Economics

December 2023 U.S. Jobs and Labor Market Charts

Report summary

This collection of charts provides a curated summary of Morning Consult’s proprietary Economic Intelligence data on U.S. jobs and employment from November 2023. Morning Consult Economic Intelligence clients can access the complete report on the Morning Consult Economic Intelligence website.

Chart pack highlights:

- Morning Consult data shows that the share of workers that are working full time has declined, with the share of employed adults working 35 hours or more down roughly 9 percentage points from its 2022 peak.

- Labor shortages are easing, with fewer workers reporting that their employer has too few workers to get the job done. The somewhat cooler labor market has resulted in slowing nominal wage growth, but workers are still feeling confident in their ability to negotiate higher pay.

- A declining share of U.S. employers are offering key benefits, with fewer employees reporting receiving health insurance and retirement contributions. Relatively low-skill industries like food & beverage, leisure & hospitality and retail are the least likely to offer these benefits.

Highlights from this report

The U.S. labor market is showing signs of cooling, a welcome relief for policymakers at the Federal Reserve looking for evidence that interest rate hikes are having the desired effect of slowing the economy. Morning Consult data likewise shows hints of cooling, with the incidence of lost pay or income ticking higher, the share of workers working full time down considerably from last year’s peak and fewer employees reporting staffing shortages compared with 2021 and 2022.

On the other hand, our high-frequency data continues to show residual strength in the labor market. Our Lost Pay and Income Tracker is still near series lows and workers are also generally very confident in their ability to negotiate a raise after years of labor market tightness and a stretch of nearly unprecedented collective action and U.S. labor strikes.

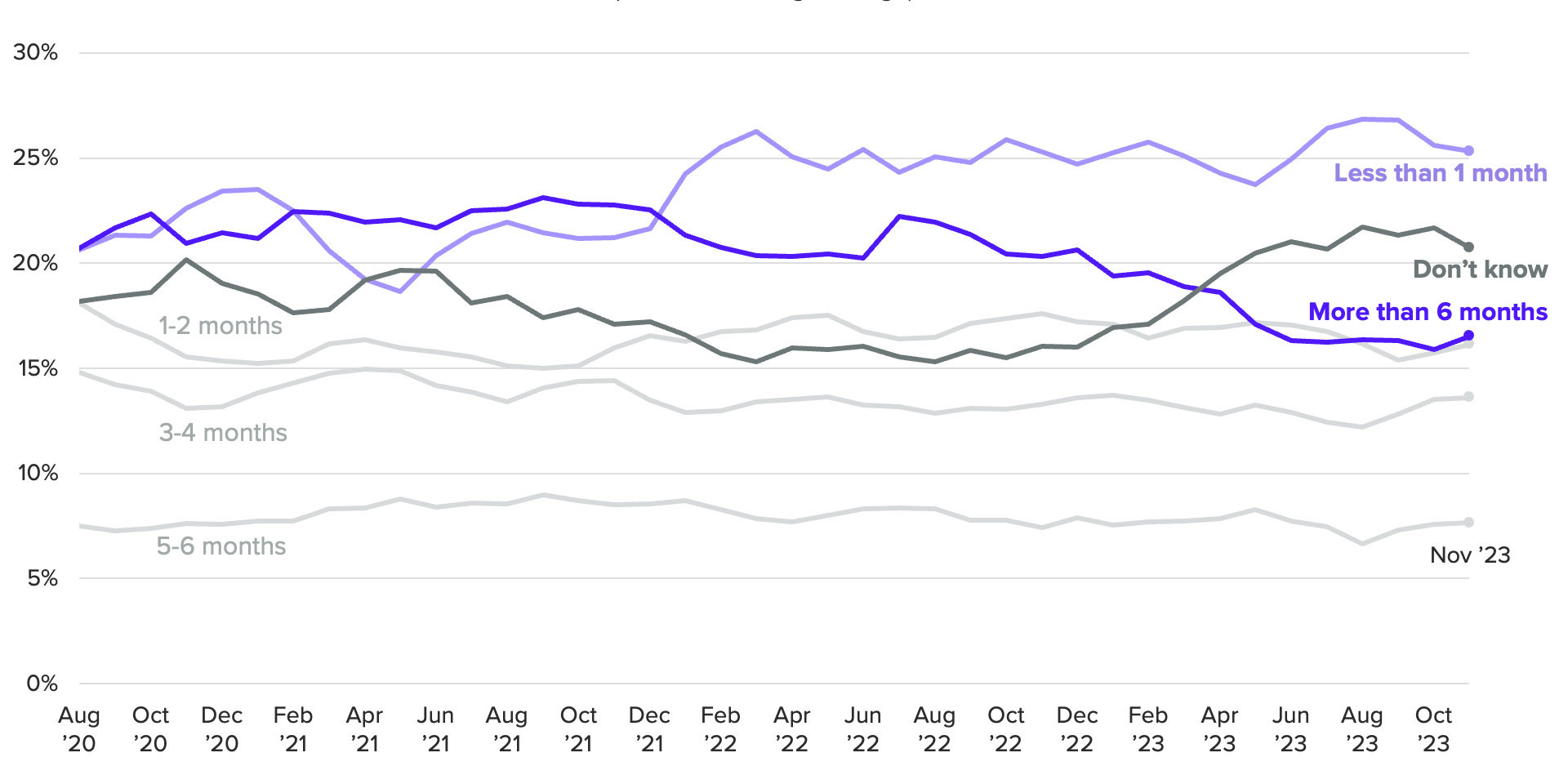

Financial Vulnerability and Economic Uncertainty Are on the Rise

(3-month moving average)

While real wages are firmly in positive territory, nominal wage growth is slowing, and robust spending means rising outlays have broadly outpaced incomes for most households. As a result, we are seeing an increase in financial vulnerability in our tracking data, with the share of households able to cover basic expenses with savings alone for six months falling considerably and those that are unsure moving higher. As savings are drawn down amid heightened economic uncertainty, it begs the question: Can consumers keep on fueling the economy moving into 2024?

About the author

Email [email protected] to speak with a member of the Morning Consult team.