The Paycheck Protection Program Was Fintech’s ‘Moment to Shine.’ That Spotlight Also Revealed the Problems With Those Loans

Key Takeaways

Lending to as many small businesses as quickly as possible while warding off fraud was “a difficult balance to strike,” Kabbage President and co-founder Kathryn Petralia said.

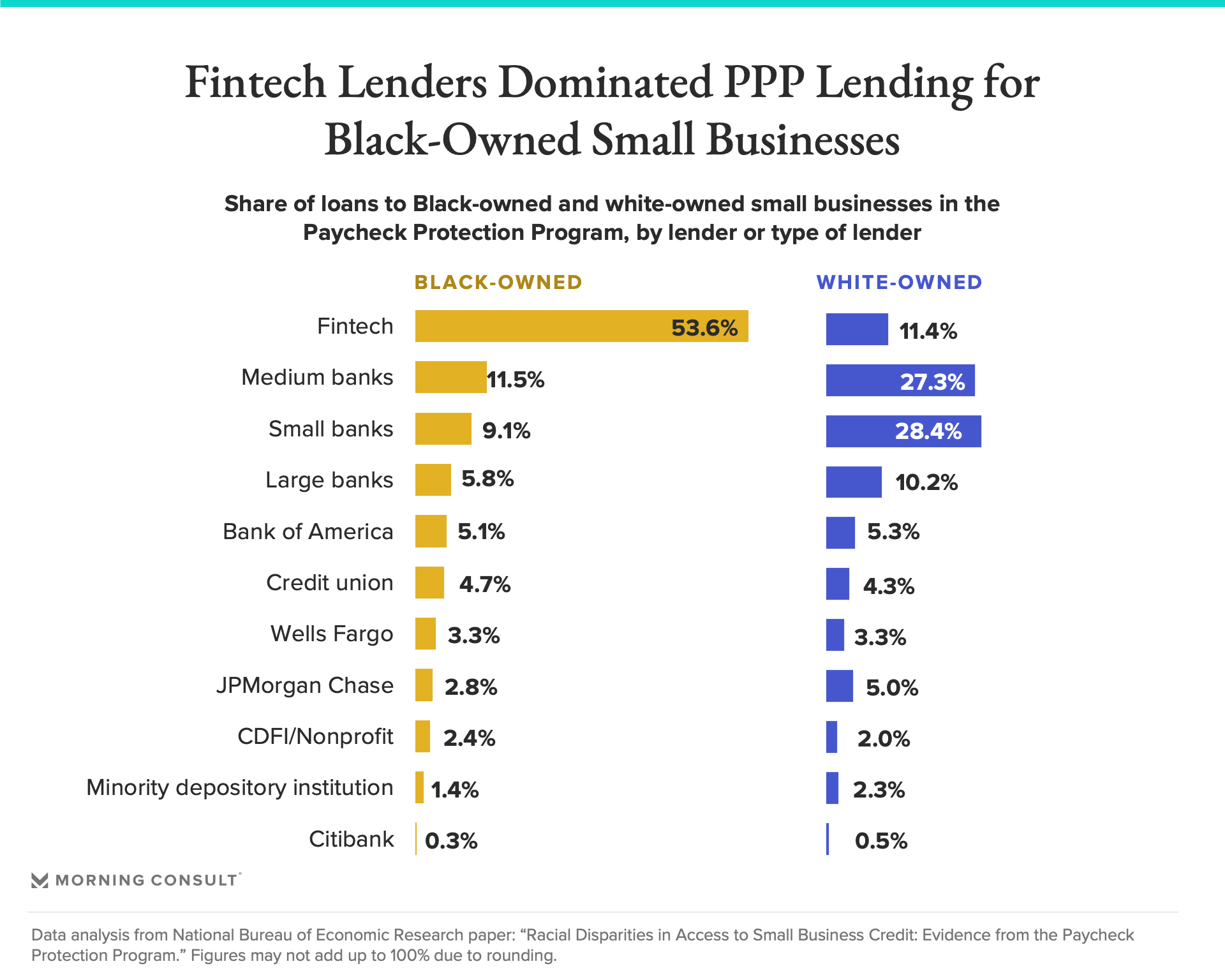

A National Bureau of Economic Research working paper found that fintechs were more successful than traditional banks in reaching minority-owned businesses.

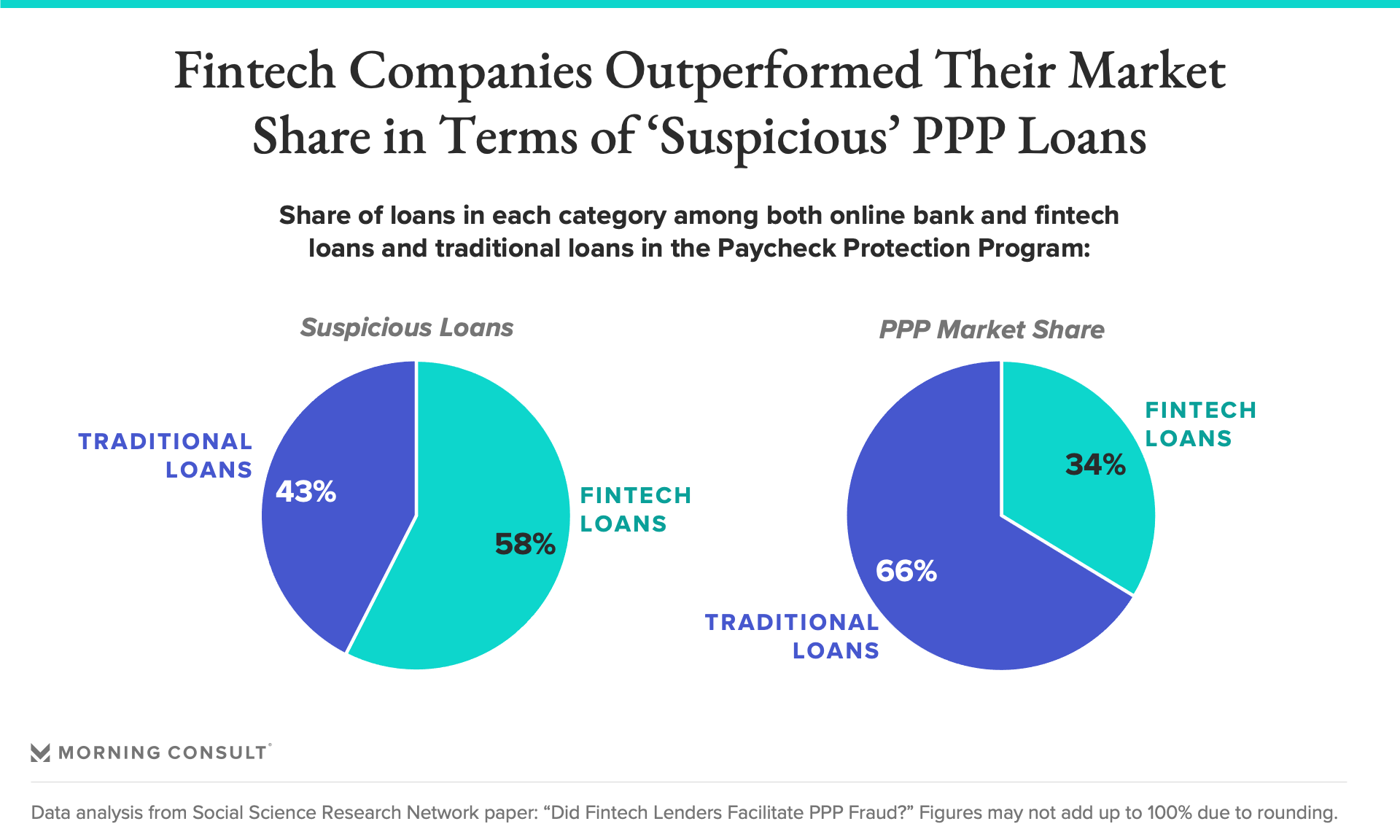

But fintechs were “responsible for a disproportionate share of suspicious loans” in the PPP, per a University of Texas paper.

Business boomed for Kabbage Inc. during the pandemic.

The online, small business lender disbursed billions of dollars in pandemic aid through the Paycheck Protection Program, earning a good amount in fees for their trouble. Along with other fintech lenders, Kabbage says its technology allowed it to make lending decisions quickly, with little human input, shuffling funds off to borrowers at lightning speed.

In an interview, Kathryn Petralia, co-founder and president of Kabbage, said that the PPP was “fintech’s moment to shine.”

Fintech’s approach comes with drawbacks, however. And in the postmortem of the PPP, policymakers at the Consumer Financial Protection Bureau and other financial regulators are looking closely at the ways fintech lenders doled out money during the pandemic as the agency shapes its public-facing opinions on fintech lending to consumers and small businesses alike, according to a source familiar with the matter.

Underlying the discussion is one of the biggest priorities for the Biden administration’s financial regulators: fair access to capital for minority communities and the role of Big Tech in the economy. Rohit Chopra, the recently confirmed head of the CFPB, zeroed in on algorithmic lending in one of his first public statements in the role, saying that lending decisions made with little human involvement could “unwittingly reinforce biases and discrimination, undermining racial equity.”

A CFPB spokesperson declined to comment on algorithmic lending and fintech regulation more broadly, but pointed to remarks made by then-acting Director Dave Uejio in September about the agency's proposed small business lending rule that would require that certain institutions report small business lending data to better understand loans to minority and women-owned businesses.

What happens when people are taken out of the lending decision-making process

While the CFPB considers fairness of fintech lending, Kabbage and other companies have extolled the virtues of algorithms when it comes to fair lending decisions.

Petralia said that Kabbage could process loans quicker than its traditional competitors, and devoted fewer human resources to loan decisions, meaning each loan cost less money to process. That allowed the company to process smaller loans from new customers, whereas larger banks would be more likely to believe they could make more money off a larger loan or a loan from a pre-existing customer, she said.

“These large banks didn’t wake up and say, ‘We want as few minority-owned businesses as possible’; the system is just set up to generate that outcome, unfortunately,” she said.

To be sure, research has found that in the PPP program, fintechs were more successful than traditional banks in reaching minority-owned businesses, according to a recent National Bureau of Economic Research working paper.

Fintech companies in the PPP did a disproportionate amount of the lending among Black-owned businesses, according to the analysis. Researchers found that the lack of human involvement actually helped fintechs lend more to Black-owned businesses, suggesting a “potential role for discrimination” among other lenders for the disparity.

Pitfall for fintech: PPP lending rules don’t reflect real-world conditions

Fintech’s work with minority communities going forward isn’t a given, policy observers say.

While Marisa Calderon, executive director of the National Community Reinvestment Coalition’s community development fund, said that the “facelessness” of fintech lending could be a bonus for minority borrowers, the structure of the PPP program, where there was very little risk to the lender, might not be a universal example for regulators to watch going forward.

“Some of our borrowers mentioned they assumed it would be easier to be approved if they weren’t going into a place where they could see what they looked like,” she said. “When your only interaction is over a computer, you’re just a number on a paper or a name on a paper.”

But algorithmic lending presents its own challenges, depending on what data is used to train lending algorithms, she said, and the PPP set out very specific guidelines for lending decisions that don’t necessarily mimic real-world experiences. So even if fintech lenders succeeded in widely distributing capital in the PPP, that’s not to say they would have the same success in a more open system.

Trading efficiency, expanded access for potentially higher levels of abuse

Fintech’s quick and easy decision-making model arguably helped distribute aid faster and wider, though it also appears more susceptible to fraud.

While this isn’t something that the CFPB has talked about publicly, experts in the field say that the model some fintechs used during the pandemic comes with certain downsides that federal regulators will have to consider as they shape fintech-lending policy.

A paper from the McCombs School of Business at the University of Texas at Austin analyzed PPP loans and found that fintechs were "responsible for a disproportionate share of suspicious loans.” The paper also noted that the lack of human touch might expand access, but “it also appears to be expedient for dubious lending.”

“There seems to be a real trade-off between expanding access, this push for quick, easy, get cash out as quickly as possible, that came with a very real cost susceptibility to abuse,” said John Griffin, coauthor of the paper and a finance professor at the University of Texas at Austin.

Kabbage, which spun off its PPP loan portfolio into K Servicing when most of the business was bought by American Express Co. last year, was at the center of that debate. The Department of Justice has looked into fraud at Kabbage and other fintech lenders, Reuters reported in May, and ProPublica found that Kabbage lent millions to nonexistent businesses, many of them fake farms.

Petralia declined to comment on the ProPublica findings or the Reuters report of the DOJ investigation. The DOJ declined to comment.

“There’s always something you would change and something you would do different, but our mandate was to get as many dollars to as many customers as possible, and if you put too many gates in the way, you end up not serving the people that need to be served,” she said. “It’s a difficult balance to strike.”

Not all lenders in the PPP had high suspicious loan rates, Griffin said. Some companies, including established lenders such as Intuit Inc. and Square Inc., had some of the lowest rates of suspicious loans.

“It’s not clear to me that fintech lending inherently is going to be more prone to fraud in other settings,” he said. “It’s very possible that fintech lending that uses big data, algorithms, etc. is every bit as careful as traditional lenders. We just didn’t see that in the case of the PPP.”

This story was updated to note that the DOJ declined to comment on its reported investigation into Kabbage.

Claire Williams previously worked at Morning Consult as a reporter covering finances.