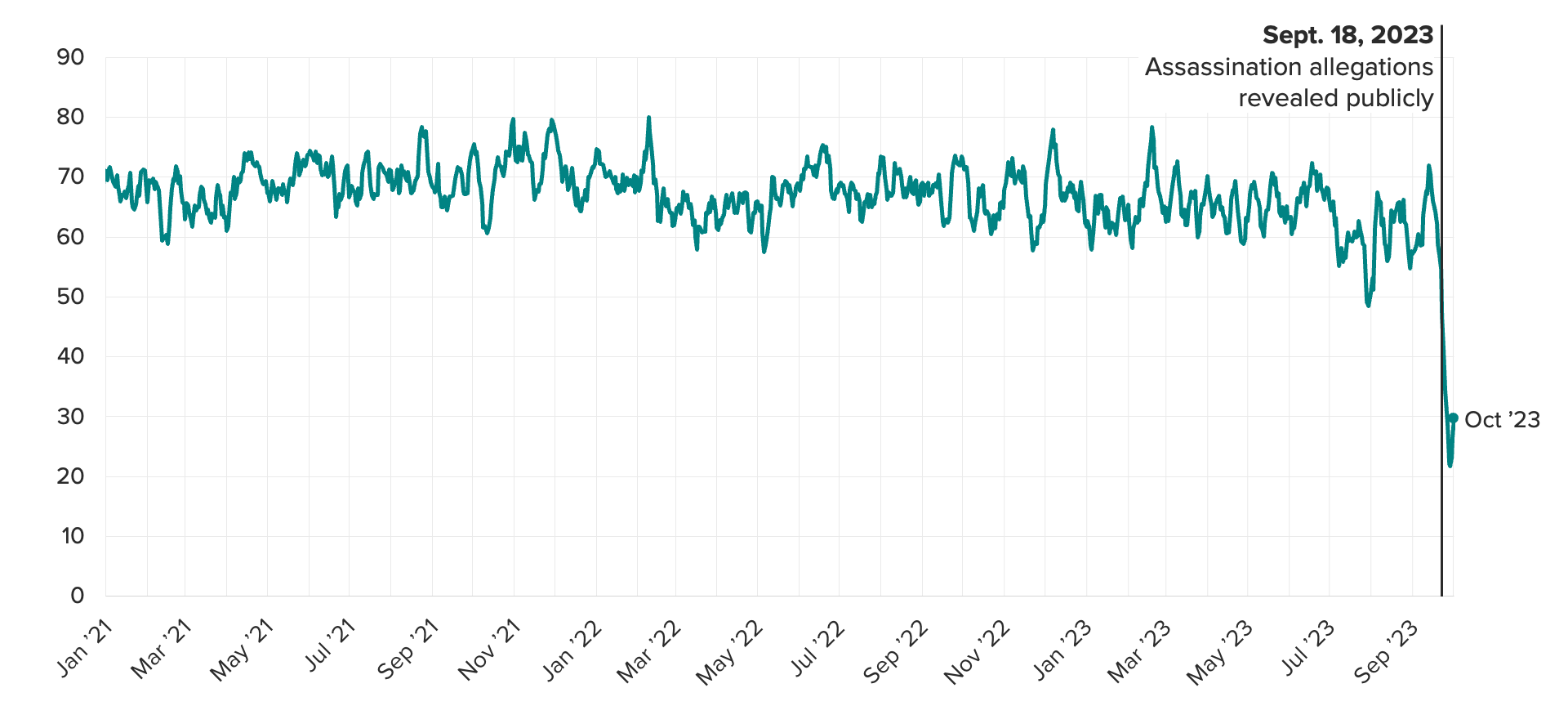

Indian Favorability Toward Canada Hits Tracking Low Amid Bilateral Spat

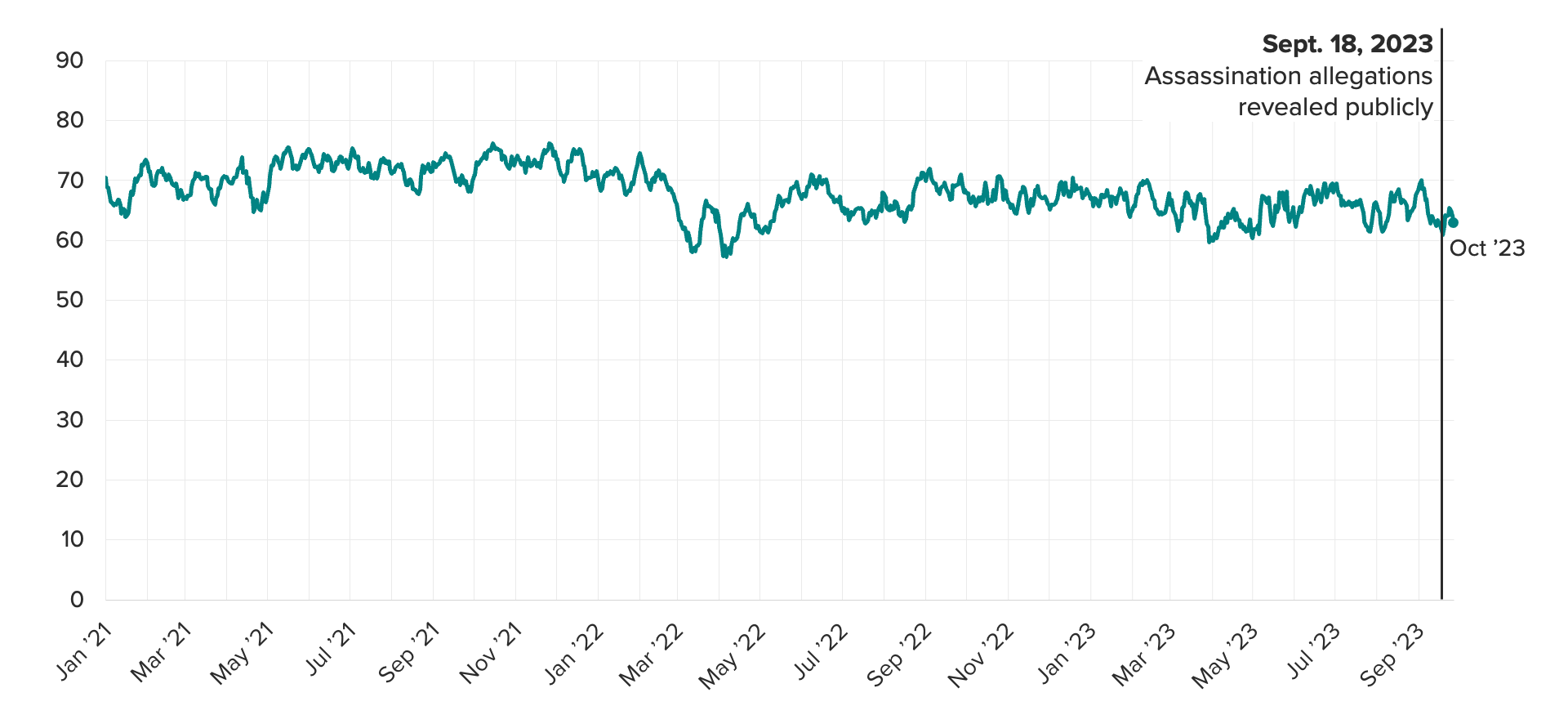

Morning Consult Political Intelligence. Data points represent 7-day simple moving averages of daily surveys conducted from Jan. 1 2021-Oct. 2 2023 among samples of roughly 400 Indian adults per 7-day window.

Key Takeaways

The Trudeau administration’s allegations of Indian involvement in an assassination on Canadian soil have driven Indian net favorability toward Canada to a tracking low.

Bilateral tensions are unlikely to ensnare U.S. consumer-facing companies doing business in India: Net favorability toward the United States among Indian adults remains in line with its historical trend despite U.S. spy agencies’ provision of intelligence on the incident to Canada.

Canadian companies with commercial operations in India can breathe a near-term sigh of relief owing to a slight softening of Indian rancor in the past several days but are not yet in the clear and should continue monitoring bilateral developments.

Sign up to get our analysis and data on how business, politics and economics intersect around the world.

The state of affairs

Net favorability toward Canada among Indian adults is hovering near a tracking low amid a bilateral spat over India’s alleged assassination of a Canadian citizen on domestic soil. The nadir was reached shortly after the Trudeau government’s airing of the incident on Sept. 18, with net favorability falling over 40 percentage points (from 64% on that date to 22% on Sept. 29). The decline coincided with a roughly 18 point increase in the share of Indian adults holding “unfavorable” views of Canada over that same timeframe. Net favorability toward India among Canadian adults hit a tracking low in parallel, notching a smaller 18 point decrease over that same time period.

We survey worldwide: Global data used in this analysis is available exclusively in Morning Consult Intelligence, an online platform tracking consumer attitudes daily on key indicators in 40+ markets. This survey asks respondents about their demographics, political beliefs, economic sentiment, brand perceptions and more.

Why our data is strong: What you’re reading reflects daily global tracking in India, a data set unique to Morning Consult. No other company surveys daily at this scale in as many markets as Morning Consult does.

On a bilateral basis, net favorability toward each country had already been falling (on net) in the week preceding the incident, coinciding with bilateral sparring on the sidelines of the G20 summit over Canadian Sikh protests.

Risk assessment for U.S. and Canadian companies

The deterioration in bilateral relations poses risks for Canadian businesses with commercial operations in India and has raised speculation that spillover effects to U.S.-India relations could similarly imperil American companies (U.S. spy agencies provided Canada with intelligence on the incident).

Our data suggests such spillover effects have not materialized. Indian views of the United States remain overwhelmingly positive, and show little deviation from their historical trend following the incident.

Indians’ Views of the United States Remain Overwhelmingly Positive, Limiting Spillover Risk

Barring subsequent statements from U.S. government officials directly attesting to India’s role in the assassination, we expect American companies to remain in the clear. We nevertheless advise those with a commercial presence in both India and Canada — who could find themselves in Indian consumers’ crosshairs amid the dispute — to remain cautious until the diplomatic crisis and public rancor toward Canada subside.

Our data affirms the latter has already begun to soften: Net favorability toward Canada among Indian adults has begun to rebound on a seven-day rolling basis, as have views from the opposite side. But Canadian companies with business interests in India remain riskier targets than American ones, and should continue to tread cautiously until more sustained signals of a diplomatic resolution and softening of public views are at hand.

Jason I. McMann leads geopolitical risk analysis at Morning Consult. He leverages the company’s high-frequency survey data to advise clients on how to integrate geopolitical risk into their decision-making. Jason previously served as head of analytics at GeoQuant (now part of Fitch Solutions). He holds a Ph.D. from Princeton University’s Politics Department. Follow him on Twitter @jimcmann. Interested in connecting with Jason to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].