Temu Is on Its Way to Becoming Ubiquitous

Key Takeaways

U.S. consumers say they are seeing, reading or hearing about Temu — the Chinese online marketplace known for selling a wide array of products at extreme discounts — as frequently as they are about American retail giants, according to Morning Consult Intelligence data.

Two in five (40%) U.S. adults have already made a purchase from Temu and, in a novel trend for a digital platform, the brand is generally more popular among older consumers than younger ones.

While questions about its longevity remain, Temu’s rapid ascent to the cultural mainstream has been stunning, and disruptive to several other industries — in both good ways and bad.

Data Downloads

Pro+ subscribers are able to download the datasets that underpin Morning Consult Pro's reports and analysis. Contact us to get access.

Since its September 2022 launch in the United States, Temu has been making headlines for its increasingly large investments in all kinds of broadcast and digital advertising. New Morning Consult Intelligence data shows that this aggressive approach is paying off.

Awareness of Temu is growing by leaps and bounds

As of March 2024, nearly 9 in 10 U.S. adults (86%) reported being aware of the online marketplace, which sells a huge variety of goods at rock-bottom prices and is owned by Chinese e-commerce giant PDD Holdings. That’s an 11-percentage point increase from the share who said the same in September 2023, when Morning Consult began measuring perceptions of Temu.

In brand tracking, double-digit bumps are impressive, and almost never occur in a span as short as six months. More broadly, reaching such a high level of awareness so soon after launching in a new market is quite challenging. As a point of comparison, 69% of U.S. adults are aware of Shein — another China-founded discount online retailer that has been operating stateside since 2017 (and is also known for spending a hefty amount on ads).

Though Temu’s overall awareness is still notably lower than that of most major American retailers like Amazon, Walmart and Target — all of which hover near 100% — additional metrics suggest that the brand is well on its way to achieving the same kind of ubiquity.

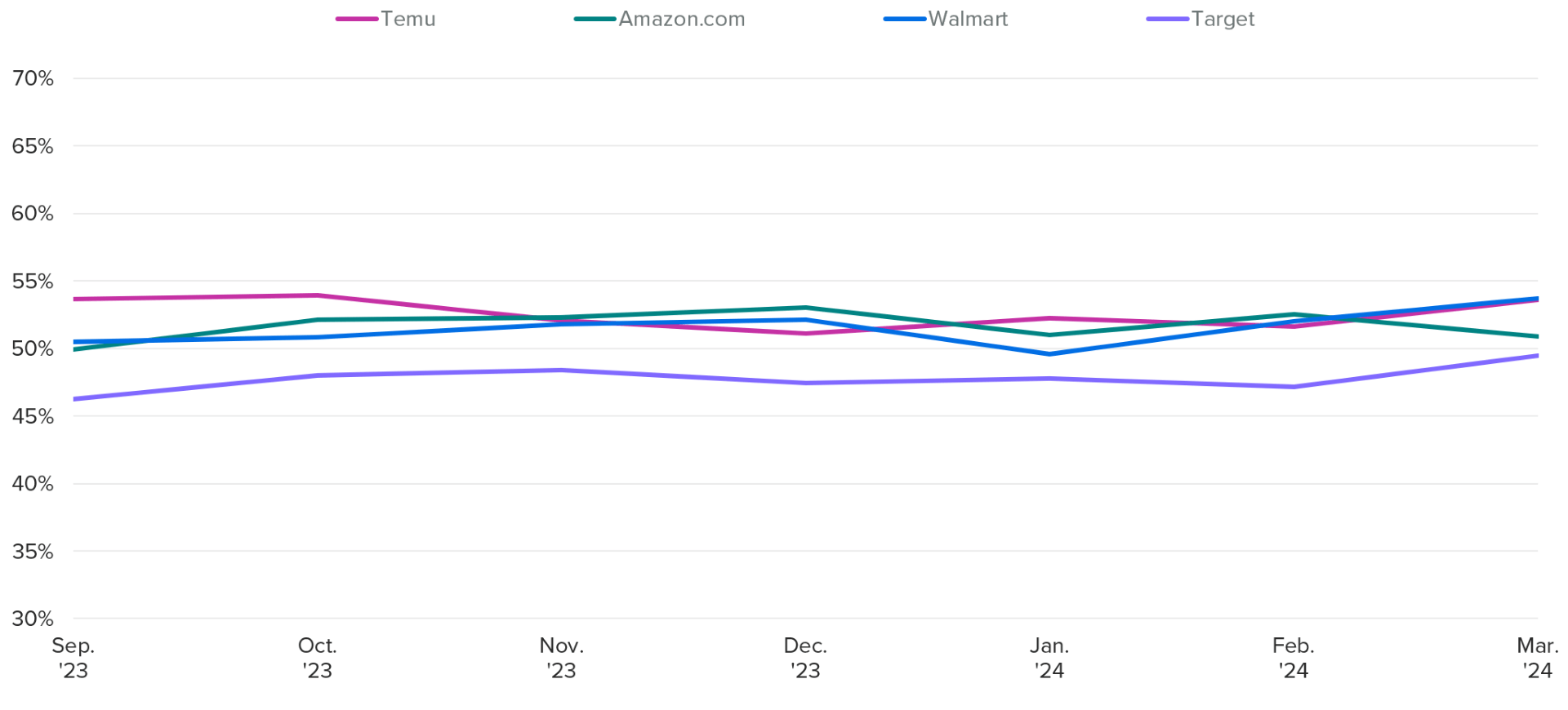

The share of U.S. adults who said they have recently seen, read or heard something about Temu is consistently on par with the likes of America’s retail giants, an impressive feat considering that the annual marketing budgets at these brands are, in most cases, still much larger than Temu’s reported $1.7 billion ad spend in 2023.

Buzz about Temu matches that of other major retailers

That said, the upstart shopping app’s advertising commitment is expected to nearly double this year, an ambition already reflected by the five Super Bowl LVIII ad slots it purchased and used to run the same commercial over and over again. It’s a rarity for a young brand to buy any kind of big game ad space — the price tag for which has historically made it a channel reserved for blue-chip stalwarts — let alone have such an outsized presence. (In 2023, the brand made its Super Bowl debut with just one ad.)

A Morning Consult survey conducted immediately after the February game revealed that almost half of U.S. adults (46%) had seen, read or heard about Temu’s many Super Bowl ads — an undoubtedly respectable result. However, football isn’t the only game Temu is playing well.

The brand is spending so much on internet ads that it’s driving up unit costs across most major platforms, and the return is evident: The same survey revealed that nearly 7 in 10 (69%) U.S. adults said they had been exposed to another Temu ad(s) prior to Super Bowl LVIII, and an equal amount said they had heard of Temu through word of mouth.

Amid the promotional pile-on, however, something rather unusual is happening: Older consumers are being especially receptive.

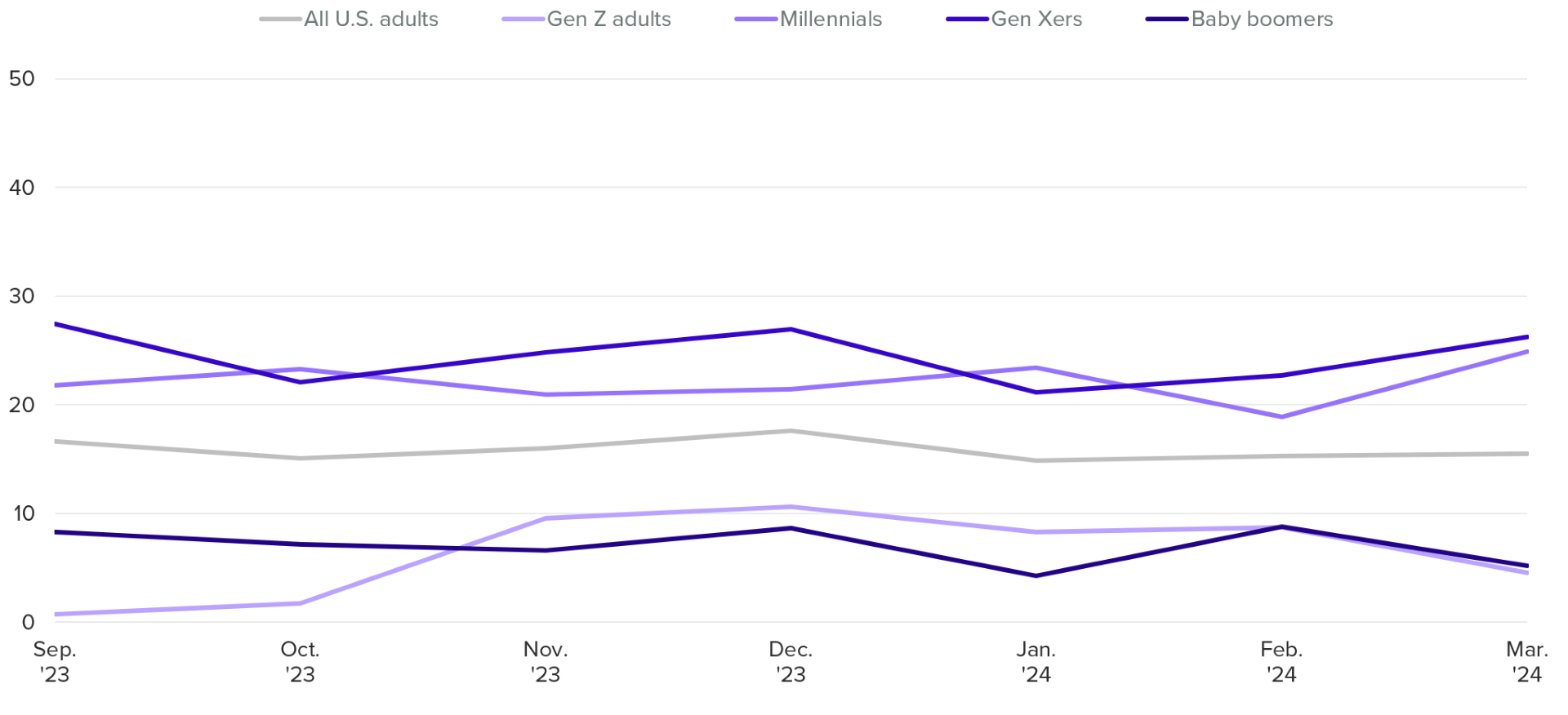

Gen X and millennials are the most taken with Temu

Technology companies have long been more favored and trusted by young people, but the opposite is true for Temu. According to Morning Consult Intelligence data, the brand’s net favorability and net trust are highest among Gen Xers and millennials (the oldest of whom are now in their mid-forties). And in both cases, these figures are head and shoulders above those of Gen Z adults, who are the most tech-engaged cohort.

Temu’s appeal is particularly strong among Gen Xers

The situation is made even more confounding by the fact that Gen Xers’ typically don’t over-index on most consumer behaviors or opinions. Temu does employ several gamified gimmicks designed to hook users on the app, which can be enticing to older folks who may not be as digitally savvy. Some Gen Xers’ Gen Z children are taking to social media to express concern over their parents’ Temu usage, describing them as “victims,” “addicts” and even “warlocks” in videos that have now gone viral.

This unexpected generational divide raises the question of whether or not the platform will have true staying power. There is precedent for the uptake of older consumers diluting the overall cultural value of brands. So, is shopping on Temu a behavior that young people will grow into, or will it remain somewhat cringe as they age into adulthood and beyond?

Temu’s biggest fans are those from households with $50,000 in income or less

The novelty of Temu’s uber-low prices appears enough to draw the youngest generation in, at least for now: Our post-Super Bowl survey found that among Gen Z adults aware of the brand, nearly half (46%) have already made a purchase from it. Forty percent of all U.S. adults have done the same.

2 in 5 U.S. adults have made a purchase from Temu

Temu’s tagline is “shop like a billionaire,” but Morning Consult Audience data paints a different picture of frequent Temu consumers. Those who shop from the app at least once weekly are more likely to have an annual household income of under $50,000 than the average U.S. population. They’re also less likely to have investments or a college degree.

Psychographically, frequent Temu shoppers place a much greater value on trendiness and variety than their general population counterparts. These are likely reasons that they also do shopping of all kinds more often than most Americans, including online and through social media.

To Temu and beyond

While the arrival of Temu and its nonstop drumbeat of digital advertising is a positive development for ad giants like Meta and Google, it’s a less sunny one for others. Some external reports show that more niche marketplaces and discount destinations like Etsy and Dollar General have lost business to Temu.

That said, America’s major retail players — which largely compete on delivery speed and product quality rather than rock-bottom prices — seem more insulated from a full-on Temu threat at the moment. Outside of total buzz, major gaps exist between Temu and Amazon, Walmart and Target on most down-funnel Morning Consult Intelligence metrics, including daily users and purchase consideration. Regulatory pressure related to Temu’s business practices loom large on the brand’s future as well.

However, Temu is currently the third-most-popular shopping app in the U.S., just behind Amazon and Walmart (having already usurped Target), so the potential for high-profile disruption is certainly there. Plus, Morning Consult research on retail habits consistently identifies price as the most important purchase-driving factor for nearly every major demographic — and it’s going to be seriously hard to beat $8 jackets or $14 vacuum cleaners.

Ultimately, the stunning pace of Temu’s U.S. ascent proves that with enough backing by a large parent company, flooding the market with advertising can still be an effective method for achieving a large-scale breakthrough, even in a fragmented media landscape.

Morning Consult Intelligence customers can access the platform here. If you are interested in learning more about our brand tracking data, reach out to your Morning Consult contact or email [email protected].

Ellyn Briggs is a brands analyst on the Industry Intelligence team, where she conducts research, authors analyst notes and advises brand and marketing leaders on how to apply insights to make better business decisions. Prior to joining Morning Consult, Ellyn worked as a market researcher and brand strategist in both agency and in-house settings. She graduated from American University with a bachelor’s degree in finance. For speaking opportunities and booking requests, please email [email protected].