COVID-19 Accelerated Use of Digital Therapeutics, but Coverage Issues and Regulatory Questions Could Slow Their Momentum

Key Takeaways

About 35 to 40 digital therapeutics have been approved by the FDA since 2017, though the agency doesn’t have a specific definition for the products.

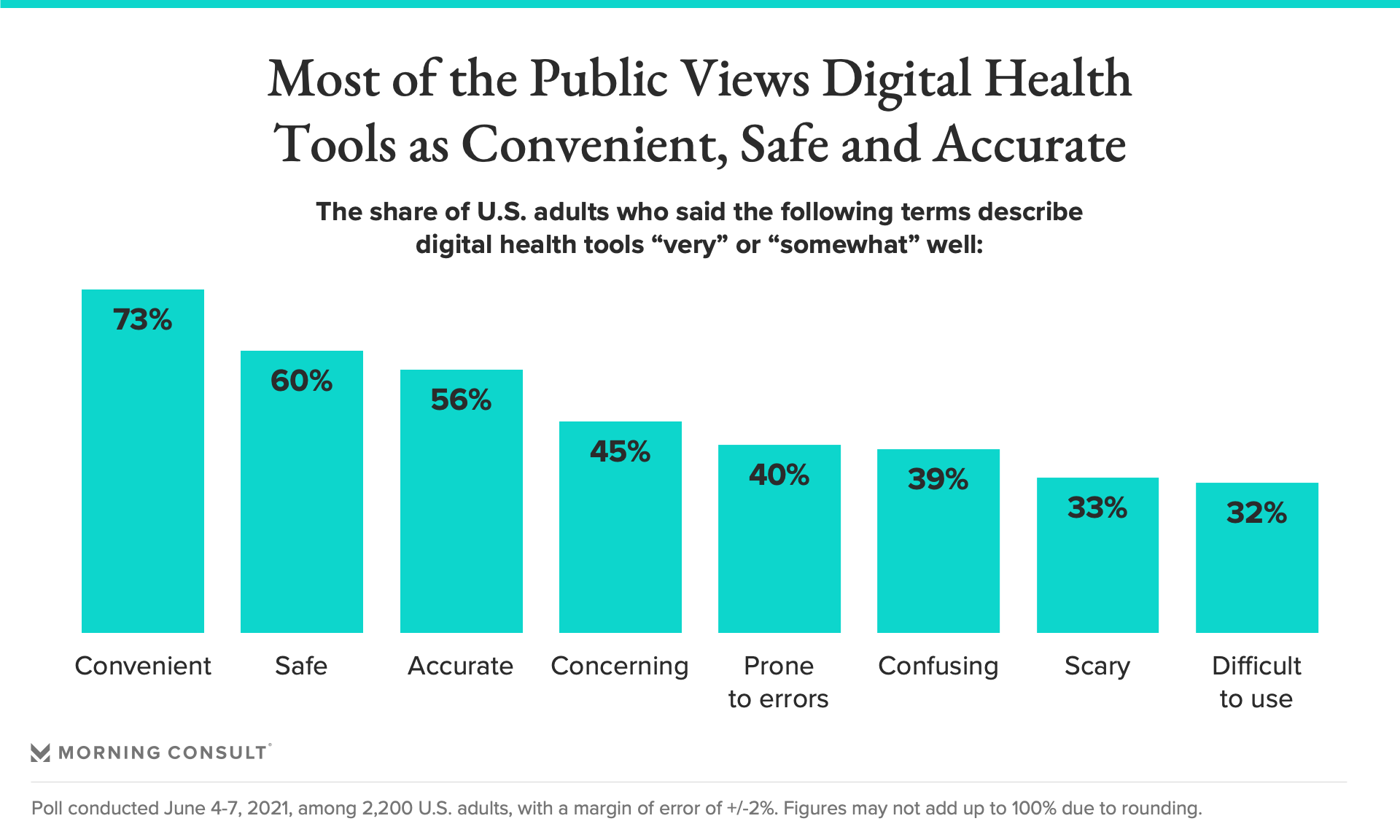

73% of U.S. adults described digital health tools as convenient, while 60% said they are safe and 56% said they are accurate.

42% of adults said artificial intelligence can help clinicians deliver better health care, while 21% said AI can make it more difficult to provide quality care.

Digital therapeutics — clinically tested tools that deliver medical interventions via software — have been gaining traction for years, with products that treat a range of conditions, including diabetes, mental health issues and cancer. Now, the digital health field’s explosive growth during the COVID-19 pandemic is helping these companies carve out a space for their products, but the young sector still faces regulatory and payer-side challenges that could slow its widespread adoption.

The first prescription digital therapeutic to be approved by the Food and Drug Administration was Pear Therapeutics Inc.’s mobile app in 2017 for patients with substance abuse disorders; today there are roughly 35 to 40 products on the market, though the FDA doesn’t clearly define digital therapeutics. Another tool from Cognoa Inc., for example, helps doctors diagnose autism more quickly by having parents submit information about their young children’s behavior in an app that also takes into account physician responses.

The difference between such products and the thousands of wellness apps or non-prescription digital health tools that are available is that “they're going to deliver a clinical outcome, or heavily facilitate that outcome delivery in a really direct way,” said Bill Evans, the chief executive of Rock Health, a venture fund focused on digital health startups.

Despite the medical benefits, a new Morning Consult survey hints at a looming challenge for these tools: clinician and patient trust. Some digital therapeutics rely heavily on artificial intelligence, and in the poll, 42 percent of adults said AI can help clinicians deliver better health care, while 21 percent said AI can make it more difficult to provide quality care and 37 percent didn’t know or had no opinion on the matter. Overall, men were more likely than women to be on board with AI in health care.

Public perception may shift as these products become more widely used. During the pandemic, federal regulators loosened some requirements to make digital health tools more accessible, and digital therapeutics companies saw an opportunity to prove their worth. In April 2020, for example, Omada Health Inc. announced that its digital mental health tool would be available for free to all commercial health plans for the next six months.

An FDA spokesperson said the agency “would like to see more evidence-based products in this area” but declined to comment on which flexibilities might last beyond the pandemic.

The pathway for digital therapeutics to the market is also fairly unique. Experimental drugs can undergo years of costly research and clinical trials, but with digital treatments, “technology inherently — this is why it's so attractive — is easier to implement and lower risk” to study, Evans said.

“There are some really promising case studies, and now companies are scaling really well because they did a good job” proving their products’ value, he added.

Getting these products on the market is only half the challenge, though. Given they’re so new, there’s no specific benefit category for digital therapies in Medicare, meaning the public health insurance program for seniors hasn’t always reimbursed clinicians who prescribe them. Megan Coder, executive director of the Digital Therapeutics Alliance, a coalition of manufacturers, said private insurers have expressed more interest in covering these tools, and companies are increasingly making them available to their employees.

More than 50 companies’ health plans cover Kaia Health’s mobile app to help consumers self-manage chronic pain through virtual physical therapy, for example. The app uses an algorithm to provide daily personalized exercises, and a 2019 clinical trial found it was more effective at curbing patients’ back pain than physiotherapy with online patient education.

In late 2019, Cigna Corp.’s pharmacy benefit manager Express Scripts launched a digital health formulary to help employers and health plans determine coverage, beginning with 15 remote monitoring services and digital therapeutics it vetted for clinical effectiveness, usability, security and financial value. The company added another five tools to the formulary in October, targeting issues including women's reproductive health, tobacco cessation and muscle and joint pain.

“The pandemic has rapidly accelerated the adoption of digital health solutions,” especially for tools addressing depression, anxiety and insomnia, said Mark Bini, chief patient experience officer at Cigna’s Evernorth, which absorbed the Express Scripts brand last year.

The formulary “already saves plans an average of $120,000 per solution in administrative costs,” Bini said.

Coder warned that the divide between what public and private plans cover could lead to gaps in access for patients with public health insurance, “an increasing disparity that will continue to grow until this issue is solved.”

Her trade group is waiting on two decisions that could help make the case for increased coverage of digital therapeutics: Upcoming changes to the Medicare physician fee schedule could make it easier for clinicians to get reimbursed for the time they spend using these tools. And the Centers for Medicare and Medicaid Services is expected to make a final call by mid-December on a Trump-era rule that would automatically grant Medicare coverage for newly approved “breakthrough” medical technologies for four years.

Medtech companies favored the rule, but insurers and providers pushed back, arguing that there are questions about their efficacy and that these tools should go through existing coverage pathways. A CMS spokesperson said the delay “allows more time to review the provisions within the current rule and make decisions on future steps.”

Yet even if insurers offer digital therapeutics to patients, their availability means little if clinicians don’t understand their capabilities and if patients are wary of using them. Morning Consult’s survey indicates U.S. adults were most likely to say digital health tools are convenient, safe and accurate, though at least a third also found them difficult to use, scary or confusing.

The poll was conducted June 4-7 among 2,200 U.S. adults, and has a margin of error of 2 percentage points.

Even as health insurers consider how to evaluate these tools and clinicians work to make them accessible to patients, Coder noted that countries such as South Korea and Germany have taken steps to make them more widely available — and that this shift isn’t likely to slow anytime soon.

“As the health care ecosystem evolves, digital therapeutics are a vital part of that,” Coder said.

Gaby Galvin previously worked at Morning Consult as a reporter covering health.

Related content

As Yoon Visits White House, Public Opinion Headwinds Are Swirling at Home

The Salience of Abortion Rights, Which Helped Democrats Mightily in 2022, Has Started to Fade