Anti-Americanism Continues to Pressure U.S. Brands But Exposure Varies Widely

Country Affinity Research Series: This memo draws upon a growing body of Morning Consult "country affinity" research which examines how consumers' views of the United States shape their views of U.S. brands. Consult our project overview, corporate playbook, and white paper for additional insights and background information. A companion analysis on anti-Americanism and tariffs from March 2025 is available here. Clients and prospects are welcome to reach out directly with inquiries.

Key Takeaways

Anti-Americanism has continued to rise in the window surrounding the Trump administration’s reciprocal tariff threats.

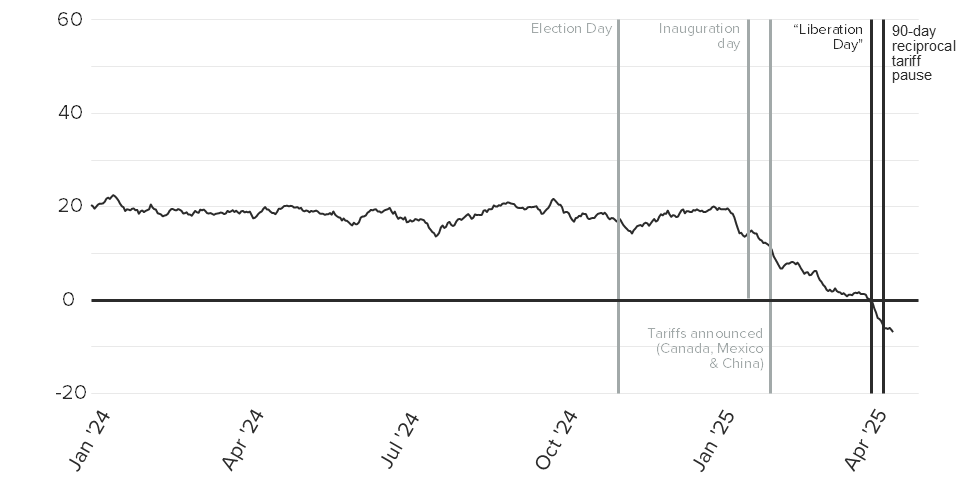

Our core metric of anti-Americanism — global average net favorability toward the United States — has now fallen by roughly 7 points since the April 2 reciprocal tariff announcements, tipping sentiment into negative territory for the first time in years and bringing the total decline to a staggering 25+ points since the start of the year.

Morning Consult Intelligence data meanwhile indicates that global consumers are continuing to pressure some U.S. brands across major markets targeted by the tariffs, including in Canada, China, France, Germany, Mexico, and the United Kingdom.

When we examine the change in net purchase consideration over 2025/YTD for a large basket of brands, the average U.S. brand serving consumers in these markets has fared similarly to the average local brand. But the hardest-hit U.S. brands continue to see steep declines in purchase consideration that consistently exceed those experienced by local competitors. This suggests that overseas consumers are uniquely singling out some American brands due to their country of origin.

Across the markets we examine, brands operating in the food & beverage sector are among the most exposed in North America (Canada and Mexico), but industry exposure in Europe is more dispersed and, on the whole, varies widely by consumer market.

U.S. companies should plan for ongoing brand risks resulting from anti-Americanism regardless of how the reciprocal tariff spat plays out, and should take advantage of the 90-day U.S. tariff pause to better understand exactly how global consumers view their brand relative to both American and local competitors, and take action accordingly.

Contact us for a confidential briefing on these dynamics and to better understand how Morning Consult Intelligence data can help you stay ahead of them.

Anti-Americanism continues to rise amid U.S. reciprocal tariff threats

Anti-Americanism — measured as net favorability toward the United States — has continued to rise amid the Trump administration’s April 2 reciprocal tariff threats, newly imposed 10% universal tariffs, and both sector- and market-specific duties (including steel and aluminum tariffs and successive waves of import taxes targeting China specifically).

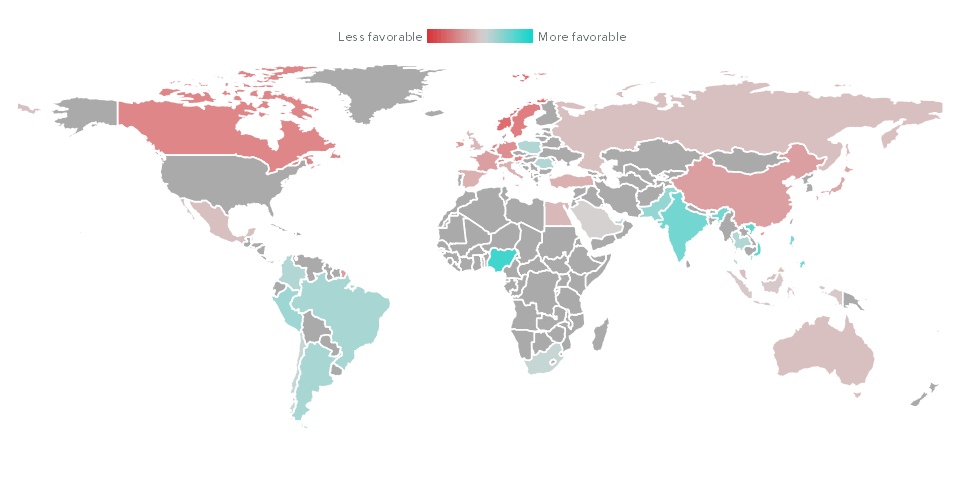

As of mid-April, Morning Consult Intelligence data shows that anti-Americanism is now pervasive among consumers in the 42 overseas markets where we field syndicated surveys daily, with red countries in the chart below indicating those where consumers hold net-negative views of the United States.

Anti-Americanism is pervasive across major global consumer markets

Despite several holdouts — largely confined to South America (which was hit with more limited reciprocal tariffs), India (where expectations of positive trade negotiations are running high), and parts of Southeast Asia — global average net favorability toward the United States has accordingly continued to plummet in the weeks following the reciprocal tariff announcements. While the Trump administration’s subsequent 90-day tariff pause (announced on April 9) initially caused sentiment to flatline, we are now seeing early signs that the downtrend may continue, suggesting the pause has not sufficiently diminished global consumers’ ire.

Global views of the United States have continued to fall amid reciprocal tariff threats

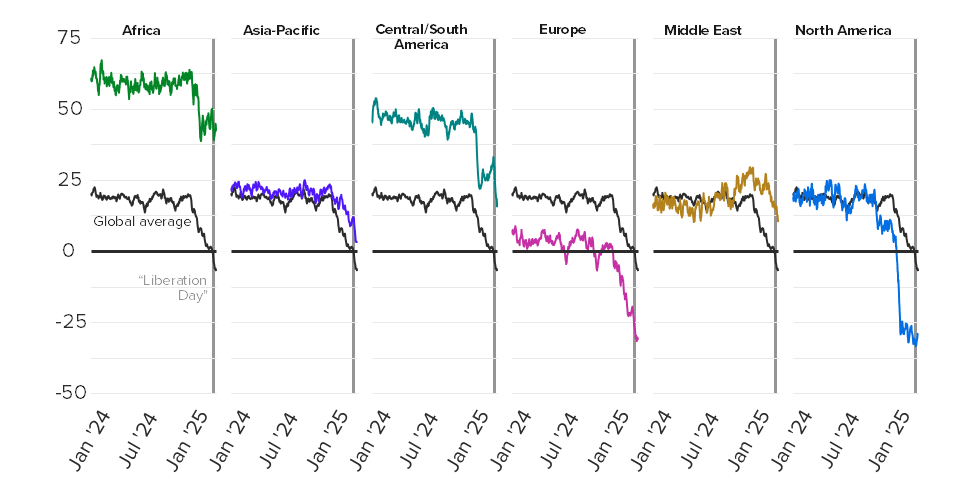

Regional trends mirror the global average, suggesting that the few country-specific holdouts referenced above have done little to stem the tide of rising anti-Americanism in the regions where they are concentrated, with European and North American consumer markets (excluding the United States) leading the charge into negative territory, followed by those in the Asia-Pacific region.

Views of the United States continue to tumble regionally, led by consumers in Europe and North America

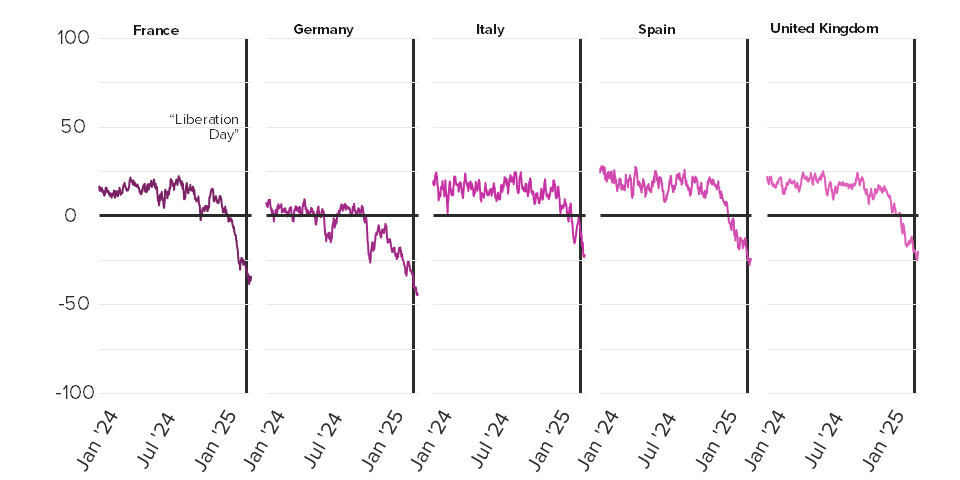

Consumers in major European and Asian markets show spikes in anti-Americanism, while Canadian and Mexican consumers show signs of a reprieve

Among major consumer markets in Europe — including France, Germany, Italy, Spain and the United Kingdom — all saw additional spikes in anti-Americanism in the roughly two-week window following the “Liberation Day” reciprocal tariff announcements, with sentiment the most negative in France and Germany. The United Kingdom, which was hit with more limited 10% tariffs compared with a higher rate across much of continental Europe, shows the least negative sentiment toward the United States at present. But with sentiment falling sharply among Brits since the beginning of the year, this is cold comfort. Major consumer markets for U.S. brands doing business in Asia — specifically in Japan and South Korea — show similar upticks in anti-Americanism around the reciprocal tariff announcements and over 2025/YTD more broadly.

Views of the United States among major European and Asian consumer markets have fallen further amid Liberation Day tariff threats

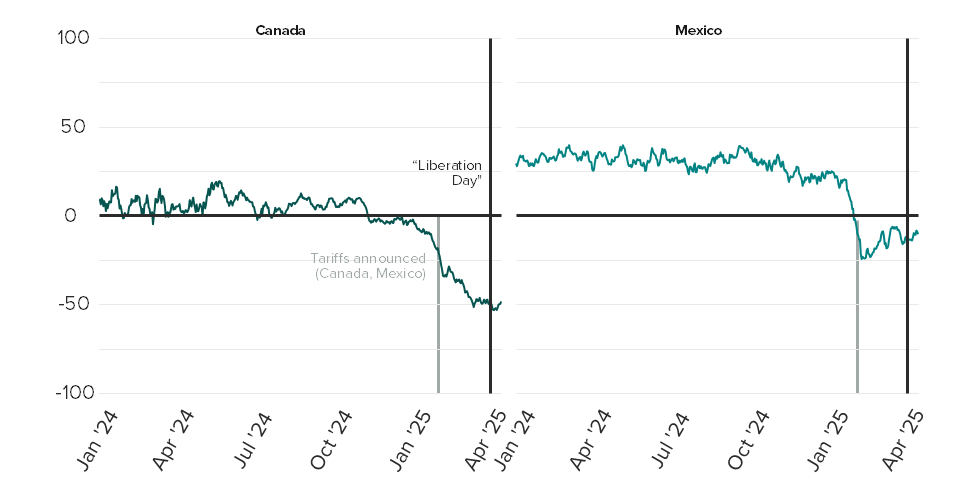

North America is the outlier. Favorability toward the United States plummeted among Canadian and Mexican consumers beginning in January 2025, when the Trump administration first announced its plans to proceed with 25% tariffs on imports from its neighbors (since formalized on Feb. 1). But views have trended sideways in Canada and rebounded slightly in Mexico around the reciprocal tariff announcements. While the 25% tariffs targeting those markets remain in force for products not covered by the U.S.-Mexico-Canada Agreement (USMCA), Canada and Mexico were among the few countries that avoided being hit with pronounced reciprocal tariffs in April. We attribute the post-Liberation Day rebound in sentiment in these markets to those developments. Anti-Americanism in both countries nevertheless remains substantially more pervasive compared with the beginning of the year.

Views of the United States among Canadian and Mexican consumers show signs of rebounding

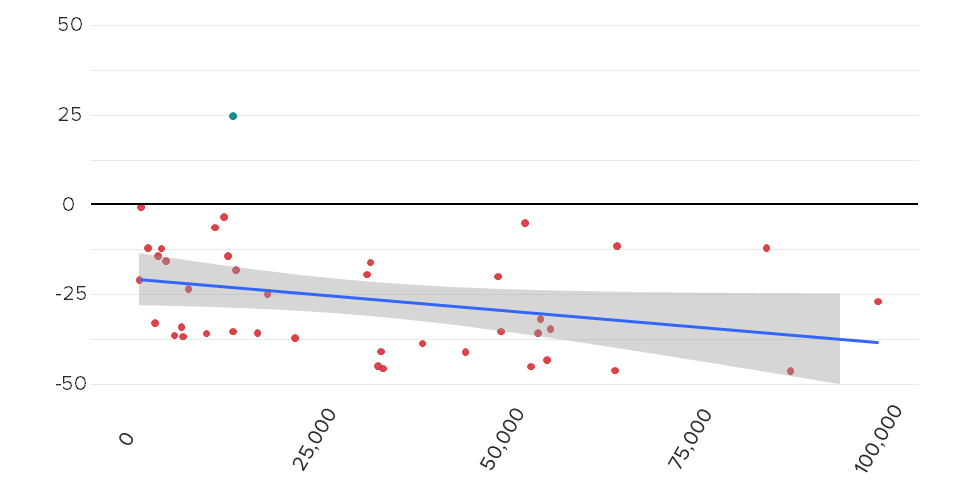

Consumers in higher-income markets have continued to sour on America the most

Adding insult to injury for U.S. brands courting consumers in overseas markets, consumers in higher-income markets remain in the lead when it comes to turning their backs on America and potentially on U.S. brands, mirroring the finding from our March 2025 analysis. From Jan. 1 through April 15, views of the United States have fallen the most in consumer markets with higher GDP per capita, where consumers with greater disposable income are more likely to be found.

Consumers in higher-income markets continue to turn their backs on America the most

Rising anti-Americanism poses heightened risks for some U.S. brands, but not all of them

As Morning Consult’s growing body of “country affinity” analysis has shown, anti-Americanism can pose challenges for U.S. brands serving overseas consumers to the extent that consumers’ views of the United States shape their views of American brands. Our earlier work on major geopolitical conflicts — including the Russia-Ukraine war, the Israel-Hamas conflict — and a supporting white paper suggests the two are commonly related. In the context of the U.S.-led trade war, the risk for U.S. brands is that consumers’ growing antagonism toward the United States resulting from an onslaught of tariffs emanating from Washington will cause them to seek out alternative goods and services provided by local and foreign (non-U.S.) brands, posing risks to U.S. companies’ revenue and market share.

Mirroring our analysis from March — expanded here to include major European consumer markets and updated through the reciprocal tariff announcements — our data continues to suggest that while U.S. brands face pressing risks on this front, not all brands are created equal when it comes to their risk exposure.

To demonstrate this, we examine two metrics: (1) the average change in net purchase consideration across U.S. and local brands tracked by Morning Consult Intelligence on a daily or weekly basis in Canada, China, France, Germany, Mexico and the United Kingdom; and (2) the maximum decline in net purchase consideration among brands within each group. Doing so reveals a mixed outlook for U.S. brands.

The hardest hit U.S. brands continue to face outsized exposure to tariff-related risks relative to local competitors

On the one hand, we find that the average change in net purchase consideration for brands within each group is similar (green squares in the chart above), suggesting the average U.S. brand serving overseas consumers in those markets has not fared much differently than the average local brand over 2025/YTD. This speaks to the possibility that consumers’ consideration of all brands in these markets is at least partially attributable to factors other than their country of origin, and that U.S. brands have varying country affinity with the United States. Worsening consumer confidence — on display in 31 of the 43 markets where we track it as of March 2025 — is one such factor, and could motivate consumers to think about adapting their overall spending behavior in turn.

On the other hand, the largest market-specific declines in purchase consideration among the U.S. brands we examine consistently exceed those we observe for local brands, commonly on the order of roughly five percentage points. And in absolute terms, the decline for the hardest-hit U.S. brands is far from trivial, ranging from roughly 10 points up to nearly 30. U.S. brands also consistently show lower average net consideration than local brands (gray circles in the above chart).

U.S. brands seeing the largest declines in each market are outliers by definition, and the swings in net purchase consideration observed on this front should be treated as the upper bound when it comes to the risks that U.S. brands can expect to face amid rising anti-Americanism. But a broader cut of the data — which looks at the range of the decline in net purchase consideration for the 20 most affected U.S. brands we track in each market (i.e. the top 20 brands in each market ranked by the decline in net purchase consideration) — suggests a wider range of U.S. brands face above-average risk exposure. From March 1-April 15, 2025, bookending the Trump administration’s reciprocal tariff announcements, brands falling in the top 20 have seen declines in net purchase consideration ranging from 3 to 18 points. These declines are generally above the impact experienced by both the average U.S. and local brand we track in each market we examine.

Reciprocal tariff announcements coincided with large declines in purchase consideration for the most exposed U.S. brands in key consumer markets

Not all industries are equally exposed, further complicating risk assessments for U.S. brands

Just as not all U.S. brands are created equal when it comes to their exposure to anti-Americanism, so too for the industries in which they operate. Among the top 20 U.S. brands seeing declining purchase consideration in the six consumer markets we examine, the industry composition of those brands varies substantially.

Industry exposure to anti-Americanism amid reciprocal tariff threats varies widely by consumer market in North America and China

In North America (Canada and Mexico), the most affected brands are concentrated in the food & beverage industry (including restaurants; see pink and green segments in the charts above). But single-brand industries — denoted as “other” and representing industries whose shares among the top 20 are five percent each (red segments in charts) — collectively make up a large share of the total. By contrast, in the major European markets we examine, the industry composition of the most affected brands is more variable by market and is also widely dispersed, as evidenced by the relatively large share of brands falling into the “other” category. Trends are similar for industry exposure in China.

Industry exposure to anti-Americanism amid reciprocal tariff threats varies widely by market across Western Europe

On the one hand, these industry snapshots suggest that relatively few industries are being particularly singled out by global consumers amid a spate of looming U.S. tariff threats. But they also suggest that few industries may ultimately be spared, owing to the relatively pronounced industry dispersion our data reveals in all of the markets we examine.

Brands should leverage the U.S. administration’s 90-day tariff pause to gameplan

If there’s one thing that’s clear from the above discussion, it’s that global consumers have turned sharply against America. But our data continues to provide a mixed picture of the extent to which they have simultaneously turned against U.S. brands. While the average U.S. brand has performed similarly to local competitors in overseas markets when it comes to net purchase consideration over 2025, the hardest hit U.S. brands have been more sharply penalized relative to those same competitors.

Looking ahead, we expect heightened anti-Americanism to persist for the foreseeable future, with attendant risks for brands. While Washington’s 90-day tariff pause will give countries time to negotiate on trade, and while much of the decline in America’s global reputation has coincided with the Trump administration’s successive tariff announcements, other longer-term drivers are also at play that will likely outlast the tariff war. The Trump administration’s willingness to see Ukraine cede territory to Russia as part of a negotiated end to the war in Ukraine, a reduction in U.S. funding for overseas humanitarian assistance, and Washington’s general geopolitical retrenchment are among these other drivers. And while it should come as no surprise to U.S. allies and partners, the trade war itself speaks to the administration’s willingness to lean further in the direction of transactional policymaking in a rebuke of America’s recent history as the world’s “benevolent hegemon.”

For all these reasons, the Trump administration’s 90-day reciprocal tariff pause will provide brands with a time-bound opportunity to gameplan around rising anti-Americanism that all brands would be wise to take advantage of, regardless of their expectations for how the reciprocal tariff landscape will ultimately shake out. Monitoring purchase consideration and other key brand metrics via Morning Consult’s Intelligence platform — both for individual brands and in comparison to U.S. peers and local competitors, alongside trends in anti-Americanism (via that same platform or our U.S. Reputation Tracker) — affords brands near real-time opportunities to strategize, scenario plan, and course correct as necessary.

Contact us for a confidential briefing on these dynamics, and to better understand how Morning Consult Intelligence data and Morning Consult Pro can help you stay ahead of them.

Jason I. McMann leads geopolitical risk analysis at Morning Consult. He leverages the company’s high-frequency survey data to advise clients on how to integrate geopolitical risk into their decision-making. Jason previously served as head of analytics at GeoQuant (now part of Fitch Solutions). He holds a Ph.D. from Princeton University’s Politics Department. Follow him on Twitter @jimcmann. Interested in connecting with Jason to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].