Tax Refunds Are a Political Wash for 2020

Key Takeaways

Average tax refunds were down as much as 16.7% in mid-February compared to last year.

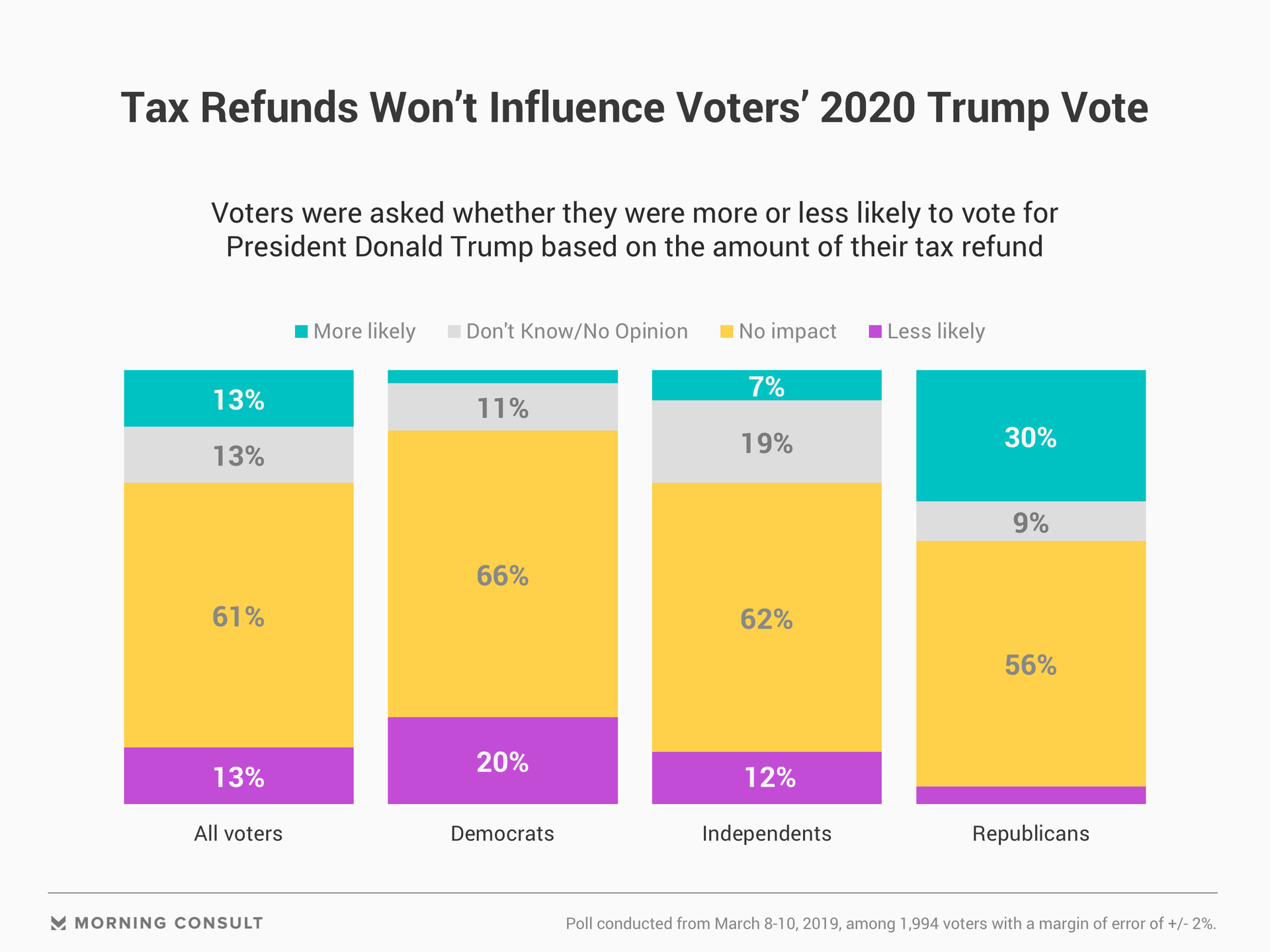

66% of Democrats, 62% of independents and 56% of Republicans say their tax refund won’t sway their vote in 2020.

Americans might be getting lower tax refunds this year, but it probably won’t affect how they vote in the 2020 presidential race, according to a new Morning Consult/Politico poll.

Some people have taken to social media, using the hashtag #GOPTaxScam, after early Internal Revenue Service data suggested that the average tax refund in the first full tax season since the 2017 Republican-led tax overhaul would be lower compared to last year. Republicans and the Treasury Department, meanwhile, have sought to explain that the size of one’s tax refund doesn’t necessarily reflect an increase or decrease in the amount of taxes paid.

But despite the back-and-forth, 61 percent of voters said their tax refund wouldn’t sway their vote for or against President Donald Trump in 2020, according to the March 8-10 survey.

That view was largely supported across parties, including among 66 percent of Democrats, 62 percent of independents and 56 percent of Republicans. The poll surveyed 1,994 registered voters and has a margin of error of 2 percentage points.

Voters were split, 13 percent to 13 percent, on whether their refunds would make them more or less likely to vote for Trump in 2020.

It’s still too early to call for sure, but it’s likely that many Americans will see a lower tax refund this year. According to the most recent IRS data, for the week ending March 1, average tax refunds increased 0.7 percent from a similar period a year ago. In mid-February, however, average refunds were down as much as 16.7 percent. The Government Accountability Office last year warned that the number of Americans who would receive a refund would likely drop, while the number of Americans who owe money would increase.

Among voters, there’s a partisan divide in how people interpret their tax refunds. Eighteen percent of survey respondents said they received a larger tax refund this year compared to last, while 50 percent said they did not.

Democrats were far more likely (61 percent) than Republicans (40 percent) to say they did not receive a higher refund in 2019 compared to 2018. At 25 percent, Republicans were more likely than Democrats, at 14 percent, to say they did receive a larger refund in 2019.

Tax refunds aren’t the only reason Democrats oppose the GOP-led tax overhaul. Democratic candidates have framed the law as helping the wealthiest Americans and corporations at the expense of middle-class and working voters. Previous Morning Consult/Politico polling showed that 78 percent of Democrats think upper-income people pay too little in taxes.

Claire Williams previously worked at Morning Consult as a reporter covering finances.

Related content

As Yoon Visits White House, Public Opinion Headwinds Are Swirling at Home

The Salience of Abortion Rights, Which Helped Democrats Mightily in 2022, Has Started to Fade