Economics

November 2023 Global Consumer Confidence Charts

Report summary

This collection of downloadable charts provides a curated summary of Morning Consult’s proprietary Economic Intelligence data on global consumer confidence and offers a preview of Morning Consult’s November Global Consumer Confidence Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Chart Pack highlights:

- U.S. economic activity remains robust, driven in large part by a consumer who just keeps on spending. However, Morning Consult data shows that high- and middle-income consumers, who propped up spending this summer, are beginning to pull back.

- The European economy remains on the brink of recession, and we are seeing a clear downtrend in sentiment emerging across Europe’s major economies.

- Chinese consumer sentiment fell sharply in October as Beijing rolled out additional stimulus to shore up confidence in the economy.

Highlights from this report

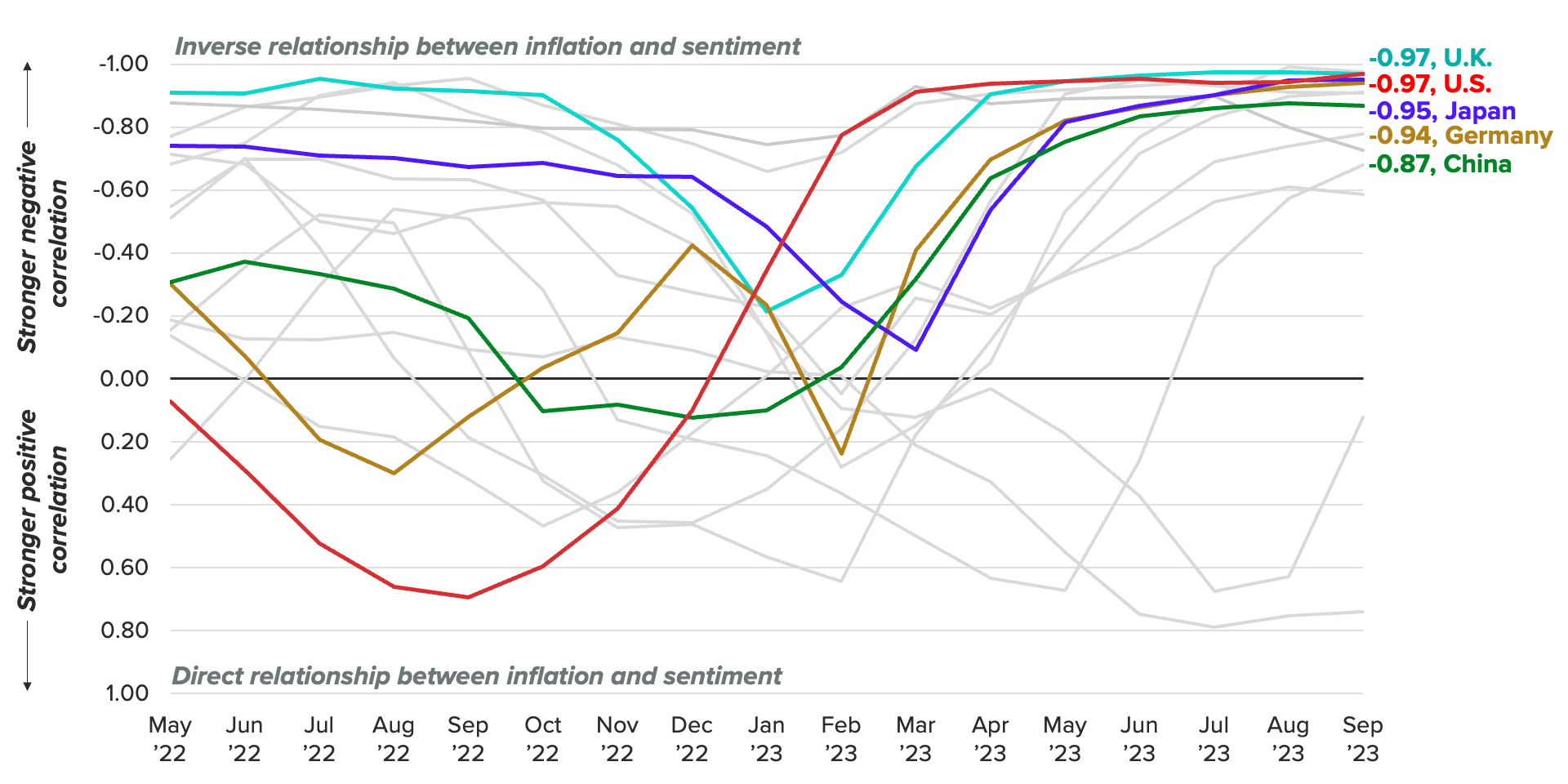

Global consumer sentiment continued to slide in October, with Morning Consult’s Index of Consumer Sentiment declining in many of the world’s largest economies. As has been the case for some time, inflation continues to be top of mind for consumers; a broad decline in inflation starting in late 2022 helped lift global consumer confidence higher. A closer look at Morning Consult data shows that the correlation between inflation and sentiment has tightened in recent quarters. However, as the pace of global disinflation slows and economic and geopolitical uncertainty rise, we may see a loosening of the relationship between inflation and sentiment. In fact, we are already beginning to see consumer confidence fall in many of the world’s largest economies, placing the broad uptrend that has been in place since late 2022 at risk.

Inflation Is Currently Top of Mind for Consumers in Most Major Economies

Looking at the relationship between inflation and sentiment at the individual country level, Morning Consult data shows that for most major economies, the correlation has strengthened considerably in 2023. As of September, the rolling 12-month correlation between inflation and the ICS has strengthened to greater than -0.90 in the United Kingdom, United States, Japan and Germany, with China close at hand at -0.87. While falling prices have been lifting sentiment in 2023, the pace of disinflation is slowing, and economic and geopolitical uncertainty are on the rise. The ICS is already starting to roll over in many countries, and we could see the strength of this relationship begin to fade in the coming months.

About the author

Email [email protected] to speak with a member of the Morning Consult team.