The Paradox of Healthy Eating: Easy to Define, Challenging to Achieve

Consumers know the basics of healthy eating, but that doesn’t mean it's easy for them to execute. What causes challenges varies by generation, creating a big opportunity for food & beverage brands in the health and wellness space to tailor new products or marketing messages to push consumers to more consistent action.

Eat your fruits and vegetables. Ask any doctor, nutritionist or parent, and they’ll give you this advice about healthy eating. It appears the importance of this common refrain is breaking through.

Health and wellness plays a central role in consumers’ daily choices about what to eat and drink. Nearly 9 in 10 U.S. adults (87%) say healthy eating is at least somewhat important to them, with 37% saying it is very important. And while healthy eating may be complex, it’s not complicated for consumers. Most U.S. adults (83%) agree with the statement “I know how to eat healthfully,” and there’s strong consensus around what behaviors consumers deem necessary for healthy eating. (Hint: Fruits and vegetables play an important role.)

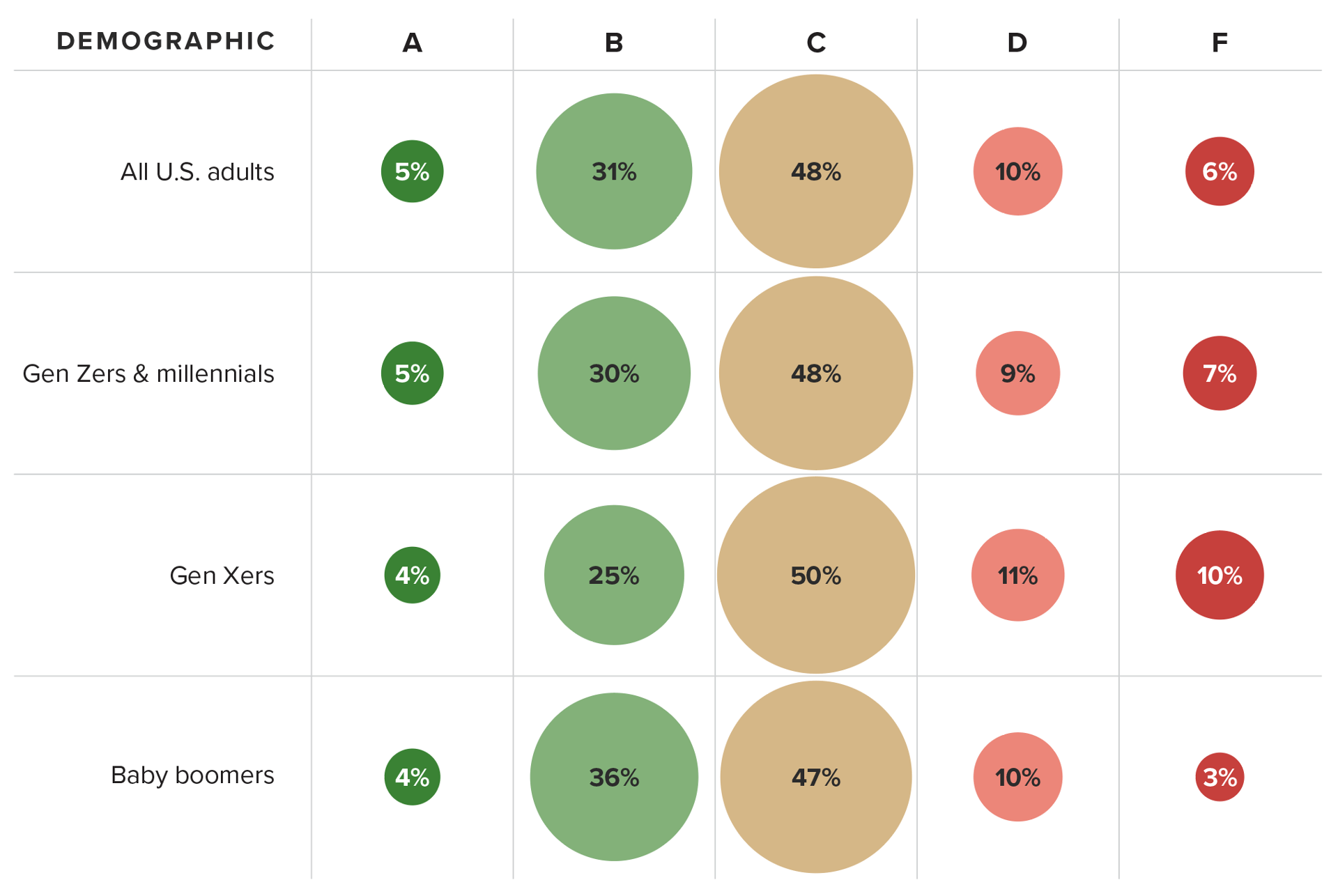

Yet only 5% of adults give themselves an A grade on their healthy eating efforts, and nearly half (48%) give themselves a C, suggesting most people feel they have a lot of room for improvement.

To address this disconnect, brands need to learn what healthy eating means to consumers today, the challenges that stand in their way, and importantly, how behaviors and barriers differ by generation. Understanding these nuances will help brands position themselves effectively in a crowded health and wellness marketplace.

Consumers strongly link healthy eating to long-term well-being

Much of the importance consumers place on healthy eating comes from their recognition of the long-term connection between diet and overall well-being. A supermajority (85%) of U.S. adults agree that overall food and drink choices are a major contributor to chronic diseases such as heart disease and hypertension.

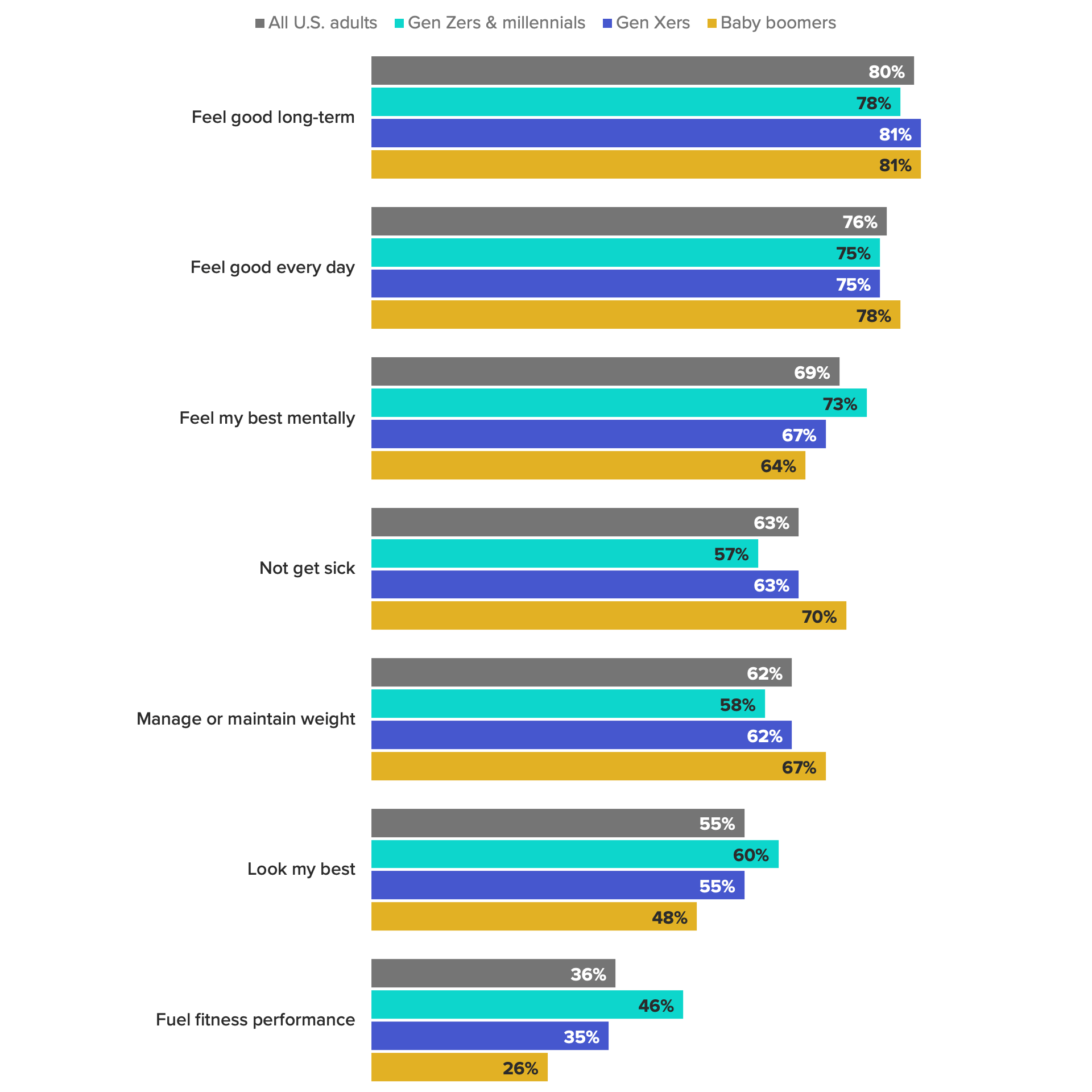

This association underscores the strong consensus around the top motivators for eating healthily: feeling good both long-term and every day. Eight in 10 adults said feeling good long-term is a major reason healthy eating is important, and nearly as many (76%) named feeling good every day as a major reason. These are powerful motivators that brands can connect with to help consumers choose healthy options. Marketing communications and new products should explicitly link to the benefits of feeling good and highlight how a brand’s offerings can help consumers achieve this goal — for instance, by calling out key ingredients that confer these benefits.

While there’s clear consensus on the importance of eating healthily in order to feel good, there is less agreement generationally on the importance of other factors. For younger generations, mental health is high on the list: Roughly 3 in 4 Gen Zers and millennials say feeling mentally their best is a major reason why healthy eating is important, 9 percentage points higher than baby boomers. While mental health may not initially evoke images of food choices, it makes sense that it does for younger consumers. Gen Zers and millennials are more likely to normalize discussion of mental health and look at wellness more holistically, inclusive of both physical and mental health.

Specific physical health factors, on the other hand, like not getting sick and maintaining weight, are more important to baby boomers. Even as coronavirus concerns diminish, the two-plus years of messages about the increased risk for adults 65 and older have ensured that immunity will remain top of mind for this group indefinitely.

Definition of healthy eating connects adding the “good” and avoiding the “bad”

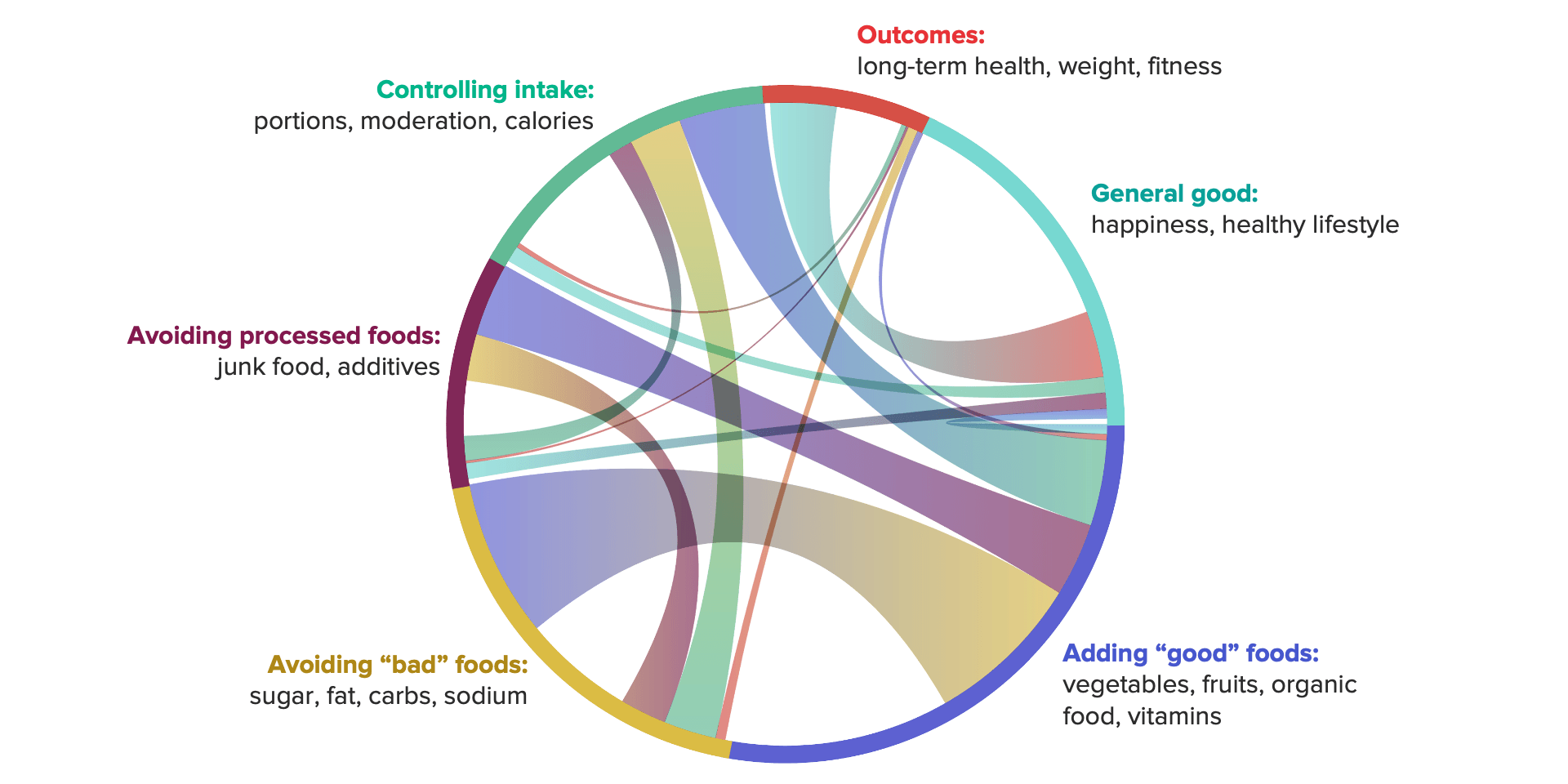

When asked to define healthy eating in their own words, consumers gravitate toward the theme of balance. The most frequently used terms to describe healthy eating are simple: fruits and vegetables. This focus on what to eat frames healthy eating as approachable and positive — but digging deeper reveals more complexity. Many consumers who mention adding healthy foods to their diet also mention avoiding intake of sugar, carbs or processed foods. This overall moderation, a give and take between what to add and what to avoid, is a key concept defining healthy eating today.

Fresh food is foundational to consumers’ healthy eating behavior

Asking about the specific behaviors necessary for healthy eating creates a similar balanced picture of give and take. The behaviors most consumers identify as necessary are about what to eat (fruits, vegetables and fresh foods in general), followed by what to avoid (unhealthy snacks, fats and processed foods). The consensus around these top behaviors is strong. Roughly 9 in 10 U.S. adults agree that fruits and vegetables are necessary for healthy eating. Similarly, there is high agreement around eating fresh foods (88%) and limiting unhealthy snacks (83%).

Again, there are some generational nuances in the data. The necessity of organic foods for a healthy diet is among the largest gaps between generations. Gen Zers and millennials are 21 points more likely than baby boomers and 13 points more likely than Gen Xers to say eating organic foods is necessary. These younger consumers have come of age at a time when organic food and beverage products are readily available. Not only does this availability increase awareness and usage, but it also means messages about the “better for you” and “better for the planet” benefits of organic products are more ingrained for these generations.

Fat and sodium, which are often cautioned against in diets intended to address hypertension or heart health (like the DASH diet), tend to be more of a concern among Gen Xers and baby boomers.

Cravings and cost challenges lead a plurality of consumers to grade their healthy eating efforts a C

Despite the agreement around the importance of healthy eating and the behaviors necessary to do so, many U.S. adults feel they are just barely achieving a passing grade. Nearly 2 in 3 adults give themselves a C, D or F, and the scores are relatively similar across generations.

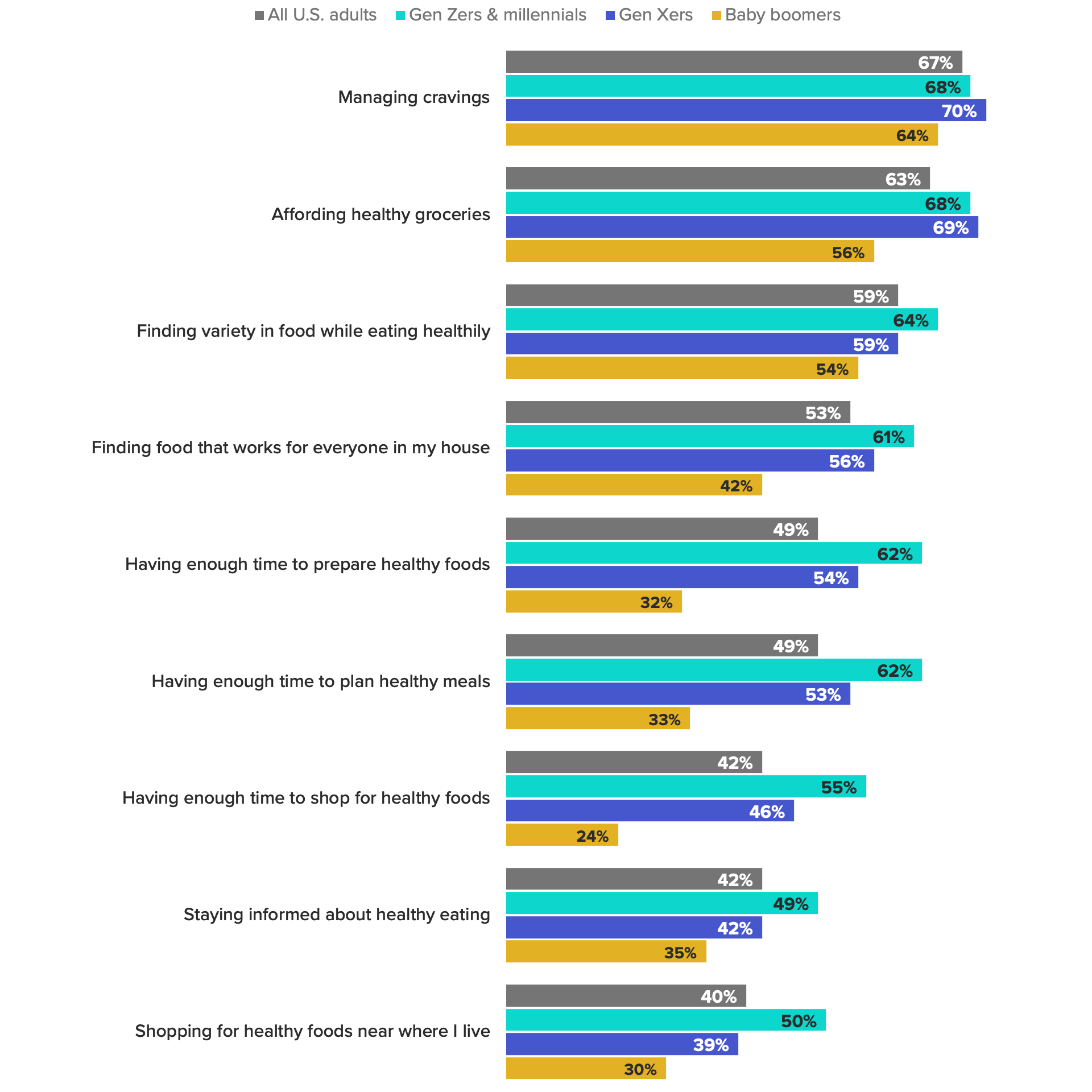

So why the low grades? So many delicious options, so little time. Managing cravings is tough for everyone — two-thirds of U.S. adults cite that as a challenge to healthy eating. Affordability is also a barrier for many consumers. Amid persistent inflation, Gen Zers, millennials and Gen Xers are more likely than boomers to say affordability is an issue, likely due to larger household sizes and the higher volume of groceries they require. Their definition of healthy foods factors in as well. Organic products, which are more associated with healthy eating for younger generations, tend to be more expensive.

Gen Zers and millennials are more likely to say most of the factors surveyed make it challenging to eat healthily. The gulf between baby boomers and these generations is particularly large when it comes to time spent preparing, planning and even shopping for healthy foods. Whether it’s career, social life or family demands, younger generations feel the pressure on their time, which makes healthy eating even more challenging. For millennials, many of whom have children, finding variety and coming up with foods that work for everyone in the household are particularly difficult.

Brands can win consumers’ loyalty by helping them elevate their healthy eating grades

The paradox of healthy eating — relatively simple to define, yet difficult to achieve — provides plenty of opportunity for food & beverage brands to help consumers who find that the pace of their busy lives often interferes with their healthy eating intentions. Brands shouldn’t focus on education or information about healthy eating, but instead focus on products, recipes and ideas that solve the challenges that create this paradox.

Companies can frame new product development and marketing communications to offer solutions for the daily variety conundrum that also cut down on preparation time and make planning easier — keeping in mind that delivering delicious products at an affordable price is table stakes.

Emily Moquin previously worked at Morning Consult as a lead food & beverage analyst.