Consumers Are Spending More on Health Care, but Sticker Shock May Be Causing Some to Delay Care

Key Takeaways

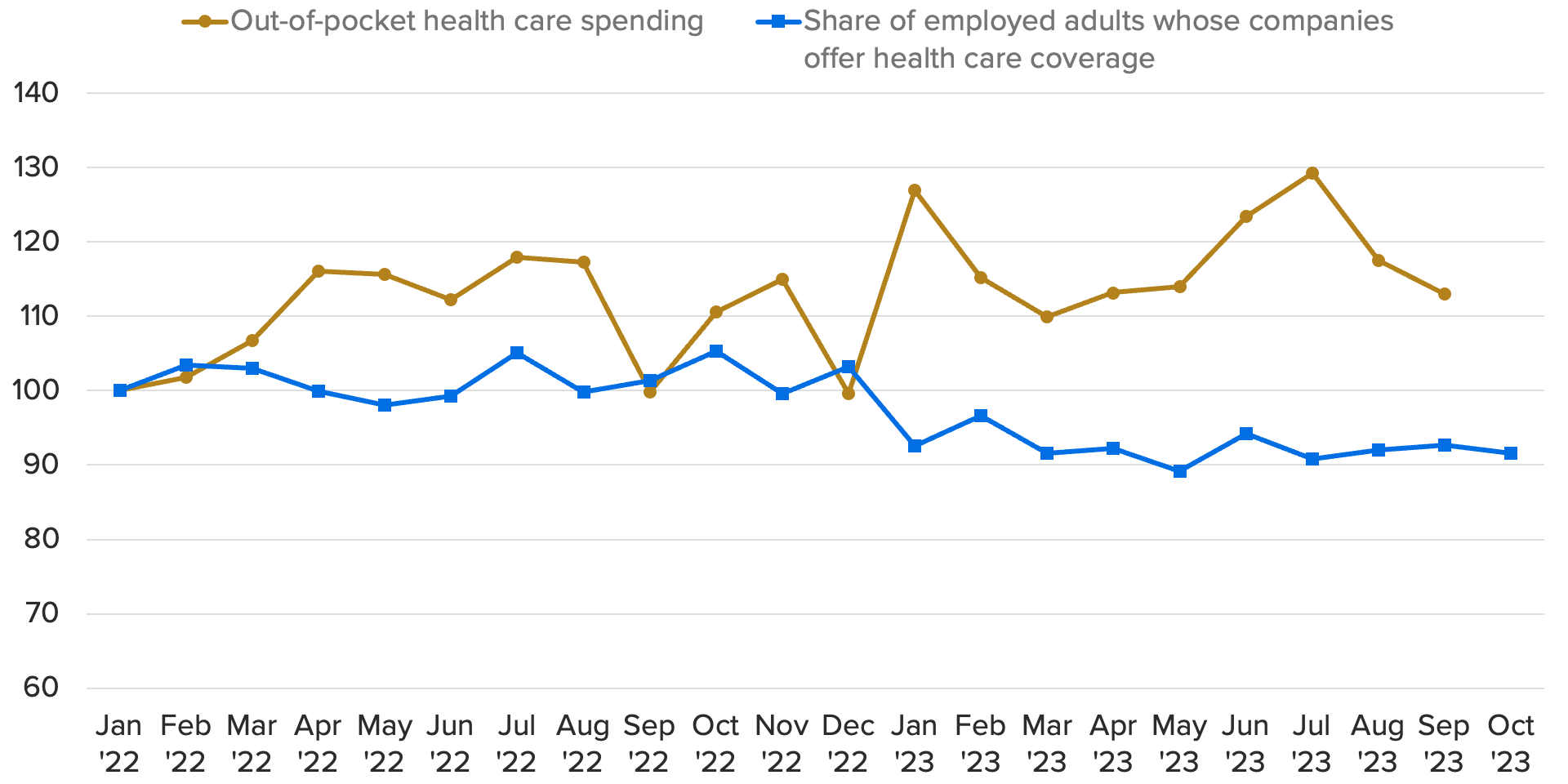

Fewer employed adults are reporting access to employer-paid health insurance benefits, coinciding with rising out-of-pocket spending on medical care.

Consumers are also becoming more price sensitive about health care, opting out of elective services due to sticker shock and relying increasingly on debt to cover emergency medical costs.

Lower earners may be disproportionately exposed to health risks, as this group is least able to absorb medical costs and most likely to defer care.

Sign up to get our data on the economy, including trends in inflation and consumer spending.

A decreasing share of employees report receiving company-sponsored health insurance coverage, driving up out-of-pocket costs for consumers

Morning Consult’s data shows that the share of employed adults receiving health insurance from employers has trended lower since tracking began in late 2021. Some of this decline may be attributable to composition effects: Industries like leisure & hospitality and retail made up about 24% of jobs gains since November 2021, according to data from the Bureau of Labor Statistics, and employed adults from these sectors were among the least likely to report receiving health insurance. Additionally, escalating cost pressures for labor, materials and financing over the past two years could also be leading some companies to seek to improve profitability by reducing benefit costs.

Out-of-Pocket Health Costs Climb as Fewer Employees Report Access to Health Benefits

As access to employer-sponsored health care declined, health care spending has climbed, with more consumers paying out of pocket. Monthly spending on health care services adjusted for inflation, excluding insurance, was 7.6% higher from January to September 2023 compared to the same period in 2022. Since tracking of the employer-sponsored health care coverage question began in November 2021, its correlation with out-of-pocket health care has been -0.62, suggesting that lower rates of coverage by employers may be associated with higher out-of-pocket spending.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

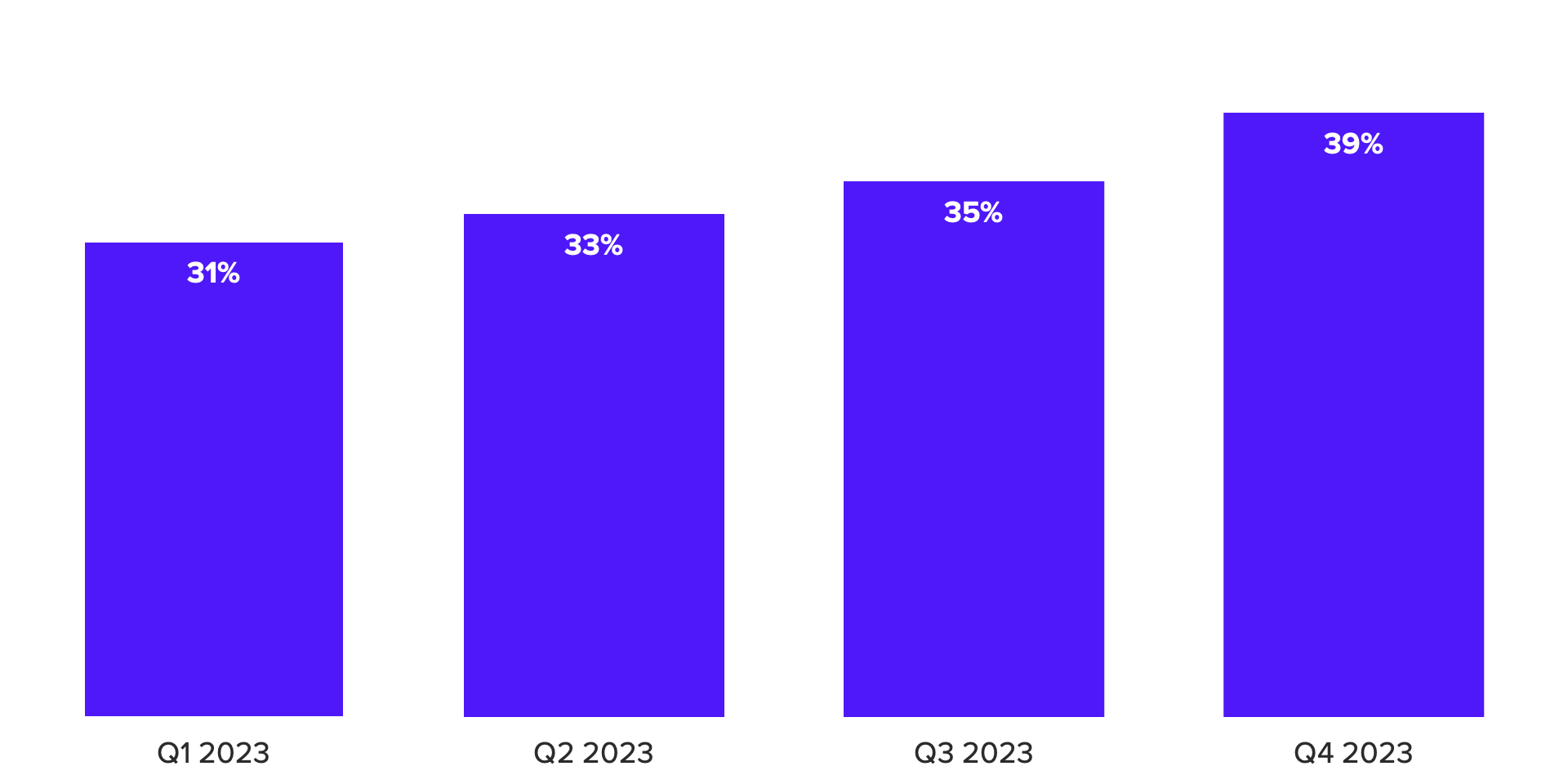

As consumers shoulder more of the burden of medical care costs, some budgets are becoming stretched, and U.S. adults are increasingly relying on debt to cover emergency medical expenses. The share of adults who experienced an unexpected health-related expense and had to use at least some debt to cover it has been trending steadily higher since tracking began in the first quarter of 2023, while the share who said they covered the expense with cash alone has declined.

Consumers Increasingly Rely on Debt to Cover Emergency Medical Costs

More consumers are skipping out on health care appointments to avoid the cost

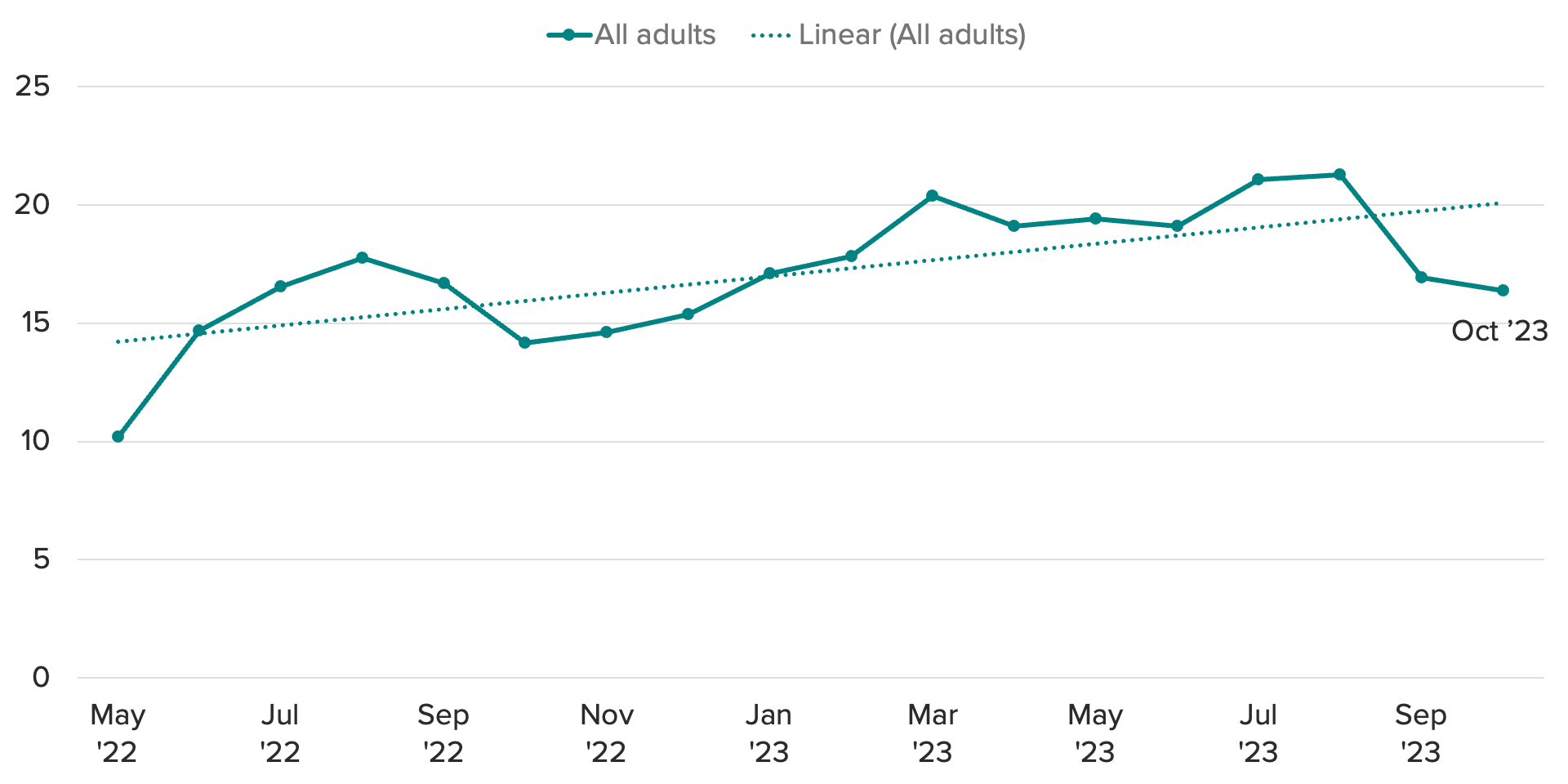

When it comes to nonurgent medical care, consumers have also become increasingly price sensitive in recent months, suggesting a growing share are forgoing medical services due to price. Morning Consult’s Price Sensitivity Index for health care services increased from 10.2 when tracking began in May 2022 to 16.4 in October of this year. Health care price growth has been modest compared to inflation overall: While health care prices have increased 2.5% since November 2021, the consumer price index has grown 10.3% during that time. However, the cost to households may be steeper if fewer workers are being subsidized by employer-sponsored health plans. As a result, more consumers appear to be forgoing or deferring elective services and health appointments because they perceive the cost to be too high.

More Adults Skip or Delay Medical Services

(3-month moving average)

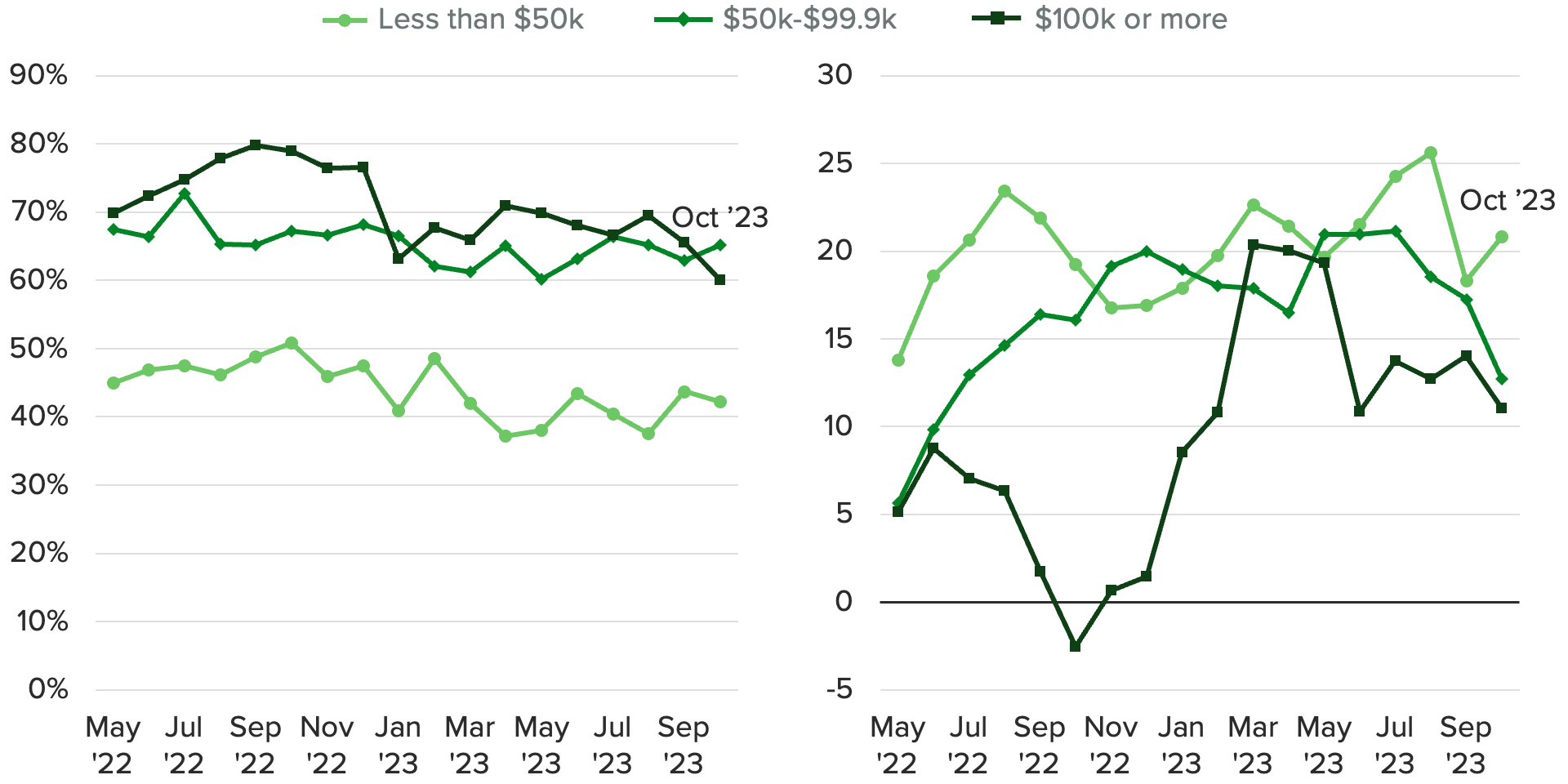

Lower-income households may be disproportionately exposed to health risks, with fewer able to afford care

Households With Least Access to Employer-Paid Healthcare Are More Likely to Defer Health Appointments

Over time, skipping out on nonurgent medical appointments could result in medical emergencies if diagnoses are missed or mild conditions worsen over time without preventative care. Morning Consult’s data suggests that lower-income adults are disproportionately exposed to health risks, and also the least able to afford medical bills.

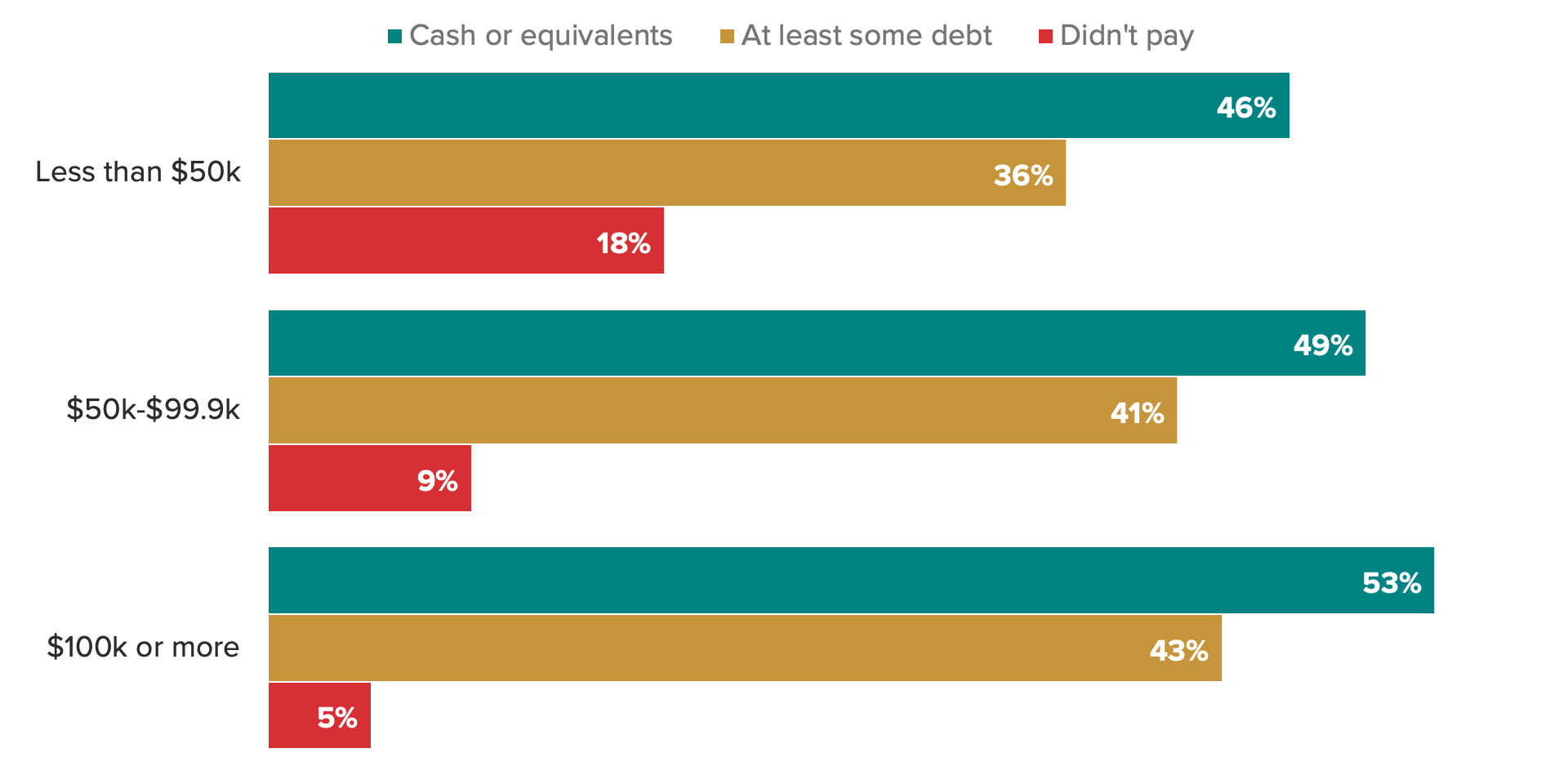

Adults from households earning less than $50,000 per year are least likely to report access to employer-sponsored health care coverage, and most likely to say they deferred health care spending due to price. This group is also more likely than their higher-earning peers to report getting sick: A separate survey by Morning Consult showed that, between September 2020 and September 2023, an average of 3.7% of lower-income adults reported they or someone from their household fell seriously ill each month, compared with 3.0% for middle- or higher-income adults. Furthermore, when emergency medical costs do come up for this cohort, they are least likely to be able to cover it with cash, and most likely to say they weren’t able to pay it at all.

Emergency Medical Expenses Tend to Be More Challenging for Low-Income Adults

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]