Online Shopping Rates Normalize as Holiday Shoppers Head Back to Stores

Morning Consult’s latest holiday shopping tracking data shows holiday shoppers are shifting back to stores after two years of favoring online channels — behavior we’ll likely see more of in 2023 and beyond. But digital channels will still push shoppers to stores, as people plan to take advantage of “buy online, pick up in store” services at similar rates to 2021.

This is part of Morning Consult’s Consumers’ 2022 Holiday Plans report, which provides analysis on consumer trends that brands should anticipate ahead of the holiday season across the finance, retail, travel and food industries.

The past two years sent holiday shoppers online, where they could avoid the risk of crowded stores and enjoy the convenience of browsing multiple stores at once from home. This year, store comfort is up, people are craving the enjoyment in-person shopping offers, and holiday shoppers are heading back to stores.

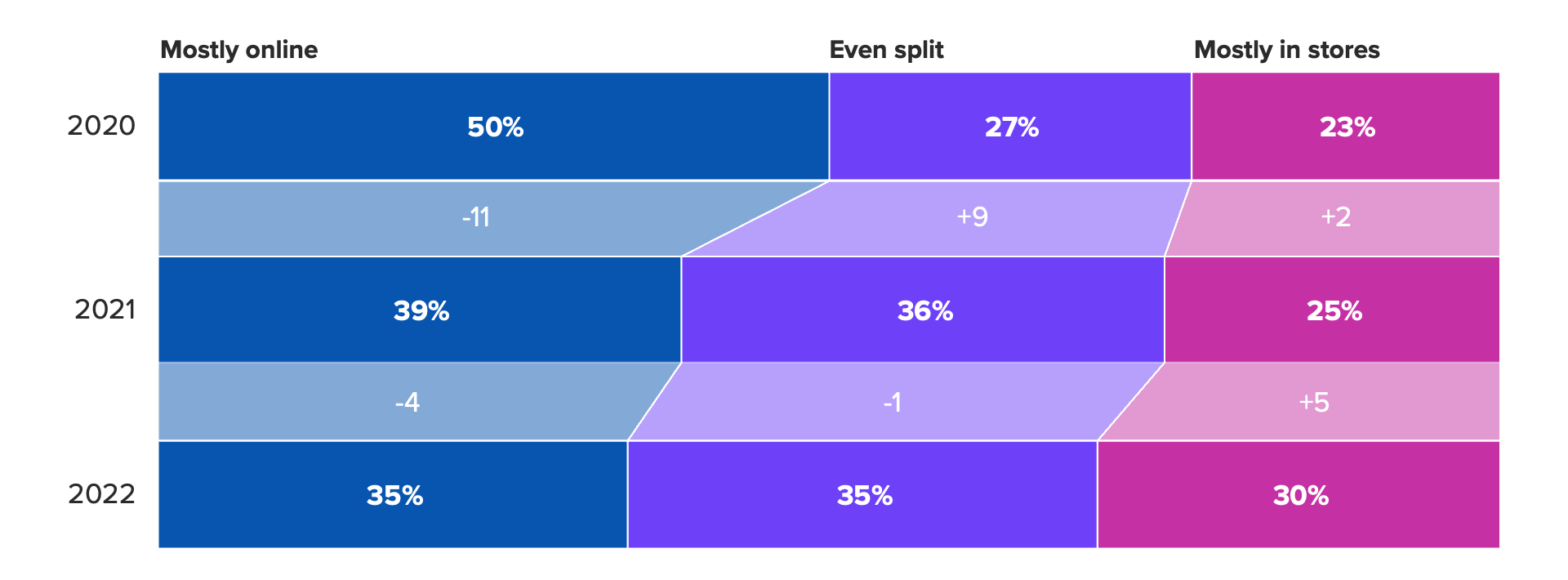

Preference for online shopping is looking similar to that of pre-pandemic years. In 2019, 33% said they planned to do more of their holiday shopping online, while just 29% said they aimed to split their shopping equally between stores and the internet; this year, 35% plan to do most of their holiday shopping online, and another 35% plan to do an even split. More of that online shopping is coming from mobile devices this year: 53% of those who have begun shopping for this season said they’ve shopped via mobile app, up from 46% in 2021.

The biggest swings back toward in-store shopping came from millennials and urbanites, while baby boomers’ and rural Americans’ shopping plans are stable from 2021. Men are more likely than women to say they’ll do most of their shopping in stores, and low-income adults are more likely than those in higher income ranges to plan on doing a majority of their shopping in person, consistent with their general preferences. People who prefer in-store shopping are most likely to cite enjoyment of the experience as the reason why, followed by the ease of comparing products in person.

Beyond the shift to stores, shoppers are blending their journeys across stores and websites. That means retailers must be transparent about discounting practices. This year’s deal-conscious shoppers will be disappointed if they head into a store only to find that the promotion that drew them in was an online-only deal. Clarity upfront can help prevent front-line staff from getting bogged down with price adjustment requests.

The rise of in-store shopping will carry into 2023 and beyond, tempering the online shopping surge that many predicted to be unstoppable. We expect to see more e-commerce-first brands move into brick-and-mortar spaces to take advantage of the unique value only in-person retail can deliver.

Key segments will lean on BOPIS and same-day delivery

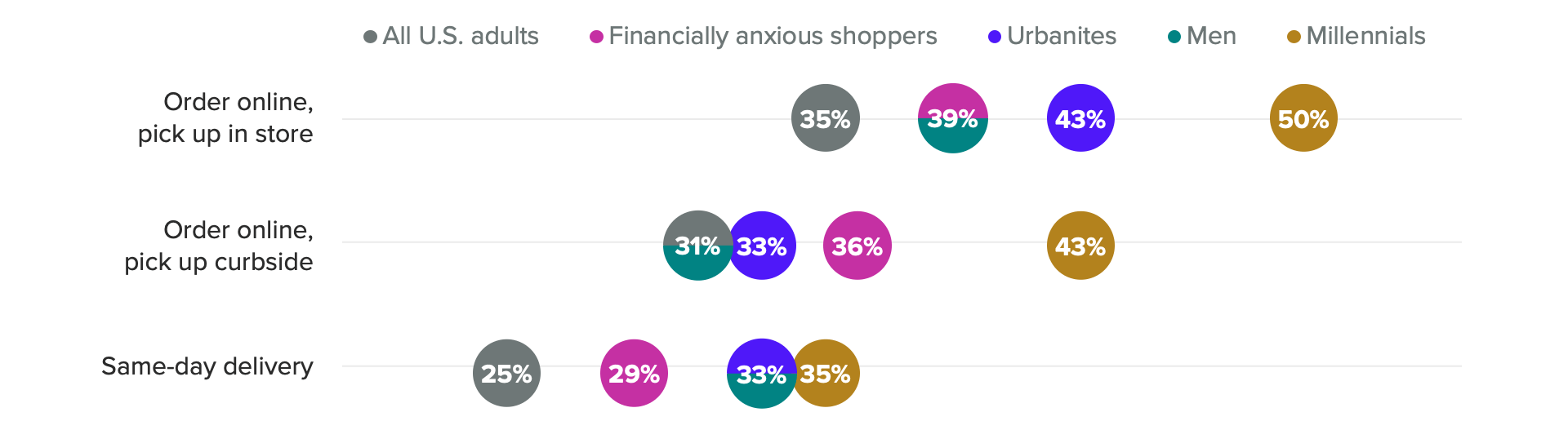

Shoppers heading back into stores are taking advantage of that blend of in-store and online shopping via “buy online, pick up in store” services. Among those who have started their holiday shopping, BOPIS usage rates are similar to what consumers reported in 2021. Key demographics use these services at higher rates than the general population: financially anxious shoppers, urbanites, men and millennials. Millennials in particular are more likely to use these services for the holidays, given their prioritization of convenience while managing busy lives and parenting young children.

The financially anxious cohort is 9 percentage points more likely to use BOPIS services than their unanxious counterparts. This is happening for a number of reasons: First, BOPIS is usually the fastest free shipping option. Second, after last year’s supply chain challenges, it’s understandable that the most anxious shoppers are worried about items arriving on time and as expected, and having to scramble for a last-minute gift if something doesn’t work out. BOPIS users tend to be profitable customers, and retailers should offer them a reason to explore the store, not just head for the pickup counter, to capture additional sales.

This shift back to stores, coupled with key segments’ usage of store-supported fulfillment, means retailers should anticipate more foot traffic as holiday shopping continues to ramp up. In-store shopping offers more opportunities for impulse buys and brand-building experiences, the latter of which can generate customer loyalty after months of disrupted shopping behavior due to inflation. But this is small comfort for retailers given shoppers’ prioritization of deals and discounts this season.