Will Services Inflation Slow Before the Fed Has to Take Action?

This is the first of three memos in our What to Watch in Inflation series. Each one will explore how different key sectors of the economy could affect the evolution of inflation in the coming months, how those developments may drive the Federal Reserve’s decision-making and what these factors imply about the probability of a recession. Additional insights on spending and inflation can be found in our January Consumer Spending & Inflation report.

Key Takeaways

Nonhousing services inflation is a critical component defining the path of inflation and the Fed’s approach to future interest rate decisions.

Much of the concern around this component is driven by supply-side considerations: Elevated wage gains are a major cost input for services industries and continue to put upward pressure on prices.

However, recent developments on the demand side have the potential to cool services inflation, as consumers’ increased resistance to accept higher prices for services may limit businesses’ ability to raise prices.

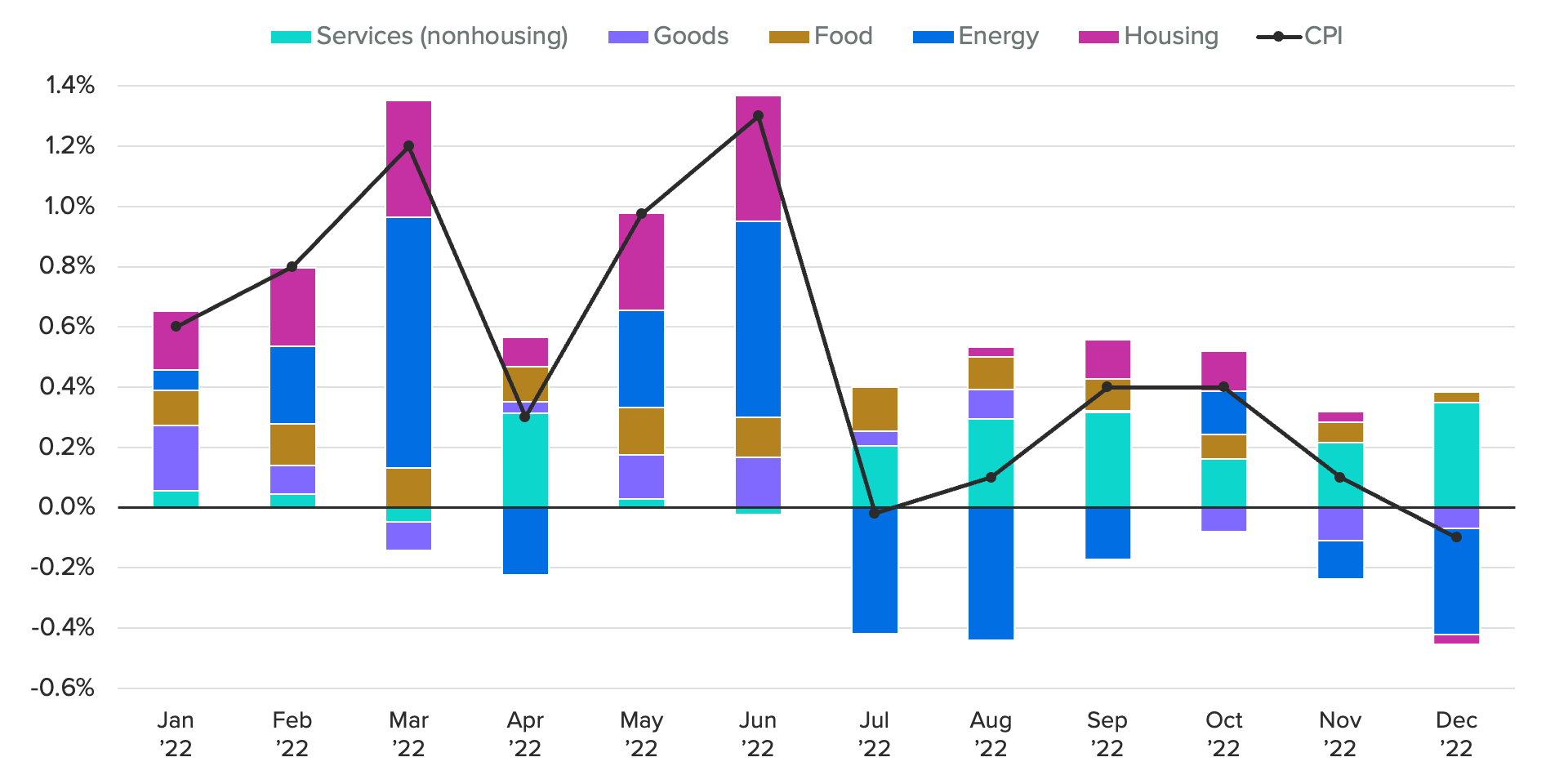

The nonhousing services portion of inflation will be a key determinant of how long inflation remains elevated and, as a result, will affect the trajectory of interest rates. In a November speech at the Brookings Institution, Fed Chair Jerome Powell called nonhousing services “the most important category for understanding the future evolution of core inflation.” Inflation for most goods categories has already started to cool, and recent developments in the housing market indicate the shelter category is poised for slower inflation growth as well. However, prices for other services continue to apply significant upward pressure on inflation.

This memo examines the drivers of price growth for nonhousing services and how prices may be impacted by these factors in the coming months.

Elevated wage growth remains an upward pressure on services prices

Powell’s concern for services prices is largely rooted in wage pressures: “Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category,” he said in his November speech. While goods costs tend to be distributed across multiple sources, including a significant contribution from material inputs, costs for most services are disproportionately driven by wages.

Notably, nominal wage growth continues to remain elevated as employers struggle to attract and retain workers, thereby putting upward pressure on inflation. Rising interest rates have begun to cool certain sectors of the labor market, with annual average hourly wage growth falling to 4.6% in December from a mid-2022 peak of 5.6%. However, measures of nominal wage growth remain well above the pre-pandemic average, with some industries — especially those most heavily impacted by the pandemic — still in recovery mode. Resilient jobs growth, in combination with a still-depleted labor force participation rate, is providing continued support for wage gains. Furthermore, wages are sticky: Once they go up, they don’t normally go down. High wage growth puts pressure on inflation, particularly for services, as businesses raise prices to offset labor costs.

Morning Consult’s labor market data provides additional evidence that persistent labor market tightness is contributing to wage and price pressures. On net, 20% of workers report that their employer has a worker shortage. That share is even higher for consumer-facing service sectors such as education and health care (37%) and food & beverage and leisure & hospitality (27%). Hiring takes time, reinforcing the notion that labor market tightness could persist in these industries and continue stoking both wage and price pressures.

Slower services demand could limit businesses’ pricing power

While supply-side factors have continued to apply sticky upward pressure on prices, demand pressures in the services sector recently began pointing down.

After a period of high growth as the economy reopened and consumers returned to pre-pandemic behaviors, services spending growth began to slow in late 2022. Real personal consumption expenditures growth flatlined in December, and Morning Consult’s measure of real average reported monthly spending showed declines in seven of the last 10 months. Notably, the spending patterns in our data appear strongly linked to inflation response: The only two months in which respondents reported spending increases in the second half of 2022 corresponded with positive inflation surprises, as energy prices finally fell in July, and pre-holiday discounting corresponded with slowing core inflation in October.

Another driver of slower services spending appears to be rising price sensitivity from consumers. Morning Consult’s Consumer Purchasing Power Barometer for services categories has weakened over the course of 2022, indicating reduced consumer purchasing power due to the pressure of increased prices. The CPPB is derived from two underlying indexes: Price Sensitivity (sticker shock) and Substitutability (trading down). The downward trend is largely attributable to elevated price sensitivity, or consumers’ willingness to walk away from services purchases due to price. Unlike goods categories like groceries or apparel, services categories can be difficult to trade down on or substitute — for example, it is difficult to find a cheaper substitute for health care. As consumers increasingly resist paying for higher-priced services, businesses may not be able to keep raising prices, even in the face of margin pressures from labor costs.

Rate path may hinge on services price trajectory

Prices are ultimately a function of both supply and demand pressures. While Chair Powell’s recent commentary put the spotlight on the supply side of services inflation, the potential price implications of slowing services demand shouldn’t be ignored. A slowdown in consumer spending runs the risk of driving the economy into a recession by putting a drag on growth, but it is also possible that slowing services demand could help the Fed achieve a soft landing by cooling inflation sooner than expected.

Monetary policy is a blunt instrument; the Fed is aiming to bring down topline inflation without being able to target specific sectors. If nonhousing services inflation becomes a helper rather than a hindrance in slowing topline inflation, the Fed may have less need to follow a rate path that risks major losses in the labor market. On the other hand, if elevated services inflation persists, the Fed may be required to more aggressively raise interest rates for the entire economy, increasing the probability of a recession.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]