How Amazon Prime Day and Walmart+ Week Improved Perceived Value for Paid Retail Memberships

Source: Morning Consult Brand Intelligence

While Christmas in July sales are nothing new, Amazon Prime Day now sets the schedule for the summer sale season. Last week saw Amazon promoting its Prime membership with discounts for members, while Walmart offered early access to their own sale for Walmart+ members and Target promoted their Circle rewards program, along with myriad sales from other retailers. For Amazon and Walmart specifically, promoting their paid memberships is critical to grow and retain enrollment.

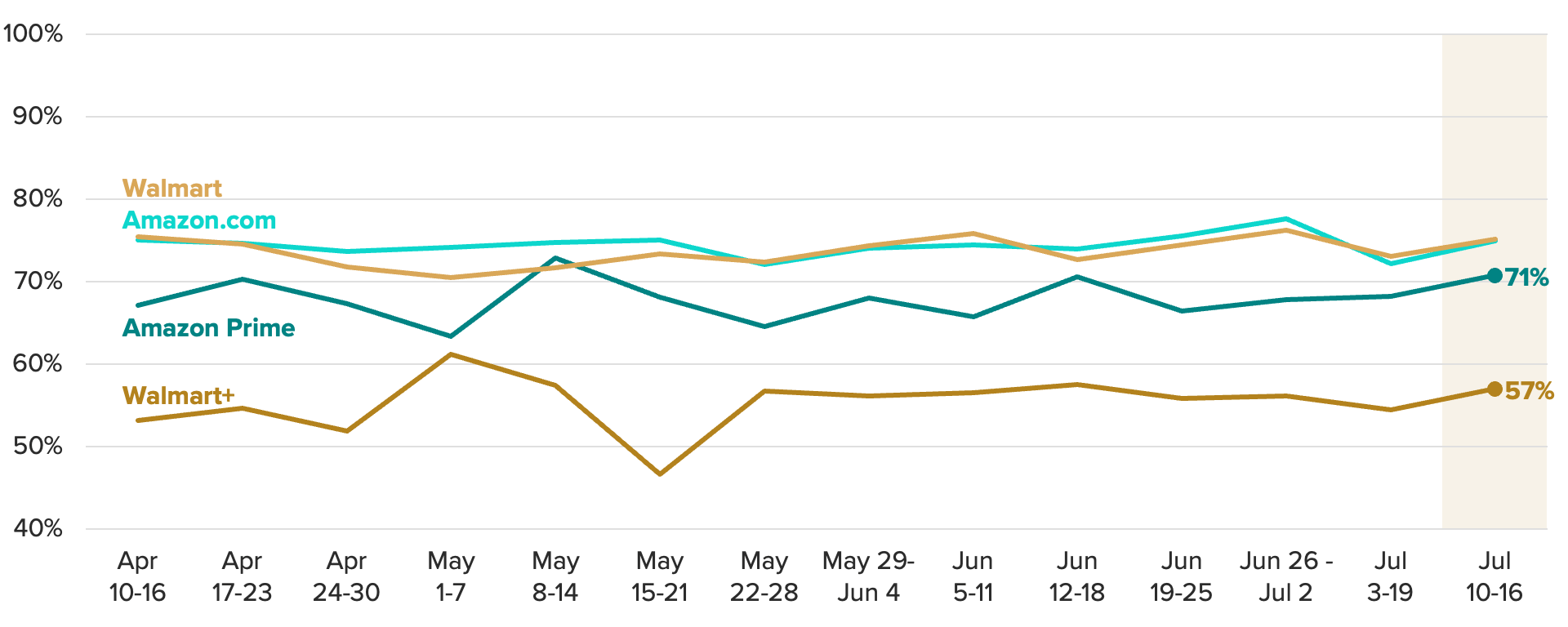

The sales were undoubtedly a success: Per Adobe Analytics, e-commerce sales rose 6.1% across July 11 and July 12. Morning Consult’s high frequency Brand Intelligence data shows that consumers’ perceived value for their paid Amazon and Walmart memberships rose throughout the week as they shopped discounts that felt similar to Black Friday deals. Purchasing consideration for Walmart+ also saw significant growth of 7.6 percentage points, helped along by Walmart’s decision to put the membership itself on sale.

Historically, the impact of these events is short-lived, with value and purchasing consideration trends normalizing once the “new toy” effect wears off and the shipping boxes are recycled. Last year, Amazon introduced a second Prime Day in October, a move the e-commerce behemoth is likely to repeat in 2023.

But the July sales events undoubtedly came at the right time. While consumers had pulled back on spending earlier in the year as inflation continued to pressure household budgets, spending among high- and middle-income groups was on the upswing at the start of summer.

Additional Morning Consult Audiences data shows that Amazon Prime members tend to be wealthier than the average household (51% earn under $50,000 annually, compared with 58% of all U.S. adults) and are better able to afford impulsive discount shopping that these deals inspire. On the other hand, the income demographics for Walmart+ members generally mirror the U.S. general population.

This memo utilizes data from Morning Consult Brand Intelligence, our flagship platform that every day asks thousands of consumers about core metrics for over 4,000 brands and products around the world. MCBI subscribers can further explore the data here. To learn more about MCBI, request a demo here.