Who’s Interested in Spot Bitcoin ETFs

Key Takeaways

29% of crypto owners are “very interested” in investing in new spot bitcoin ETFs, roughly four times that the share of the general public (7%).

Men, millennials and high-earners are also more likely to express strong interest in investing in spot bitcoin ETFs, the same groups who are most likely to own cryptocurrency.

Still, disinterest is high among women, older Americans and those from middle- or low-income households, where over half say they are “not interested at all” in investing in spot bitcoin ETFs.

Data Downloads

Pro+ subscribers are able to download the datasets that underpin Morning Consult Pro's reports and analysis. Contact us to get access.

For the latest global brand, media and marketing news and analysis, sign up for our daily brands news briefing.

The cryptocurrency industry won a big victory earlier this year when the Securities and Exchange Commission (SEC) approved the first group of U.S.-listed exchange traded funds (ETFs) which track bitcoin’s price. The move was over a decade in the making and one that crypto die-hards hope will not only provide some legitimacy to a volatile industry, but also make it more attractive to traditional investors. The new spot bitcoin ETFs allow investors to have exposure to the world's largest and oldest cryptocurrency without directly holding it.

But new data shows that the industry still has some work to do to broaden the consumer appeal of the new spot bitcoin ETFs: Just 7% of U.S. adults are “very interested” in investing in them.

Crypto ownership remains steady, in good times and bad

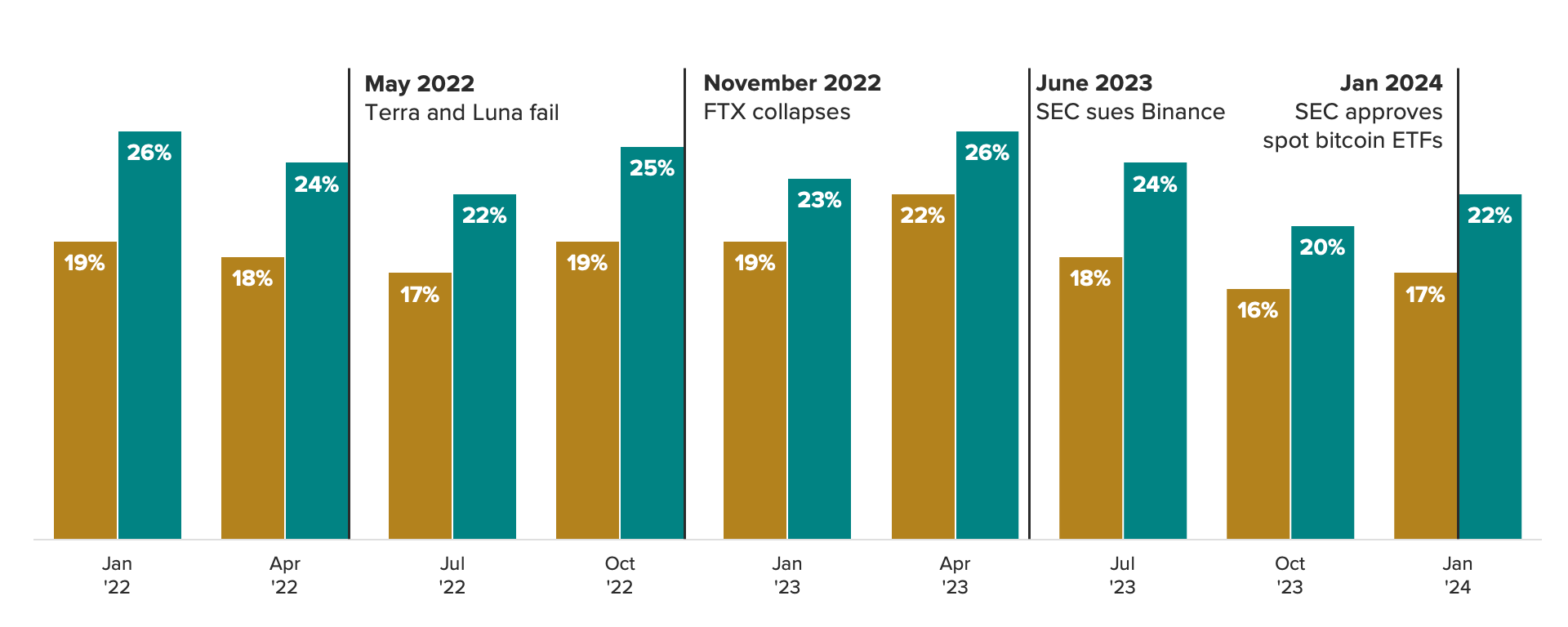

Morning Consult has been tracking cryptocurrency trends since January 2022, and one datapoint has always been clear: Ownership and purchasing interest in purchasing remains steady. In the past, we have noted the importance of that unwavering behavior in the light of scandals in the industry like the collapse of cryptocurrency exchange FTX in November 2022 and the same looks to be holding true with the recent positive news.

The latest wave of Morning Consult’s cryptocurrency tracker began fielding about two weeks after the SEC approved multiple spot bitcoin ETFs, and yet, again, cryptocurrency ownership held steady. Seventeen percent of U.S. adults said they owned crypto and 22% said they are likely to purchase it in the next month, relatively consistent with the prior quarter.

Who owns and is likely to purchase crypto

Intent to purchase bitcoin did see a small uptick from the prior quarter: 24% of U.S. adults said they are likely to purchase it in the next month, a 3-percentage-point increase from Q4 2023.

Even more notably, bitcoin’s price recently hit record highs due in part to investors pouring money into U.S. spot exchange-traded crypto products. But the price has since fallen, due to a number of factors like concerns over inflation and potential selling pressure from Grayscale, a digital asset management firm which manages the $26 billion exchange-traded fund GBTC.

New spot bitcoin ETFs are exciting crypto owners

Given the industry excitement around spot bitcoin ETFs, we took a closer look at what its potential pool of buyers would look like — and it looks very crypto heavy. Twenty-nine percent of crypto owners are “very interested” in investing in new spot bitcoin ETFs, roughly four times that of the general public.

Crypto Owners Are Most Interested in New Spot Bitcoin ETFs

Men, millennials and high-earners are also more likely to express strong interest in investing in new spot bitcoin ETFs, which is particularly interesting because these are the same groups most likely to own cryptocurrency. For example, nearly a quarter (24%) of men said they own cryptocurrency in January, 7 points higher than the general population and 14 points higher than women.

That interest has already converted to investment for some, specifically crypto and bitcoin owners. Eight percent of crypto owners and 9% of bitcoin owners said they invested in spot bitcoin ETFs in January, right after their approval.

What’s also notable is the intensity in those not interested. Over half of women, older Americans and those from middle or low income households say they are “not interested at all” in investing in ETFs.

While crypto enthusiasts may have hoped to widen the crypto investor pool with spot bitcoin ETFs, right now, they look more likely to be sparking those who were already interested in bitcoin or crypto in general. That is not necessarily a bad thing, rallying enthusiasts could be good for an industry accustomed to volatility. Nevertheless, it will be crucial to continue to monitor interest and ownership to see how the investor make-up shifts as these novel funds ease into the market.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].

Caroline Smith is a manager of financial services intelligence at Morning Consult, where she analyzes high-frequency data to help the company deliver real-time insights to the financial services sector.