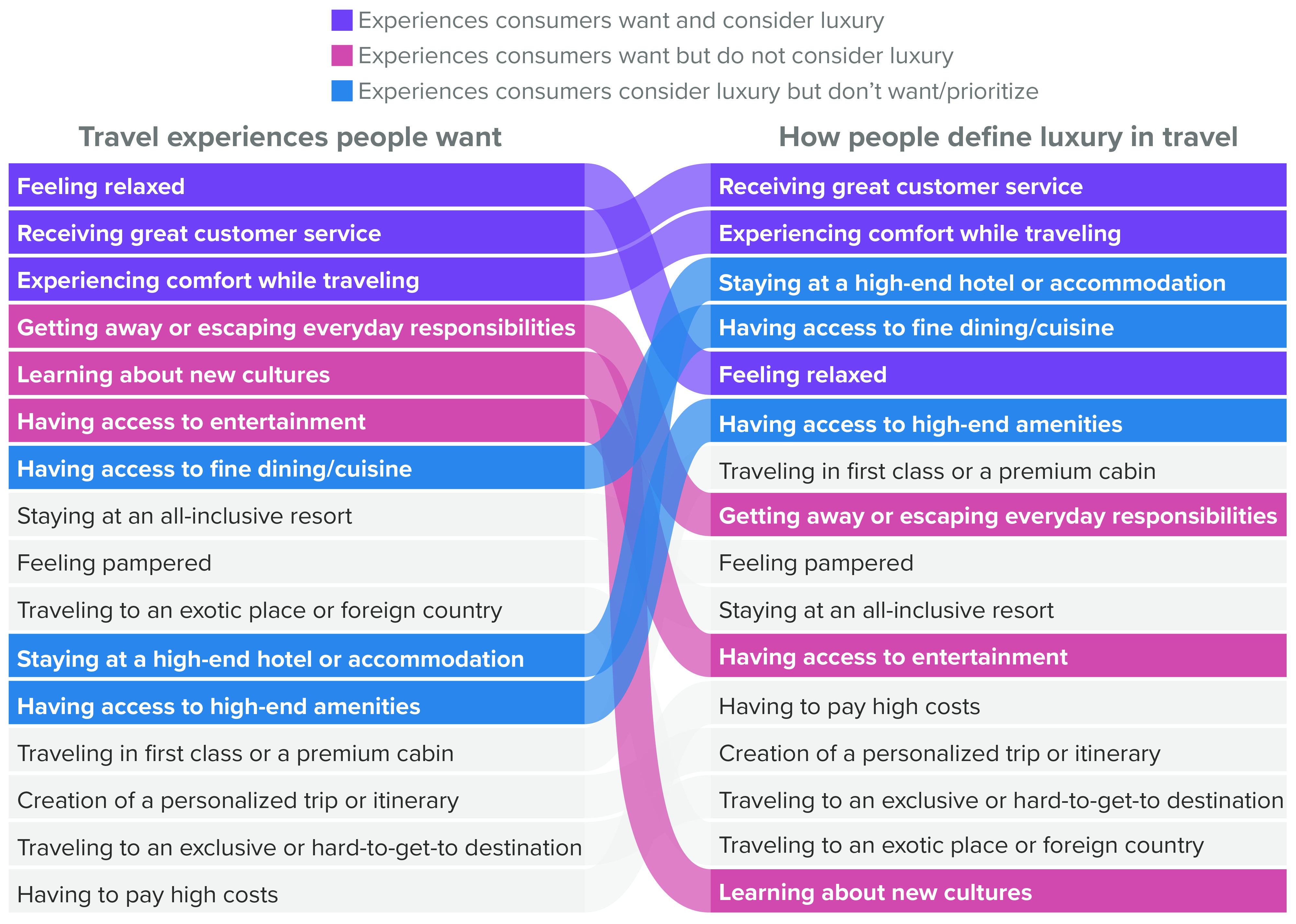

The shifting language that appeals to travelers reflects not only a new way of talking about luxury, but also evolving preferences in the space. When it comes to leisure travel, experiences like taking a first-class flight or staying in a fancy hotel — traditional markers of a luxury trip — don’t appeal to consumers as much as feeling relaxed, experiencing comfort and getting great customer service. Of course, just because a certain aspect of travel is preferred by consumers doesn’t mean it is perceived to be luxurious. Travel brands must find the overlap between the things leisure travelers want and the things they define as luxury to unlock new opportunities.

Comfort and Great Customer Service Are Considered Both Appealing and Luxurious

Several elements of luxury are simply not at the top of consumers’ list of travel interests. For example, fine dining and high-end amenities are considered luxurious, but they’re not the things travelers most want. Conversely, some of the things travelers hope for on a leisure trip — getting away from responsibilities or learning about new cultures — don’t fit their definition of luxury.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

The sweet spot? Relaxation, comfort and great customer service. They’re the top three things leisure travelers are most interested in experiencing on a trip and also among the elements of travel that consumers most associate with luxury. When it comes to great customer service, for example, 55% of U.S. adults said it would “definitely” have to be part of a travel experience for it to be considered luxury, and 58% said they are “very interested” in receiving great customer service on a leisure trip.

The good news for travel brands is that these are desires that can be fulfilled. Premium cabin seats and corner hotel suites may be limited, but the opportunity to provide excellent service and to help guests feel relaxed and comfortable is infinite. Given the rise of automation, this should also give hospitality leaders pause. It will be crucial, as digital tools evolve, to consider what enhances the customer experience and what may make a guest feel they’re lacking the service they desire.

No matter the definition, luxury travel feels out of reach for many

The idea of taking a luxury trip is enticing for the majority of consumers: Nearly two-thirds (64%) said they are interested in doing so, with 29% saying they are “very interested.” But given the way luxury travel is often positioned by the industry, it feels out of reach for many: 58% of consumers said they could not take a luxury trip right now even if they wanted to.

Perhaps surprisingly, the demographic profile of those who said they are both interested in luxury travel and do not think they can do it is quite similar to that of adults in general. Naturally, there are some minor differences by income: The lowest earners make up 57% of this group, compared with 50% of the general population, while middle- and high-income consumers slightly underindex. And baby boomers are underrepresented compared with the population as a whole, largely because they are less likely to say they’re interested in luxury travel.

Those Who Are Interested in Luxury Travel but Can’t Do It Largely Mirror the General Population

The main takeaway is that there is both interest in the space and a perceived lack of accessibility among many. The experiences that comprise “new luxury” don’t require the traveler to be affluent, though, which means the audience is broader than many travel brands (and perhaps travelers themselves) may have thought. And ultimately, experiencing something that seems luxurious will make a traveler feel valued and interested in coming back for more. Travel brands must double down on experience, offer great customer service and help customers feel relaxed and comfortable to truly deliver luxury.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.