Product Subscriptions Can Secure Loyal Customers — if Retailers Can Manage Churn

Key Takeaways

About one-third of U.S. adults have a product subscription, and while that number isn’t growing particularly quickly, there’s an opportunity for retailers to secure recurring revenue from high-value subscribers.

Consumers see similar benefits from the two primary types of subscriptions: discovery and replenishment. But discovery subscriptions have a steeper hill to climb to prove their value to shoppers and avoid churn.

Food subscriptions, like meal kits, dominate the market. Brands in other categories can piggyback off of advertising opportunities with food subscription services to tap into the lucrative consumer segment of those with multiple subscriptions in their households.

Data Downloads

With robust sample sizes, Morning Consult’s public opinion data can be analyzed by specific demographics, such as gender, generation, political party, income, race and more. Please contact [email protected] to purchase this data.

Higher prices mean consumers are willing to break up with their favorite brands in search of a better deal. Inflated prices aren’t going anywhere, but product subscriptions can offer a balm to retailers and brands. Subscriptions range from meal kits to household goods to direct-to-consumer supplements to deliveries of artisanal coffee roasted to your preferences … the list goes on. While subscriptions aren’t making the same waves in retail that they were a few years ago, 32% of U.S. adults have at least one product subscription, and it’s high time for brands to re-examine those opportunities.

This analysis explores two types of subscriptions:

- Replenishment subscriptions provide items that are automatically ordered at an interval controlled by the customer. For example, a household might subscribe to having laundry detergent delivered every two months.

- Discovery subscriptions offer a surprise selection of products curated by brands or tastemakers that introduce shoppers to brands or products they might not have found on their own.

The benefit for brands is obvious: locking in recurring revenue and habitual customer loyalty. For consumers, the “set it and forget it” convenience of replenishment subscriptions means mindlessly crossing things off your shopping list and not worrying about running out of necessities. In addition, discovery subscriptions make it easy for consumers to try new things and discover products they wouldn’t have found otherwise.

Subscription use is growing, albeit slowly

Since Morning Consult began tracking in March 2022, the share of U.S. households with replenishment subscriptions has been steady: 25% of households reported having at least one subscription then, compared with 27% in November 2023. Discovery subscriptions aren’t as popular but have seen a bit more movement, starting at 16% and now sitting at 20%.

Replenishment Subscriptions Are Consistently More Popular Than Discovery Subscriptions

Replenishment subscriptions are not only more common, they’re also stickier. A greater share of replenishment subscribers than discovery subscribers say they’ve had their subscriptions for more than two years (31% versus 25%).

Of course, subscriptions aren’t permanent, and retailers should be realistic about churn when evaluating launching new subscription offerings. More than 4 in 10 U.S. adults (44%) said they’ve canceled a subscription, and that number rises to 67% for those who have maintained at least one subscription for a year or more.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

A plurality (31%) of those who have canceled did so within one to three months of initiating the subscription. Replenishment subscribers tend to cancel because they no longer need the product, they don’t think it’s worth the cost or they find a better deal elsewhere; discovery subscribers cancel because the products they receive aren’t what they expected, in addition to the reasons above. Discovery subscriptions carry a higher risk, given that customers generally don’t select the products included, making expectations management a higher priority for these offerings. Brands offering subscriptions should work to reinforce their value early on and request feedback so customer service issues can be corrected before customers cancel.

Retail subscribers tend to be male, millennial, wealthy and urbanites

Most subscribers have one to three subscriptions; 10% have more than five. Those with multiples tend to mix replenishment and discovery subscriptions. The demographic profile of people with multiple subscriptions reveals a pretty specific customer, one often courted by the DTC brands that supply so many subscriptions. People with multiple subscriptions are much more likely to be men (63% are male; 37% are female), millennials, urban dwellers and members of high-income households.

Men, Millennials, Urban Dwellers and High Earners Are Likely Subscribers

Those with multiple subscriptions say convenience is a chief reason for subscribing, in addition to avoiding running out of products they use regularly. This profile habitually uses other convenience-oriented retail services, like “buy online, pick up in store” offerings. The fact that this profile is also high-income means they might be willing to pay more for convenience, but they’ll still cancel their subscription if they can find a better deal elsewhere.

Food and grocery subscriptions dominate the market

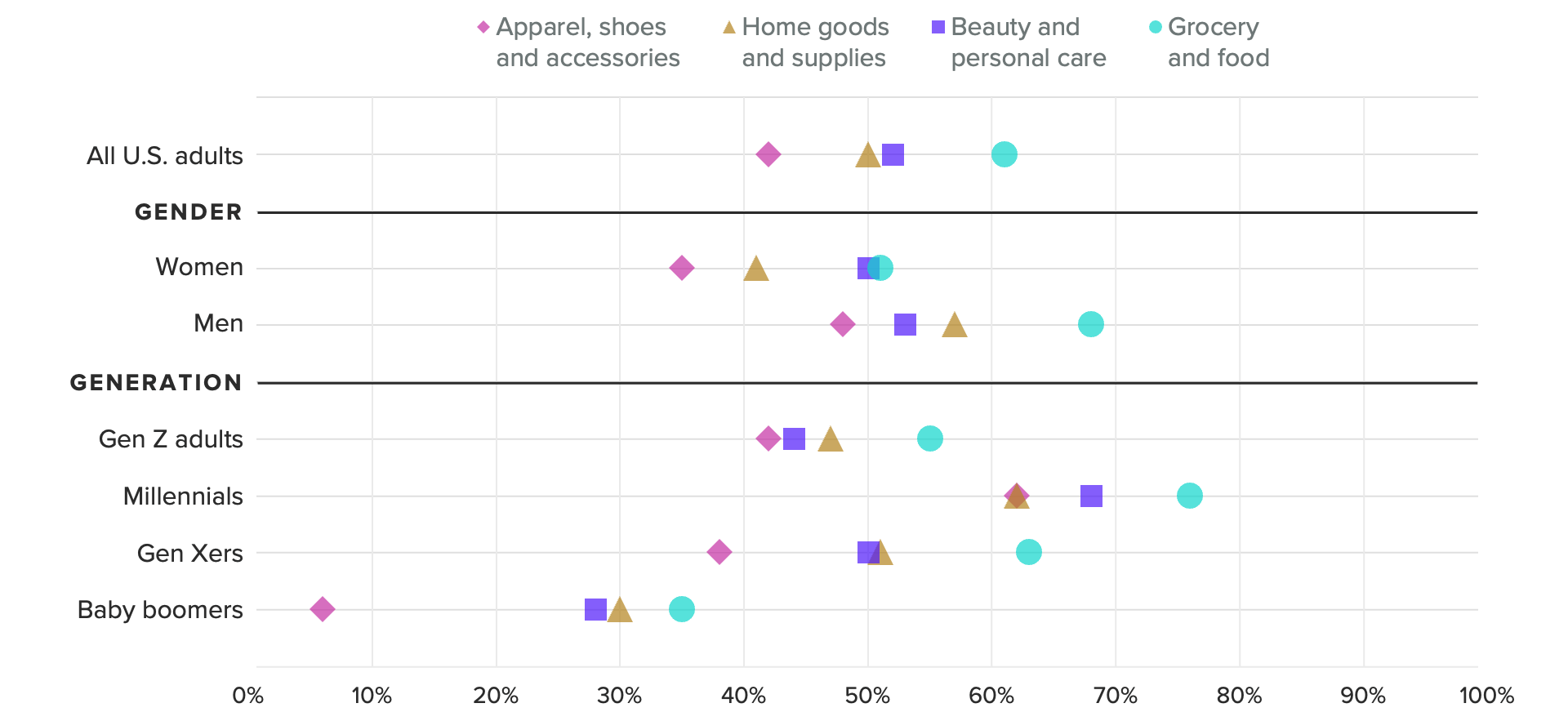

Whether it’s a CSA box, a meal kit delivery or a coffee subscription that saves people from using the scary grocery store coffee grinder, food subscriptions are the most popular across demographics. Food is the top category for those with just one subscription, indicating that this is a great gateway subscription to expand from. Beauty or personal care products and household goods follow food in popularity, with apparel lagging behind the pack.

Grocery and Food Subscriptions Are Popular Across Demographics

Food, personal care and household supplies need to be replenished regularly, while clothing does not, making the former categories more obvious ones for subscriptions. There’s still a target audience for clothing subscriptions, namely millennial men. Apparel lends itself to discovery subscriptions rather than replenishment, effectively outsourcing shopping and styling. A large majority (70%) of those with a discovery subscription say they subscribe to an apparel service, compared with 49% of those with replenishment subscriptions.

While food might be the most popular category, those with multiple subscriptions tend to subscribe to a variety of categories. Many subscription services include advertising and free samples in their deliveries, presenting a natural opportunity to cross-pollinate across categories and subscription types.