Where Consumers Are Looking to Cut Entertainment Spending

Key Takeaways

Over 3 in 5 (64%) consumers with at least five video streaming services say it’s important to spend less on them in the next year, 13 percentage points higher than U.S. adults.

Consumers were more likely to prioritize cutting back on one-off entertainment expenses in the past year, but recurring entertainment expenses, like video streaming, are important for many to save on in the next year.

That goal could be a challenge to achieve as all major streamers have recently raised prices and some big players, like Disney, are planning on cracking down on password sharing.

Data Downloads

Pro+ subscribers are able to download the datasets that underpin Morning Consult Pro's reports and analysis. Contact us to get access.

The options for quality entertainment can feel endless. New streaming shows, big budget movies and superstar concerts are just a few of the options Americans have at their fingertips. But all those choices come with a cost, and despite inflation falling from record highs in the summer of 2022, consumers are still feeling pinched.

Similar to last year, consumers continue to report cutting back more on one off expenses over most subscription services. But, they aren’t done trimming. Many consumers still have plans to tighten their entertainment budgets even further in the upcoming year, and saving on subscription services are among their highest priorities.

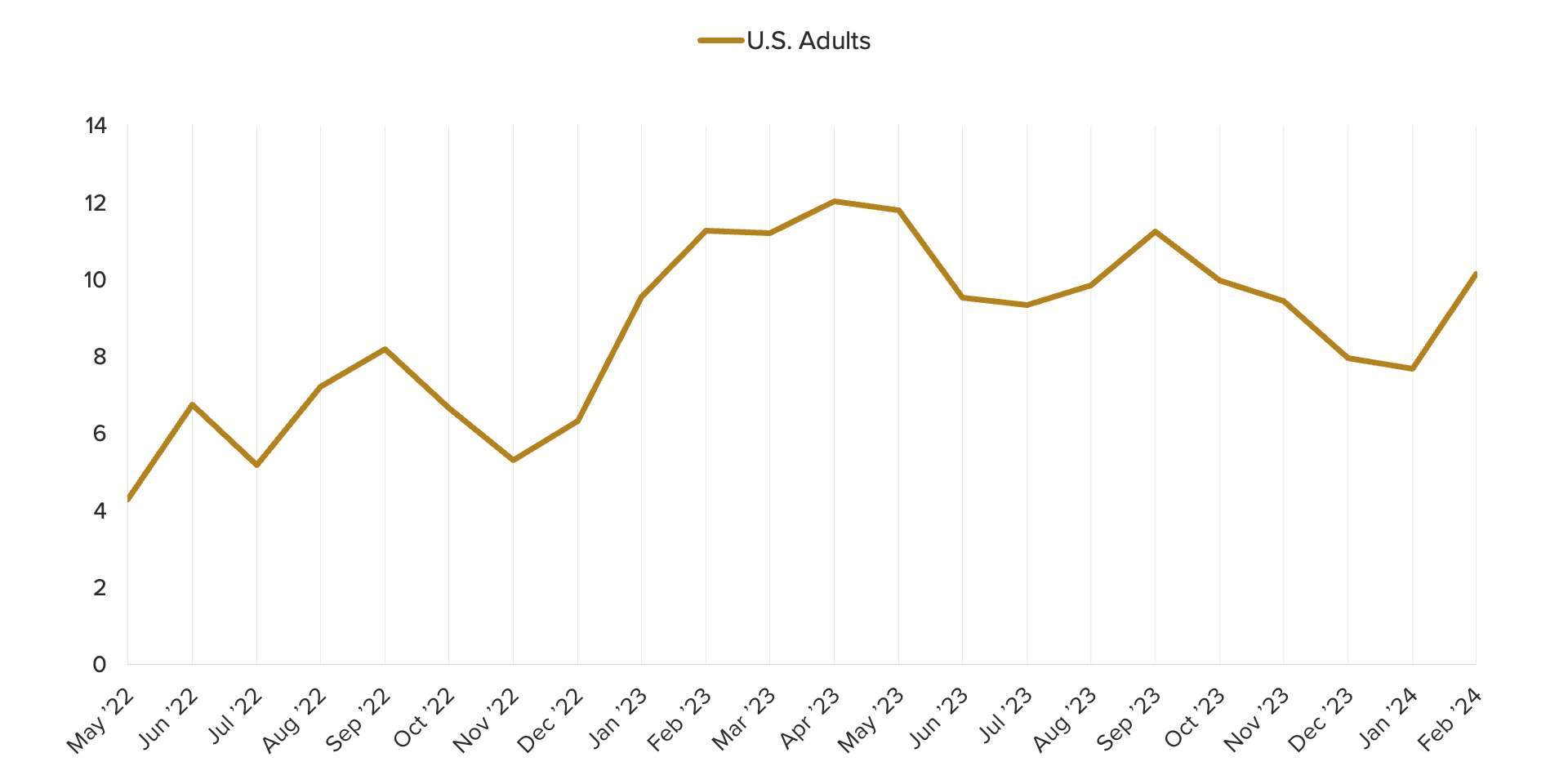

Telecom price sensitivity is down from its peak, but rising

Morning Consult’s proprietary index tracking the prevalence of consumers walking away from purchases due to prices indicates that telecom (including internet, mobile plans and streaming subscriptions) price sensitivity is down from its peak in April of last year, but growing in recent months.

Consumers Are Walking Away from Telecom Purchases Due to Prices

This improvement is likely due to softer inflation helping support discretionary spending overall. However, core inflation remains stubbornly high, driven largely by services categories like rent and car insurance. The elevated cost of living continues to put pressure on household budgets, forcing consumers to make trade-offs with their discretionary spending. Many are prioritizing entertainment outside the home, like travel, rather than adding new telecom services.

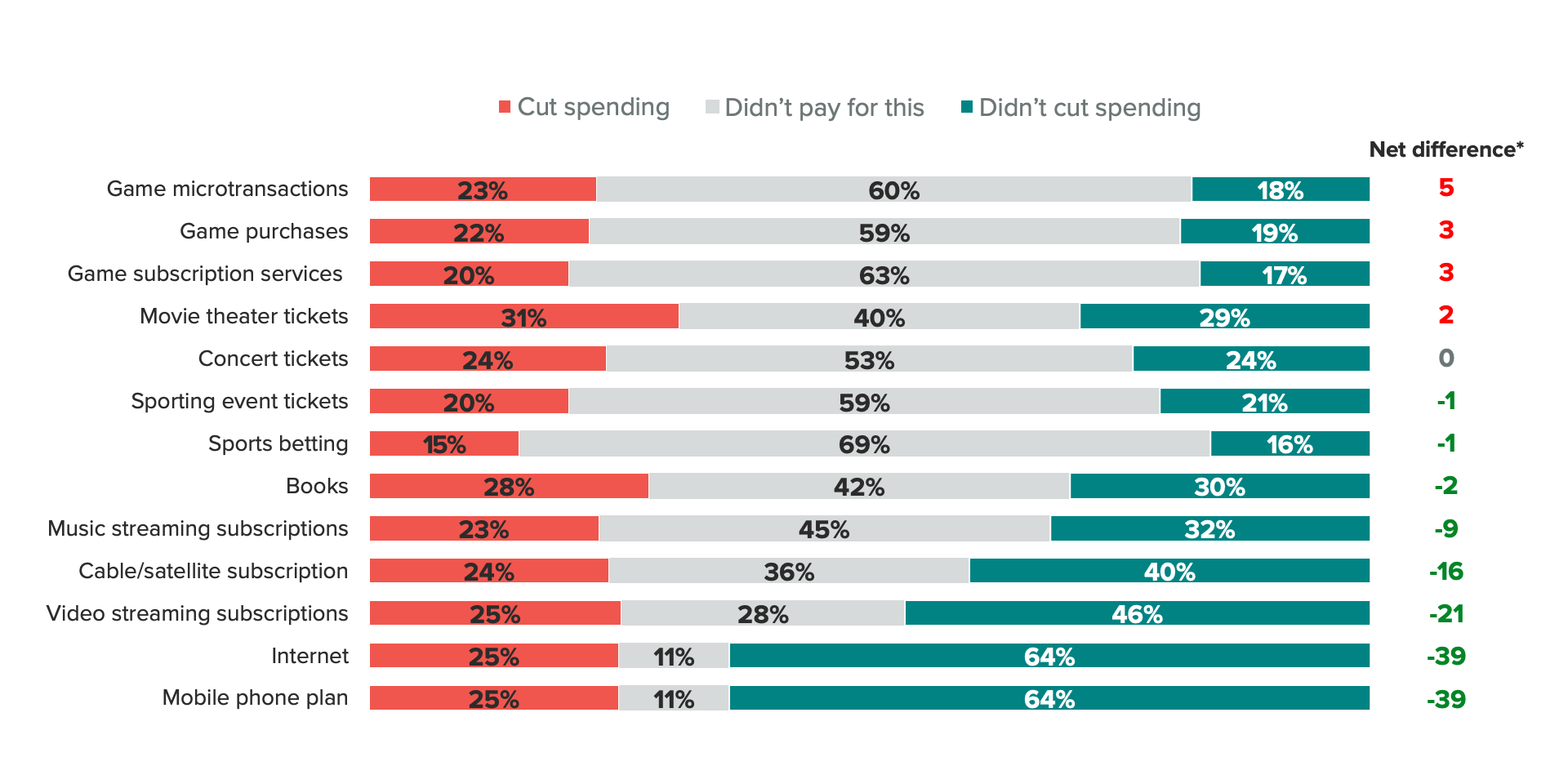

One-off entertainment purchases are first to go

While telecom and entertainment prices aren’t contributing much to the recent volatility of topline inflation, consumers have still decided to cut back or stop spending in these categories in the past year, likely to make more room in their budgets for higher prices of essential services, like rent.

When asked specifically where they cut back or stopped spending in the past year on entertainment, the largest shares of consumers said one-off purchases like movie theater tickets and books. Looking at the data by net difference between those who cut spending and those who didn’t in a particular category also shows single use entertainment expenses most impacted, with a particular emphasis on gaming.

Entertainment Subscriptions Saw Fewer Cutbacks Than One-Off Purchases

U.S. adults were more likely to say they cut versus not cut their spending in the past year on every type of video game expense we asked about, including both one-off purchases and subscriptions.

Two areas the majority of adults aren’t cutting back? Internet and mobile phone plans. The largest shares of consumers said they didn’t cut back on these expenses, and the smallest shares of consumers also said they didn’t pay for these expenses.

Consumers aren’t done trying to save on a number of entertainment expenses

But that doesn’t mean consumers aren’t looking to find future savings. In fact, internet and phone plans are the top priorities for consumers looking to save on entertainment costs. Roughly 3 in 5 U.S. adults said it’s important to spend less on those categories in the next year.

Trimming Future Recurring Entertainment Expenses Is Important for Consumers

That goal could be tricky for consumers given internet and mobile phone plans are recurring expenses and major telecom companies, like AT&T and Verizon, have recently announced price increases to some of their plans.

Next on consumers’ list for cutbacks are a variety of subscription services, including video streaming, cable or satellite television and music. Streaming services become even more of a priority for the most prolific users. Over 3 in 5 (64%) of those with five or more streaming video services say it’s important to spend less on them in the next year, 13 points higher than U.S. adults.

The inclination to cut may be due to more than just economic pressures. Streaming services used to be a great deal for their subscribers, but prices, and password restrictions, have changed. Netflix plans can now cost over $20 a month, an all-time high, and every other major streamer also implemented price hikes in 2023. In addition to raising prices, more streaming companies are looking to crack down on password sharing, which could bring them more revenue, but add yet another recurring entertainment expense to consumers’ budgets.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]