Live Games on TikTok? Decision-Makers Are Rethinking Sports Viewership for Gen Z

Key Takeaways

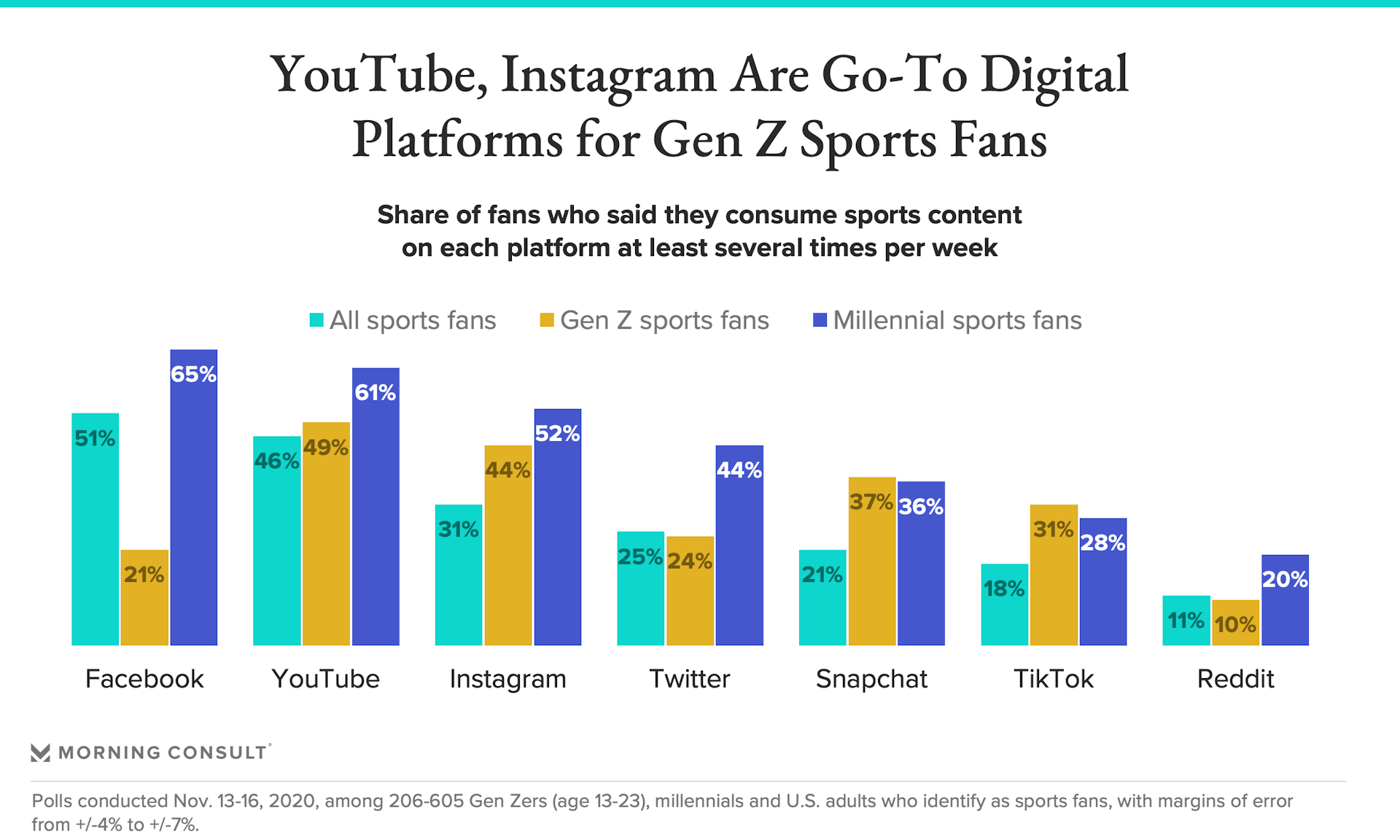

YouTube is Gen Z fans’ preferred platform for sports content, with 49% saying they use it several times per week, followed by Instagram (44%) and Snapchat (37%).

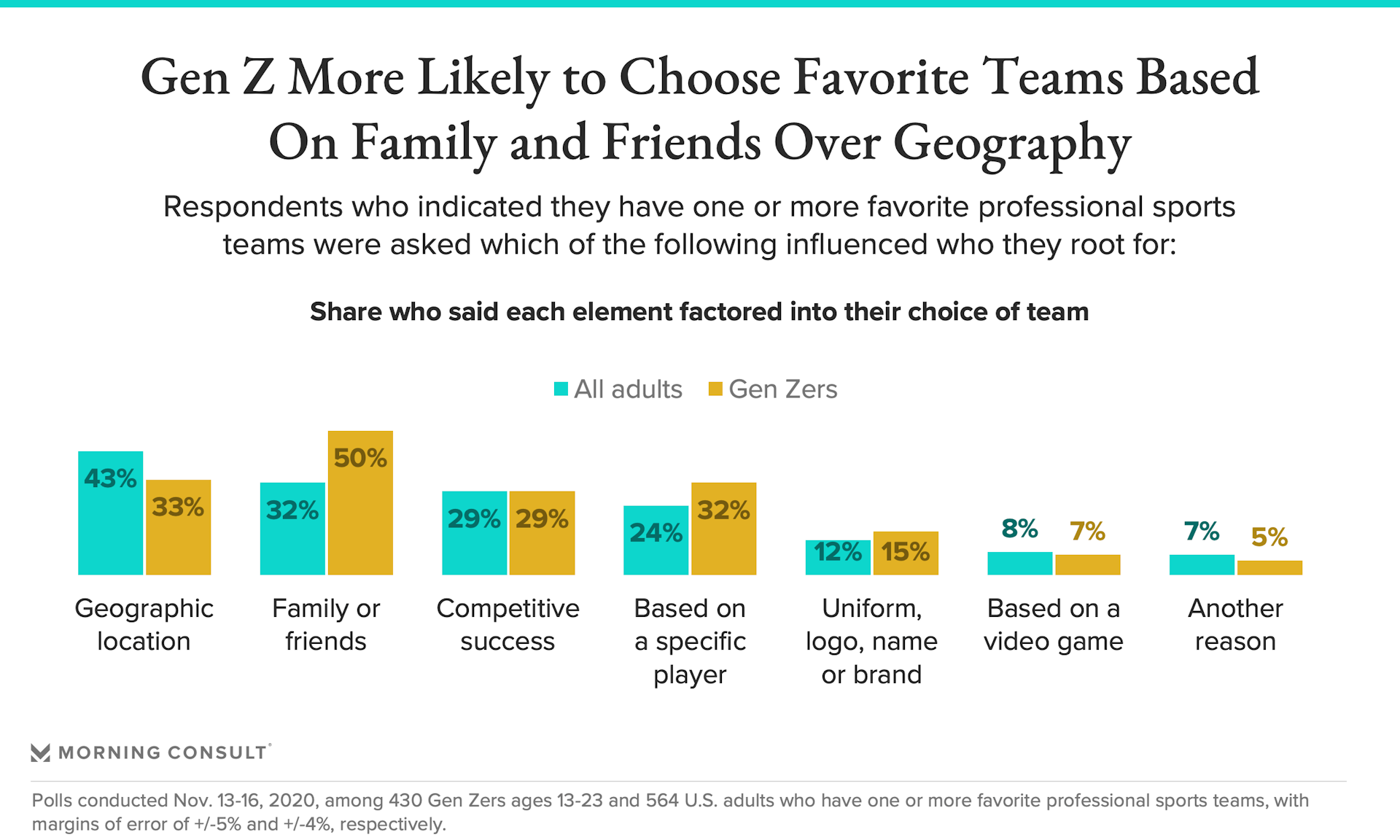

50% of Gen Z fans said friends and family played a role in choosing their favorite sports team.

13% of Gen Z sports fans said they consume information on fantasy sports at least once a week, compared to 35% of millennial sports fans.

Ask any marketer how to connect with a younger audience and you'll likely be told about the importance of "meeting them where they are.” When it comes to live sports, that’s translated in recent years to making traditional telecasts available to stream online.

But to make watching live games more appealing to Generation Z, some decision-makers in the sports world see a need for more fundamental change.

“We may need to look at doing a ‘tik tok’ version of our games where we feed possessions in a swiped up or down version interspersed with non traditional content,” said Mark Cuban, owner of the NBA’s Dallas Mavericks, in an email.

Cuban doesn’t have it all figured out quite yet -- he said the biggest challenge will be presenting such game clips in a way that still “qualifies for ratings” -- but he insists the industry has to adapt to foster the next generation of fans.

The sports world is already dealing with a smaller pool of future fans: Morning Consult’s first in-depth look at Gen Z's interest in sports revealed that 53 percent of individuals aged 13-23 identified as either “avid” or “casual” fans, a smaller share than the 63 percent of the general population and 69 percent of millennials who considered themselves fans. Gen Zers were also less likely than previous generations to watch live sports regularly and more likely to say they “never” watch live sports.

Now, follow-up research shows that the majority of Gen Zers who identify as sports fans don’t consider watching live events “an important part” of being a fan. Younger fans are also consuming non-live sports media such as articles, podcasts and studio shows less frequently than older fans and taking different approaches to choosing their favorite teams and athletes.

Adapting live sports to a new generation

Live viewership is the lifeblood of the sports industry. Since 2017, media rights have been the largest revenue stream for the North American sports industry, according to PricewaterhouseCoopers. The vast majority of that business is tied to broadcasts of live games and, while viewership metrics have declined virtually across the board in recent years -- a trend exacerbated this year amid the pandemic -- industry experts expect major sports properties to receive significant raises in their next wave of rights deals.

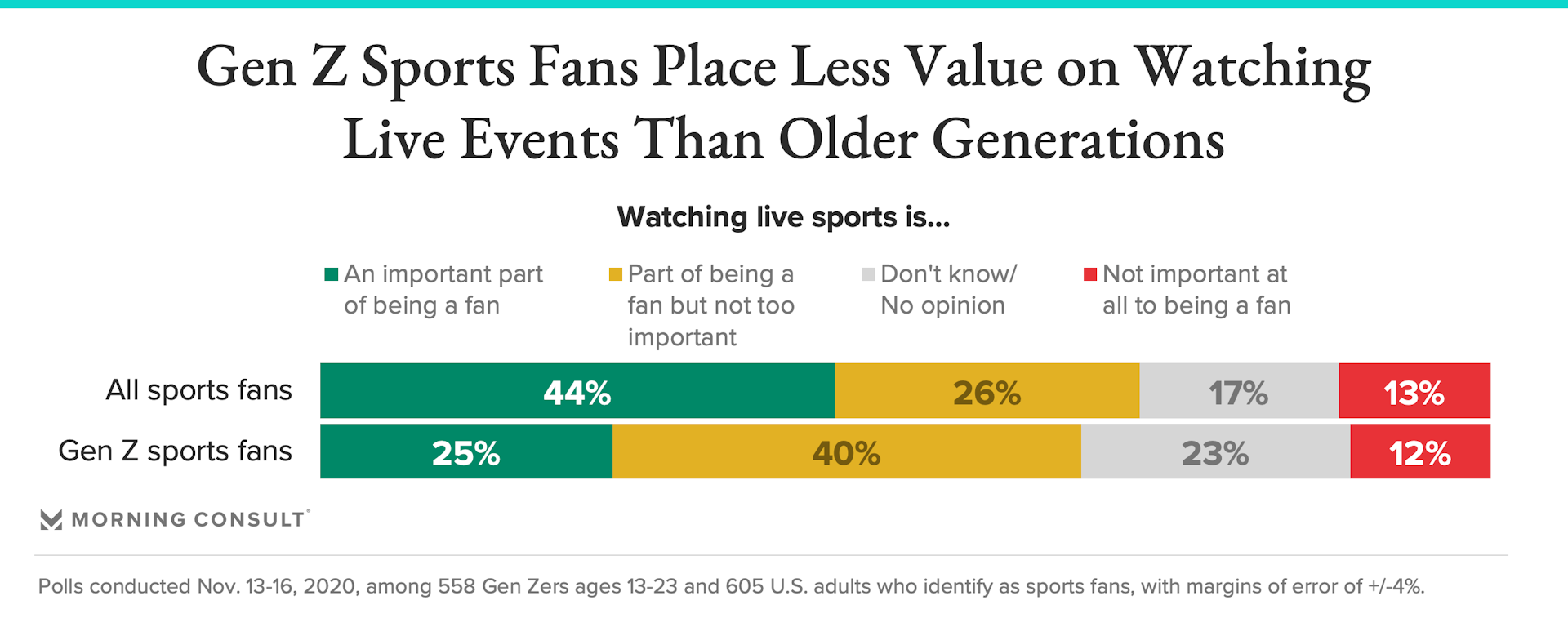

Among Gen Z sports fans, 25 percent of respondents said watching live competition either on TV, via streaming or in person is “an important part of being a fan,” while a 40 percent plurality said watching live is “part of being a fan, but not too important.”

Gen Z sports fans’ attitudes exhibit a considerable shift from previous generations of fans. Among sports fans across all age groups, 44 percent considered live events an important part of being a fan, while 26 percent said it is part of being a fan, but not too important.

Sports properties and their media partners have sought to tailor live sports to younger audiences by offering games via streaming services, creating interactive second-screen elements like predictive games and introducing new broadcast technology and advanced statistics. There’s also hope that incorporating sports wagering into the viewing experience will help further engage adult viewers.

But Bo Han, founder and creator of a soon-to-launch sports viewership app called Buzzer, said that a different approach -- one he calls “live short-form” -- is needed to cater to Gen Z fans on their mobile devices.

"In concept, streaming is great,” Han said. “But we're repurposing a linear format that makes sense on television onto the mobile screen and expecting the same results."

Buzzer, which will launch a closed beta in the first quarter of 2021 and projects a broad launch in the second quarter, will offer users access to individual moments in live sporting events through targeted mobile notifications based on favorite teams and players, as well as things like fantasy teams and active bets. Users interested in catching a particular moment as it happens would either pay a small fee or authenticate their existing pay-TV or over-the-top subscription to watch it instantly.

Buzzer’s inclusion of an authentication system, Han said, would allow it to deliver new viewers and incremental revenue while operating within the current media distribution landscape, which isn’t going away anytime soon.

Decision-makers at major U.S. leagues and teams understand, however, that while the current media rights model is a cash cow, it is likely the biggest obstacle to reimagining the live viewing experience to cater to the next generation of potential fans.

“Live game consumption is where we do the worst at bringing the product to the younger audience because we've set up a structure over decades that can't just be unwound in six months,” said Chris Marinak, chief operations and strategy officer at MLB.

Marinak, who reports directly to MLB Commissioner Rob Manfred, said the league envisions a future in which fans can subscribe to one product to gain access to every second of the league’s games. That service, he said, would offer users an algorithm-driven, whip-around experience personalized to their interests, bouncing from a favorite team’s game to a favorite player’s at-bat to a record-breaking moment.

The league is in the process of building the technology to power such an experience, leveraging Google’s machine learning technology via an already-established partnership. The bigger hurdle, it seems, is that the league’s media rights are shared by three national partners and an army of regional sports networks all intent on preserving exclusivity.

“From a rights standpoint, the last thing that needs to be sorted out is this idea of local versus national,” Marinak said, “so we can get to a world where, if I'm a subscriber, I can get whatever content I want to get.”

Mavericks owner Cuban has also been thinking about new formats for live events. In an October interview with Megyn Kelly about the NBA Finals’ decreased ratings, Cuban noted that, while the sport drives tremendous engagement among young people on digital platforms, many of the league’s young fans don’t watch cable television, where most of its games are shown.

In an email, Cuban shared his own vision for incorporating segments of live NBA games into the “AI curated, personalized streams” that social media has popularized among young people.

Short (form) and sweet

In addition to watching fewer live games, the latest Morning Consult research shows Gen Z sports fans are also consuming non-live sports media less frequently than fans from other generations.

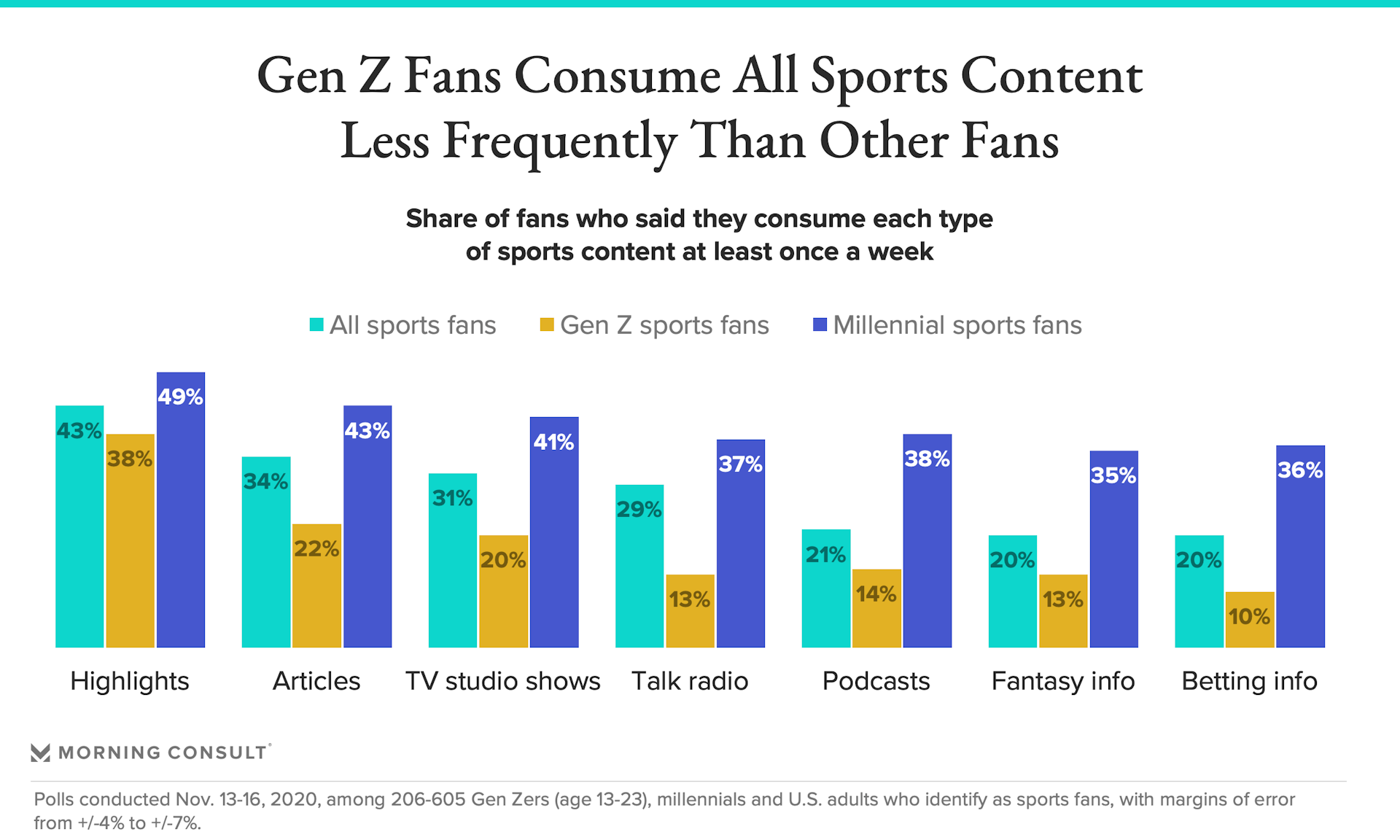

Thirty-eight percent of Gen Z fans indicated that they watch sports highlights at least once a week, roughly the same as the share who said they watch live sports weekly. By comparison, 43 percent of all sports fans and 49 percent of millennial sports fans said they watch highlights at least weekly.

Gen Z fans also indicated they are less likely than their older peers to read articles, watch TV studio shows and listen to podcasts and radio. They also are less likely to consume information pertaining to fantasy sports and wagering in a given week.

The survey results also offer a look at which social media platforms Gen Zers turn to for sports content, with YouTube and Instagram leading the way, followed by Snapchat and TikTok. Older fans, including millennials, most frequently find sports content on Facebook, a platform that has fallen out of favor with the younger generation.

Industry insiders bullish on the sports industry’s ability to connect with Gen Z see highlights as an increasingly important touchpoint, as they distill hourslong games down to the most exciting moments and are ideal for sharing on social media.

“Highlights will become even more important, and more valuable, over time,” said Jene Elzie, chief growth officer at Athletes First Partners, a boutique sports marketing firm with clients including the National Basketball Players Association and United States Olympic and Paralympic Properties.

Marinak said “democratizing access to highlights and postgame content” is an important part of MLB’s fan engagement strategy and touted the league’s new Film Room platform, which allows fans to compile and share their own highlight reels, as a major step forward.

But given the increasing relevance of short-form content, Cuban said sports properties like the NBA need to do a better job monetizing social media highlights.

“Our revenue vs consumption ratio is incredibly low,” Cuban wrote.

Elzie agreed there is a need to further monetize highlights. The next step, she said, is figuring out how to put highlights behind a paywall to create “really strong revenue opportunities.”

“I think we're going to see that more and more,” Elzie said, “especially as some of these big social media players get into the space a little bit more aggressively.”

Choosing favorite teams and players

In addition to looking at Gen Z’s sports consumption habits, the latest Morning Consult survey results offered insights into what drives younger fans to root for specific teams and players.

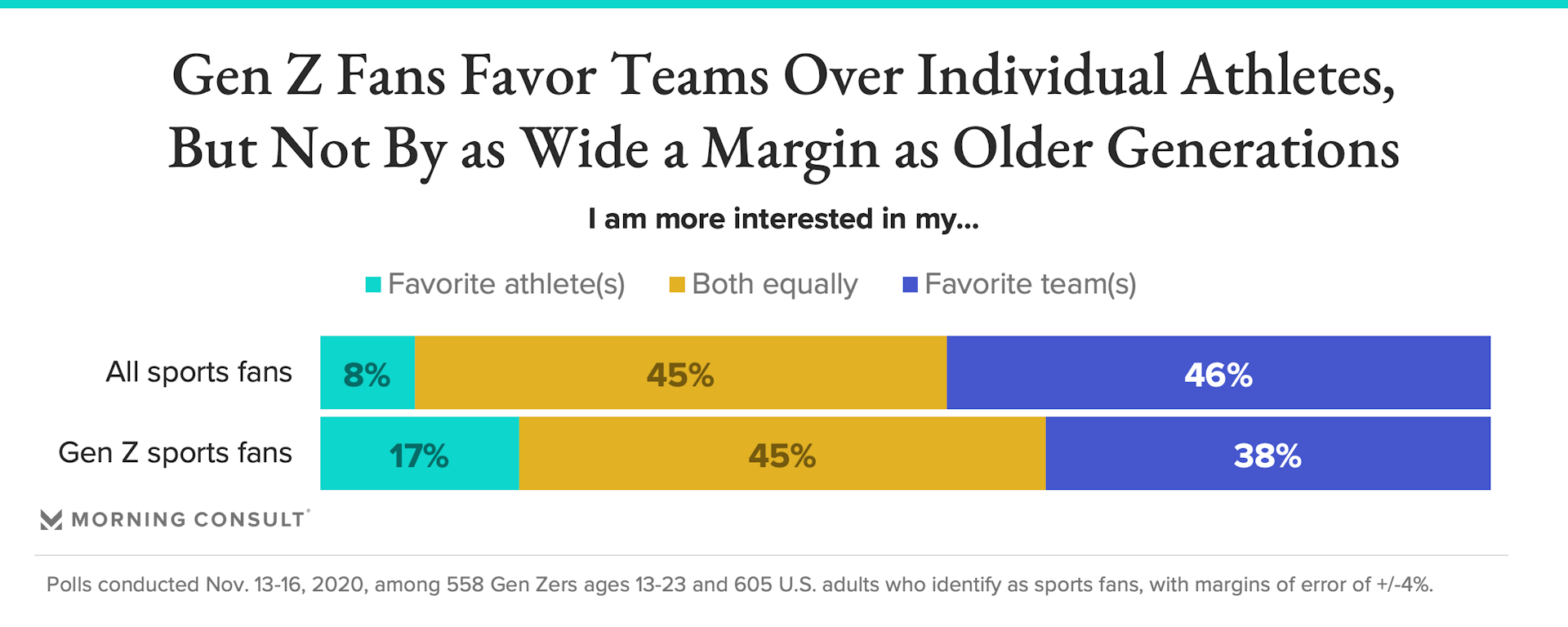

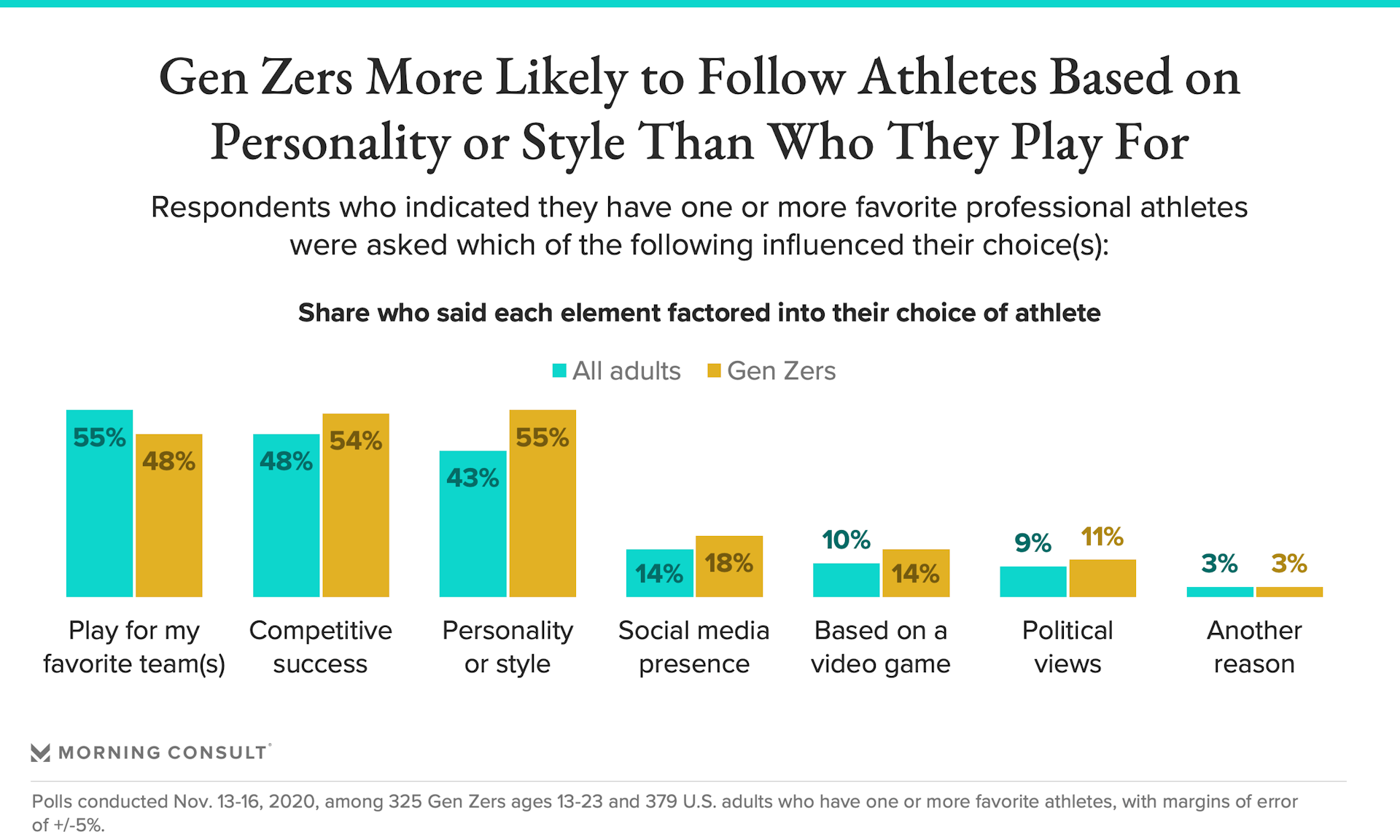

While there is a school of thought in the industry that young fans care more about individual athletes than teams, twice as many Gen Z respondents said they are more interested in their favorite team than their favorite athletes.

The margin by which they favor teams over athletes, however, is narrower than among other generations of fans, indicating personalities are more important to young fans than older ones. In addition, Gen Zers were more likely than older fans to choose their favorite team based on an individual player.

Jason Kaufman, senior vice president of research and insights at the NBA, pointed to the league’s players as the primary reason that Gen Zers overindexed as NBA fans relative to the general public in Morning Consult’s initial Gen Z survey.

“Our players are young people themselves, so I think there's a relatability there,” Kaufman said. “And when you think about the values that a lot of youth have right now, whether it's being globally conscious or socially active, I think there's a lot of complementary thinking between our fans and our players."

The most common factor influencing Gen Zers’ team loyalties was their family and friends: Half of Gen Z respondents and 61 percent of female Gen Z respondents said this was a factor in choosing their favorite teams. Gen Zers were less likely than other generations to choose their favorite teams based on geography, with 1 in 3 saying location played a role in determining their allegiances.

When it comes to choosing favorite players, 55 percent of Gen Zers cited personality and style as a driving factor and 54 percent pointed to competitive success. Playing for the respondent’s favorite team, which was the most significant factor for older fans, was slightly less important at 48 percent.

While some of the data surrounding Gen Z’s fandom raises red flags, those within the industry are confident sports will continue to be a passion point for young Americans. Marinak said he believes that while platforms and content types are changing more rapidly than ever before, the ethos of Gen Z -- a desire to connect and enjoy shared experiences -- aligns with sports’ ability to bring people together.

“What sports offers is something that this generation really craves,” he said, “and that's a fundamental reason why I think we all feel good about this generation.”

Alex Silverman previously worked at Morning Consult as a reporter covering the business of sports.

Related content

As Yoon Visits White House, Public Opinion Headwinds Are Swirling at Home

The Salience of Abortion Rights, Which Helped Democrats Mightily in 2022, Has Started to Fade