Getting to Know the Gen Z Grocery Shopper

Key Takeaways

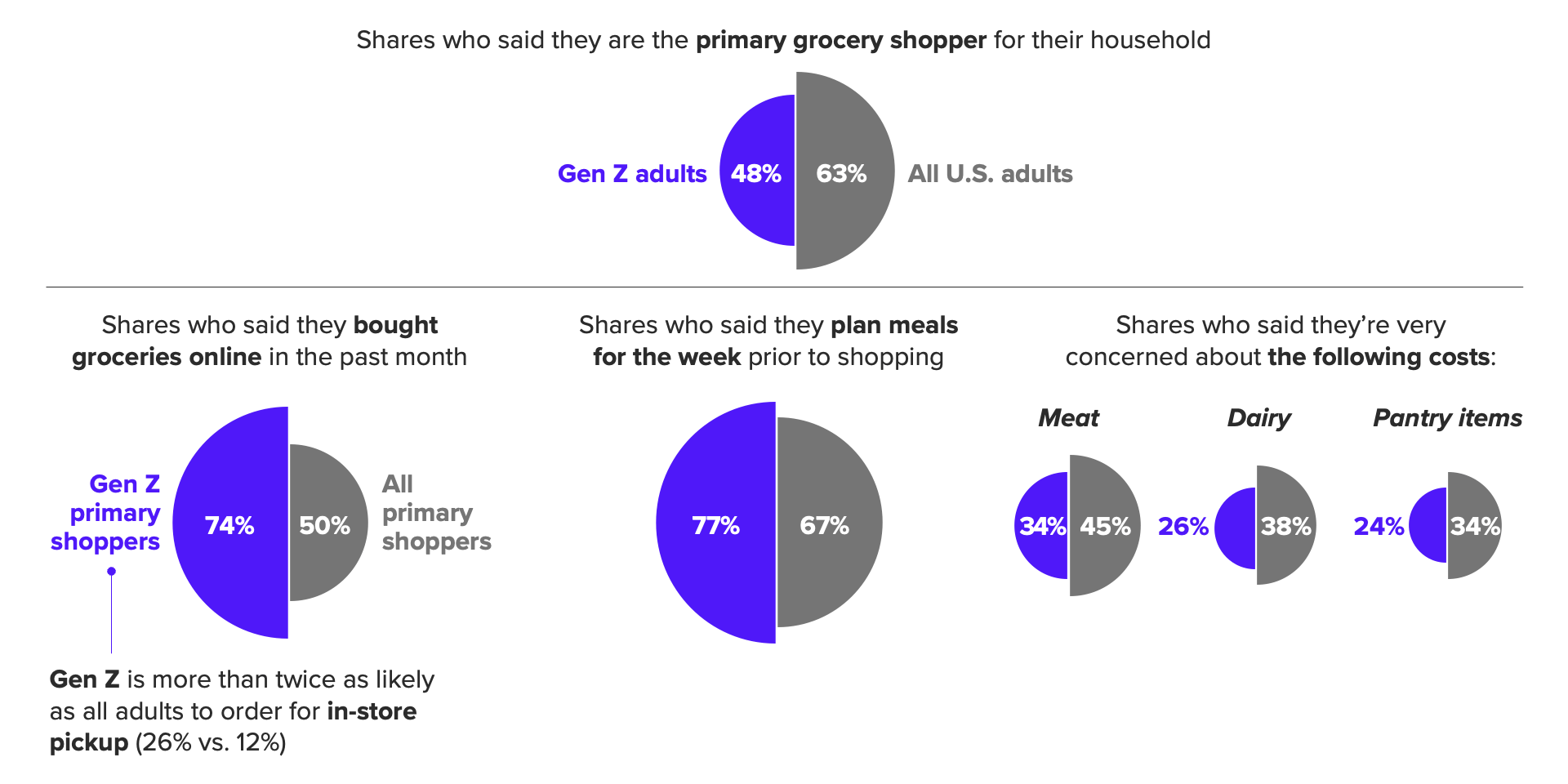

Nearly half (48%) of Gen Z adults say they are the primary grocery shopper for their household.

Gen Zers are more likely to buy groceries online and plan meals than the average primary grocery shopper.

The youngest generation of adults’ grocery shopping responsibilities will only grow as they age. Brands that meet them where they are now can win loyal customers today and in the future.

For more trends in the grocery industry, download our semiannual State of Food & Beverage report.

Gen Zers are known for breaking the norm. Whether it’s taking longer vacations, frequently seeking out new restaurants or even the desire to choose social media influencing as a career, the choices the youngest generation of adults are making look quite different than those made by their older counterparts.

That propensity for disruption can even be seen at the grocery store, where Gen Z primary grocery shoppers are more likely to say they shop online and plan meals ahead of making purchases than the typical primary grocery shopper.

Meet the Gen Z Primary Grocery Shopper

Gen Zers’ grocery shopping habits have the potential to shake up the industry

Nearly half (48%) of Gen Z adults say they are the primary grocery shopper for their household. And while that share is smaller when compared with the average U.S. adult, it’s only likely to grow as this generation ages. Brands that understand and cater to Gen Zers’ shopping habits will be best positioned to win their loyalty now and in the future.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

Three key behaviors of Gen Z primary grocery shoppers:

- They shop online: Gen Zers’ “digital natives” moniker shines through in their proclivity to buy groceries online. About 3 in 4 (74%) Gen Z primary grocery shoppers said they purchased groceries online at least once in the past month, 24 percentage points higher than all primary grocery shoppers. The good news for retailers is that Gen Zers are also far more likely to choose in-store pickup, which is typically cost-effective and efficient to provide.

- They prioritize meal planning: Another habit that may be related to Gen Zers’ digital fluency is meal planning. Gen Z primary grocery shoppers are 10 points more likely than all primary grocery shoppers to say they plan meals for the week prior to shopping for groceries. This provides a great opportunity for brands to connect to their path to purchase with inspiration on social media, digital planning tools or recipe ideas in retail apps.

- They are less cost-conscious: Gen Zers don’t (yet) have the spending power of older generations. But retailers may find that, despite Gen Zers’ lower incomes, they are less price-sensitive. For example, Gen Z primary grocery shoppers were less likely than all primary grocery shoppers to say they were “very concerned” about the cost of meat, dairy and pantry items. Many Gen Z primary shoppers are likely buying for one- or two-person households, where inflation doesn’t impact the bottom line as much as it does for larger households.

Emily Moquin contributed to this analysis.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].