Allbirds Shows Signs of a Comeback With Their Core Millennial Customer

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

It’s a tough time to be a digital direct-to-consumer brand: Customer acquisition costs are rising, fundraising is challenging and consumer trends are always changing. These digital startups targeted millennials, who have a strong penchant for online shopping, by offering a limited product assortment (see: Casper, Away), convenient fulfillment and friendly return policies. And Allbirds, the brand that created environmentally friendly wool sneakers popular with techies and at least one U.S. president, was an exemplar of the DTC brand trend when it launched in 2016.

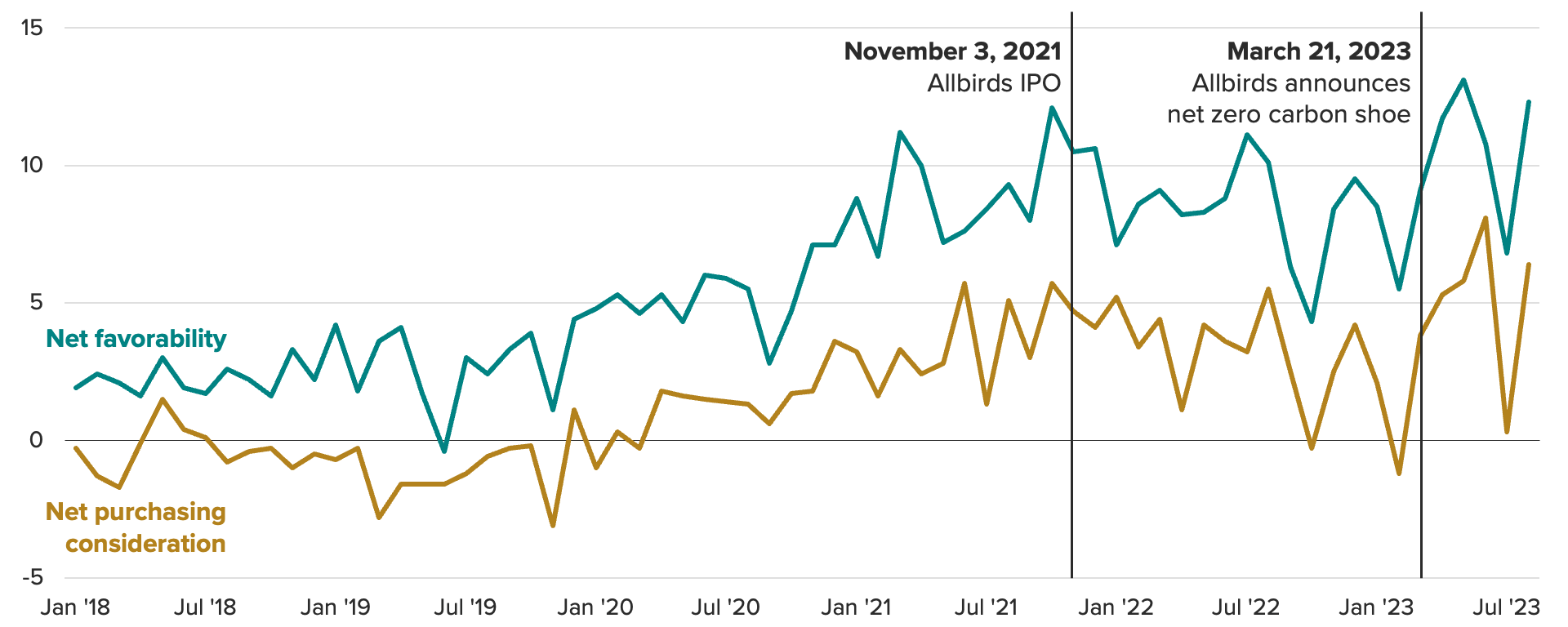

After their IPO in November 2021, Allbirds’ favorability and purchasing consideration among millennials started to stall as consumer trends shifted and new product expansions didn’t capture consumers in the same way their core sneakers did. Like more established DTCs, Allbirds moved beyond the digital direct model and into brick-and-mortar and wholesale, but the stagnation dragged on. Allbirds’ popularity among Gen Z adults lagged behind millennials as the brand struggled to capture a younger audience.

However, following the March 2023 announcement of a net zero carbon shoe, Allbirds’ purchasing consideration and favorability among millennials has been on the upswing, reaching series highs in May and June. Good news in their second-quarter earnings is another indicator that the DTC dream isn’t dead for Allbirds.

This is particularly impressive in the current inflationary environment, where shoppers are less willing to shell out for discretionary products and environmentally friendly products are less relevant than they were a year ago.

What brought Allbirds to the fore years ago isn’t what will keep them there. Whether the company can keep up this positive momentum — and hold its own in a sneaker market crowded with trendy innovators — remains to be seen. Recapturing the attention (and dollars) of their core millennial audience and expanding their reach into other consumer cohorts is a steep hill to climb, but it appears they’re on their way.

This memo utilizes data from Morning Consult Brand Intelligence, our flagship platform that every day asks thousands of consumers about core metrics for over 4,000 brands and products around the world. MCBI subscribers can further explore the data here. To learn more about MCBI, request a demo here.