Millennials Pose the Biggest Attrition Threat to Banks

Key Takeaways

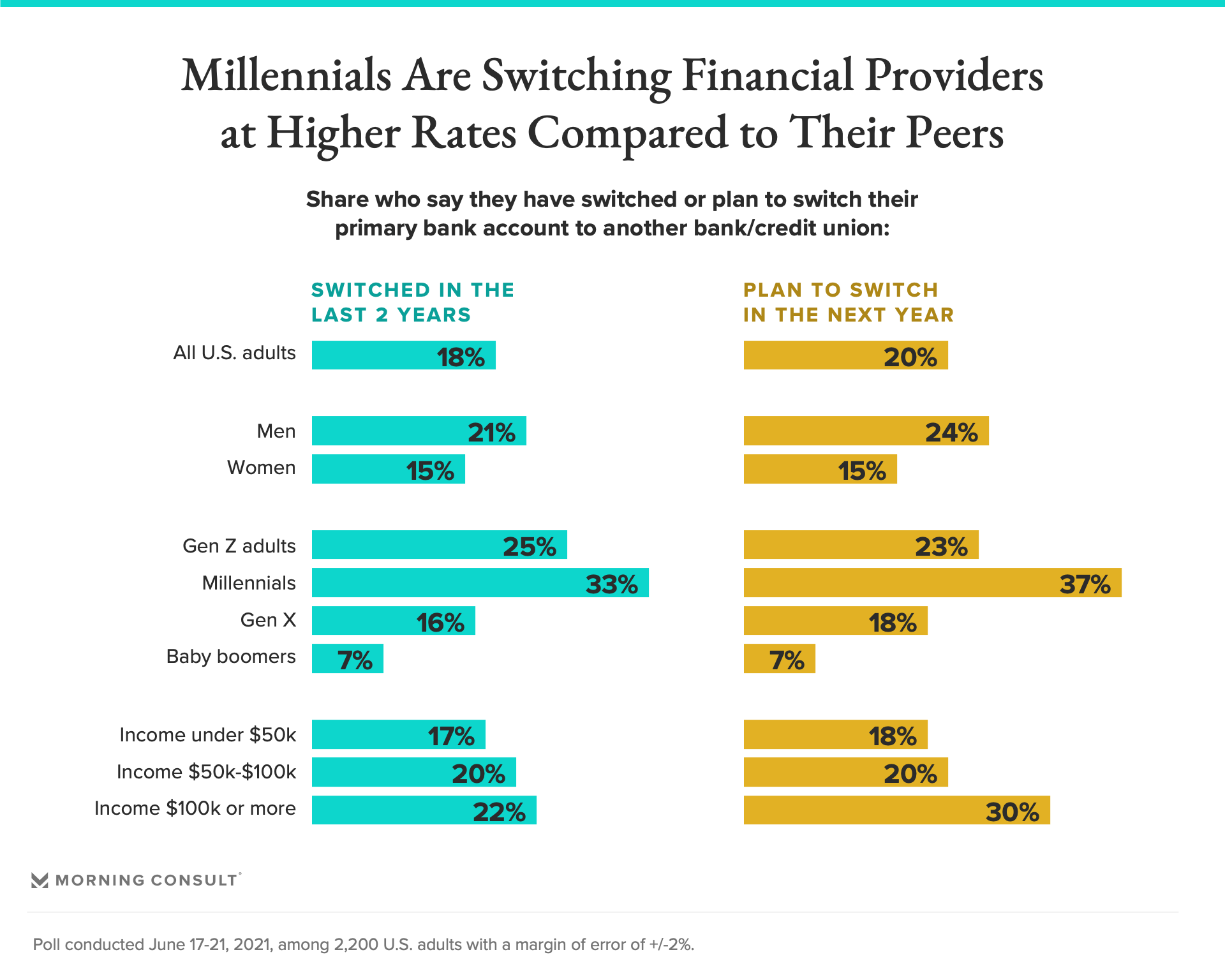

Roughly 1 in 5 adults say they have switched their primary bank in the last two years.

Millennials are most likely to say they have switched in the past two years, or that they plan to switch in the next year.

U.S. adults who have switched in the past report high satisfaction with the bank or credit union they left.

Banks should expect nearly 20 percent of their customers to leave them in the next year, according to analysis of a recent Morning Consult poll, as U.S. consumers continue to navigate their personal finances made more uncertain by the novel coronavirus. A roughly equal share report that they have already switched their primary provider within the last two years.

Banking leaders should be especially mindful of younger generational churn: Gen Z adults and millennials are more likely to say that they have switched or plan to switch primary providers than Gen Xers or baby boomers.

What’s behind the data: The pandemic slashed millions of jobs, hurled the country into a deep economic depression and depleted many Americans’ confidence in their financial situation, potentially prompting many to switch their providers. It also gave millions more free time to cross off things that have long been on their to-do lists, especially tasks that can be done online such as switching banks.

What’s more, banks are continually improving their digital onboarding capabilities, making it easier to switch and less likely that customers will abandon the journey halfway through; Gen Z and millennials are more likely to use these services, as they are to turn to social media for their financial advice.

Older generations, on the other hand, show little risk of switching. Not only do older generations tend to use more traditional, offline channels for their banking, but they also tend to be more deeply embedded with their primary bank or credit union and prioritize a longstanding relationship over any benefits from switching to a new provider.

The data also pushes back on the idea that U.S. consumers are switching banks due to high dissatisfaction with their current provider.

Roughly 3 in 4 U.S. consumers who either have already switched providers in the past two years or plan to in the next year say they were satisfied with the bank they left at the time they left, or are currently satisfied with the provider they plan to leave.

The big takeaway: The banking relationships of the country’s youngest generations are the most at risk, and satisfaction doesn't necessarily translate to loyalty for many customers. Bank leaders need to focus on building trust with these consumers to secure their loyalty and business as their assets grow.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.