What Drives Brand Loyalty in Retail, According to Shoppers

Key Takeaways

Loyalty is consistently built when products contribute to a shopper’s sense of self and shopping is fun. Brand reliability — things like keeping products in stock and ensuring product expectations match reality — is also necessary to build and retain customer loyalty.

When brands invest in true differentiators — like a best-in-class rewards program or innovative products — these can be meaningful loyalty drivers as well.

Measuring loyalty requires understanding both behavioral and attitudinal outcomes, as some attributes and experiences are better suited to impact one type of loyalty more than the other.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Retailers are feeling pressure to improve customer loyalty: Shopping behavior is still being disrupted as consumers continue to battle inflated prices, and the cost of acquiring new customers keeps going up. Growing with known customers could be easier — if you know what keeps them coming back to your brand.

To identify the most impactful drivers of retail loyalty, Morning Consult studied six well-known, highly trusted apparel brands to identify what common attributes led customers to be loyal to those brands. (Tested brands were blinded for publication.)

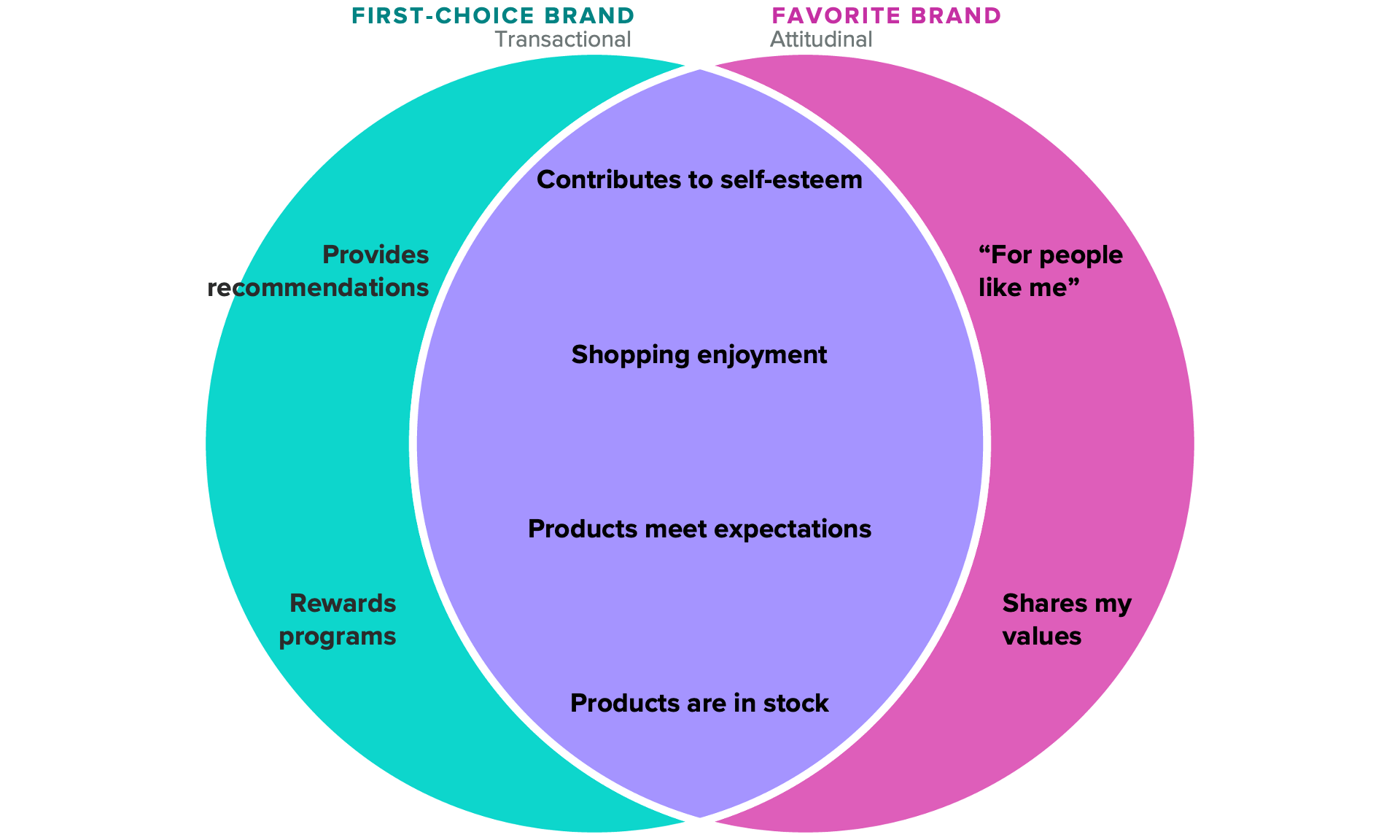

Of course, loyalty can be measured in many ways. In the consumer survey underpinning this analysis, we evaluated the power of brand attributes against several outcomes that describe ways customers can be loyal to a brand. In this analysis, we focused on customers who indicated a brand is their first choice when shopping for apparel, as well as customers who indicated that a brand is their favorite in the category.

- First choice implies more behavioral and habitual loyalty — customers will shop that brand more frequently, and it will earn a greater share of shoppers’ wallets than competitors.

- Favorite implies a more emotional connection to the brand, even if shopping there might be aspirational or otherwise not always a shopper’s go-to.

For each of the 15 attributes tested, a dual-model regression analysis determined how each attribute ranked in its power to drive first-choice and favorite status for each brand. This analysis outlines the universally powerful attributes in driving brand loyalty, as well as those that are more niche.

Brands that contribute to shoppers’ self-esteem and make shopping fun win across loyalty metrics

Two key elements were strong drivers of brand loyalty across most apparel brands included in this analysis, and on both measures of loyalty. First-choice and favorite-brand status are both consistently driven by:

- The brand’s ability to contribute to a wearer’s self-esteem (“I feel good about myself when wearing products from this brand”)

- Whether the brand makes shopping enjoyable (“I enjoy shopping from this brand”)

For many, what they wear is directly connected to how they feel, both in terms of physical comfort and as a means of self-expression. This finding should translate to other categories with a direct connection to individuals’ self-expression, like cosmetics and wearable technology. There’s real power in feeling great about how you look and present yourself to others — whether you’re donning a brand with cultural cachet or one that perfectly syncs with your sense of style, that “X factor” is hard to replicate.

Making shopping enjoyable is a more directly actionable finding. A recent drop-off in the share of consumers who said their preferred shopping channels are enjoyable should be concerning to retailers. Morning Consult analysis finds that encouraging shopping as a social event is one consistent driver of enjoyment, as is efficient checkout.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

Beyond self-esteem and shopping enjoyment, a secondary set of drivers is indicative of retailer reliability: Products that meet expectations and are in stock are also consistent loyalty drivers, though not quite as powerful as those described above. Consistently delivering on basic shopper expectations is critical for brands to build and retain customer loyalty.

Leading Loyalty Drivers Contribute to Both Transactional and Attitudinal Loyalty

Attributes that had minimal impact on loyalty tend to be table stakes, or elements that are standard across the retail sector — including free shipping, good return policies, ease of shopping and promotions. While these are of course important to offer to customers, they’re insufficient to keep them coming back.

Behavioral and attitudinal loyalty are impacted by different drivers

Many drivers tested impacted one loyalty measure but not the other, illustrating the need for brands to have a variety of metrics for evaluating customer loyalty and their efforts to achieve it. Understanding that certain initiatives will impact consumers’ emotional connection to the brand but might not touch a more behavioral measure is critical for evaluating the success of marketing and customer experience efforts.

For example, providing good recommendations and offering popular rewards program features and benefits both have a direct impact on first-choice status. Conversely, shared values and a feeling that products are “for people like me” were stronger drivers of favorite-brand status.

Some drivers will always be unique to a brand based on its own differentiators

Certain attributes tested in this analysis were highly ranked for one brand but had a moderate or low impact on all the other brands included. The consistent through line in these unique results is that the brand in question made that attribute a consistent part of its marketing efforts. This requires consistent investment in and prioritization of these attributes across customer communications, but when done effectively, it can be a real differentiator.

For example, Brand C in this evaluation makes its rewards program a consistent priority, and its program is among the industry’s best in class. For that brand, the rewards program was the top driver for first-choice status and the fourth driver for favorite-brand status. Rewards programs ranked highest for the tested retailers that sell a variety of brands versus those that sell only their own brand.

True Differentiators Can Be Loyalty Drivers

Brand A makes technical athletic apparel, a category where innovation is a key driver, and that was the second most powerful attribute driving the “favorite” metric for that brand. Innovation is not a meaningful driver for brands with less specialized apparel products. That innovation comes with a higher price point, but offering a fair price for its products was the top driver for Brand A’s first-choice status — customers are willing to pay a premium as long as they feel like the price is fair for the product value.

Related content

Frequent Returners Are Unbothered by Rising E-Commerce Return Fees

Retailers Need to Rebuild Consumer Trust and Bring Fun Back to Stores as Inflation Persists