What U.S. Retailers Can Learn From China’s Rewards Programs

Key Takeaways

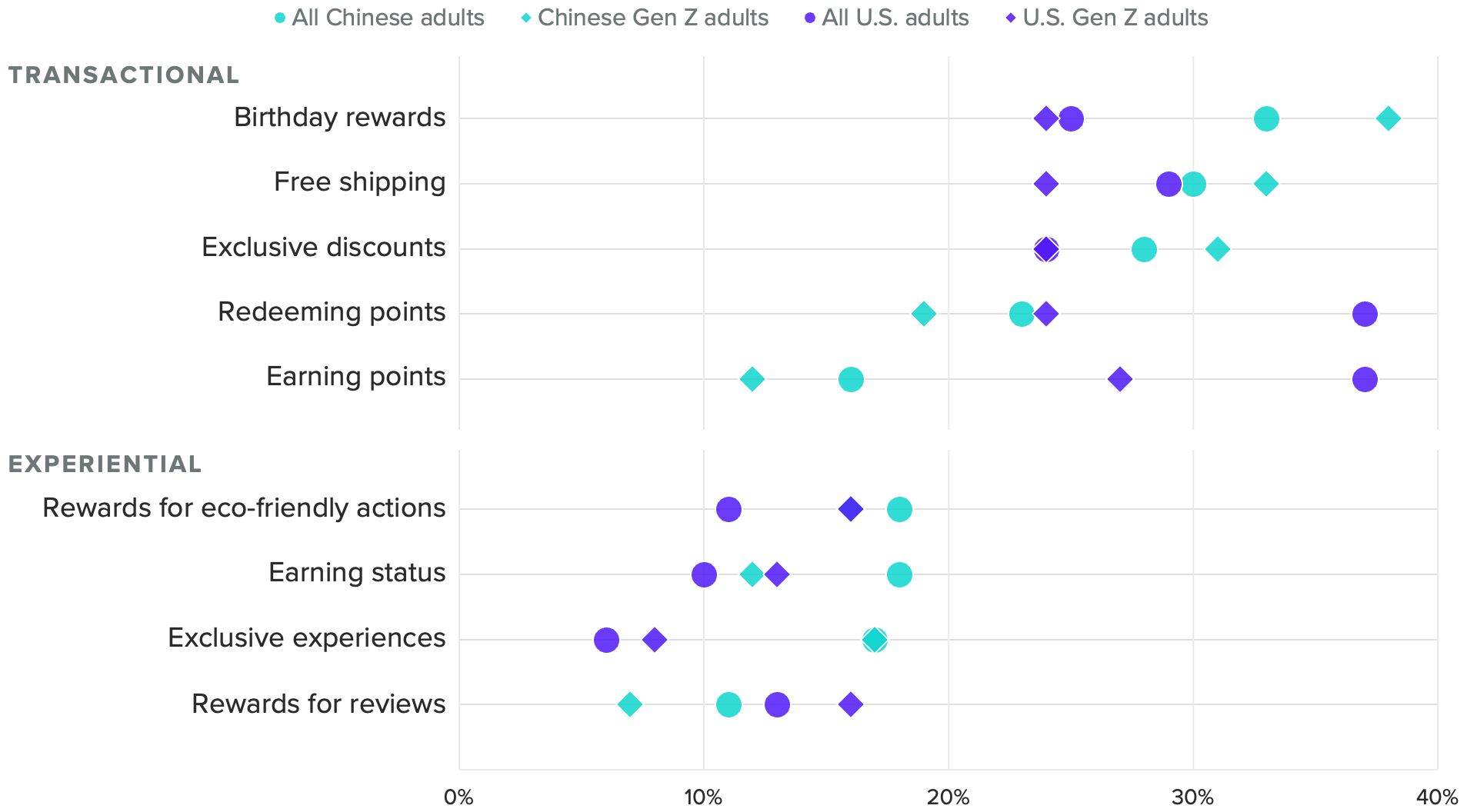

When it comes to a desire to accrue points from rewards programs, there’s a stark gap between U.S. and Chinese consumers: Earning points when making purchases is an important feature for 16% of Chinese adults, compared with 37% of U.S. adults.

Points accruals are table stakes for U.S. retail rewards programs, but Chinese consumers have very different preferences. Yet retailers often look to China for inspiration to advance their own rewards programs, so it’s crucial to understand where differences in consumer culture will prevent a successful tactic in one market from working in the other.

Experiential rewards — more common in China and more popular with Chinese shoppers — are proving to be more compelling for American Gen Zers than for older U.S. consumers.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Retailers seeking insights into the future of customer experience often look to China, where consumers tend to be more digitally engaged with brands. For rewards programs (aka loyalty programs) in particular, Chinese shoppers are more drawn to experiential rewards — those that aren’t directly linked to transactions (i.e., points) — like invitations to exclusive brand events or enhanced customer service. Experiential rewards are a key component of more mature rewards programs that build relationships, not just points balances, by making customers feel special and underlining brand attributes and values.

Chinese consumers are more engaged with experiential rewards program benefits

Chinese shoppers love a birthday reward the same way American shoppers love points, but overall they’re more interested in earning status and experiential benefits than the transactional benefits that are so commonplace in U.S. rewards programs. Chinese Gen Zers in particular love freebies like free shipping or exclusive discounts but care far less about earning and redeeming points than their American counterparts.

Consumers in both countries report participating in similar numbers of retail rewards programs, though 32% of Chinese shoppers said they participate in paid programs like Alibaba’s 88VIP versus just 19% of Americans. U.S. shoppers love their points, and typically wouldn’t consider a paid retail membership like Amazon Prime a rewards program because there’s no points accrual component. Meanwhile, 88VIP includes both standard program discounts as well as rewards for engaging with the entire brand ecosystem, meeting the demands of Chinese shoppers.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

Chinese Shoppers Care Far Less About Points Than Americans, and More About Brand Experiences

Experiential rewards are where rewards program innovation lies, particularly for U.S. retailers trying to expand beyond points. While benefits like earning status are more common in the U.S. travel industry than in retail, some premium U.S. retailers can emulate the prestige of status tiers with access to exclusive events and enhanced customer service. Gamified rewards, like earning benefits or badges for trying new menu items or completing a certain number of visits in a short time frame, are prevalent in the U.S. food & beverage industry, but less so across retail more broadly. China’s mobile-first culture enhances brands’ ability to leverage gamification, something that U.S. retailers can emulate when engaging younger shoppers.

American Gen Zers appreciate these experiential and gamified offerings more than older shoppers while showing less interest in transactional benefits, supporting the case for U.S. retailers to invest in such features to keep young consumers engaged, even when they’re not adding items to their shopping carts.

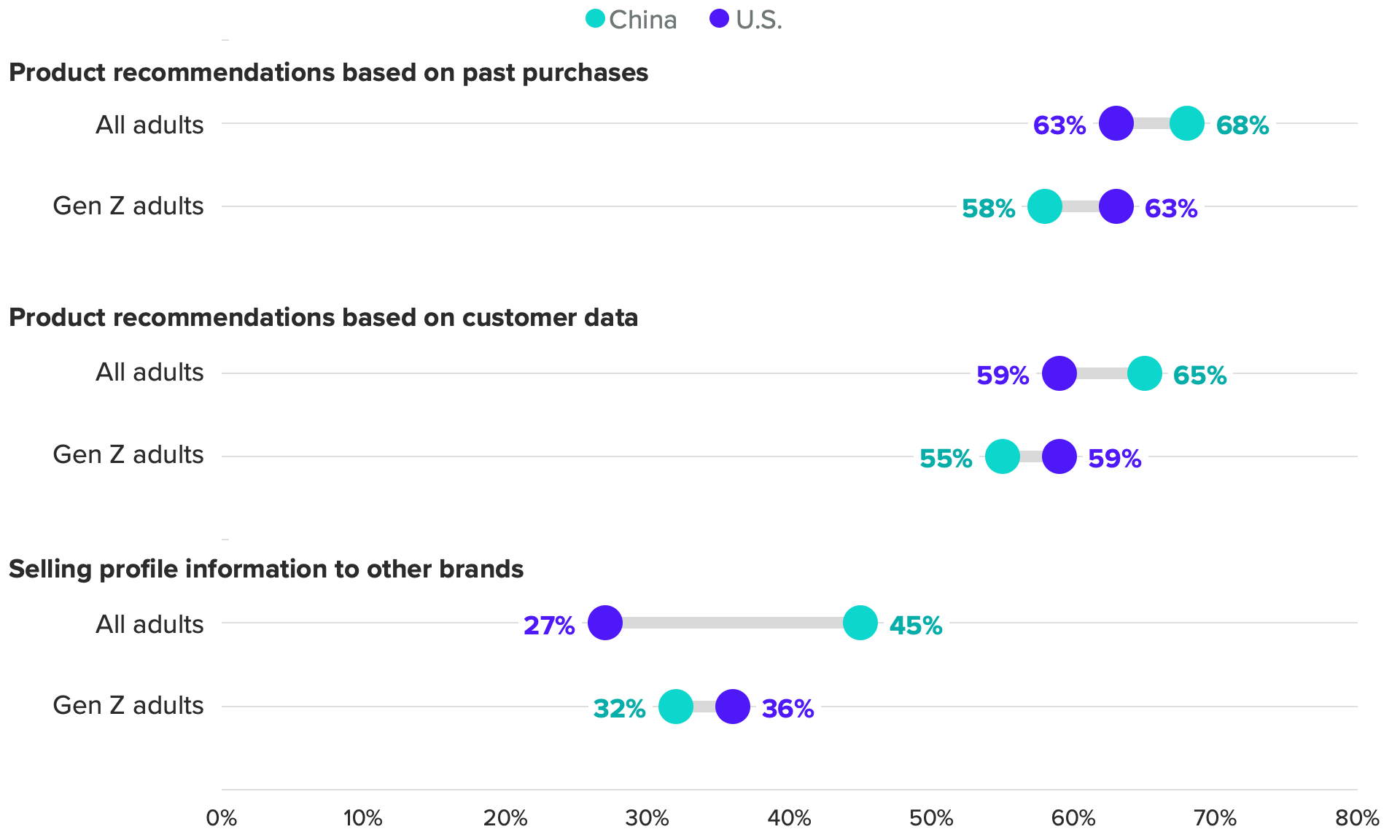

American and Chinese consumers have similar attitudes about privacy — except when it comes to selling data

Deepening customer engagement via rewards programs not only helps cement loyalty, but also enhances retailers’ ability to learn about their most valuable customers. While it’s standard in China for brands to communicate with their loyal customers on WeChat, that level of connectivity is still aspirational for U.S. brands. American consumers are generally more skeptical about companies' use of their personal information and data, and online shopping ranks relatively high in terms of consumers’ worries about the use of their personal data.

When U.S. and Chinese consumers see a direct benefit to brands using their data, such as to drive personalized recommendations, they express similar levels of comfort. However, take away the benefit — in the case of brands selling customer data to third parties, for example — and U.S. shoppers balk at a higher rate than their Chinese counterparts.

Chinese and American Shoppers Diverge on Brands Selling Their Data

Gen Zers, on the other hand, meet in the middle: Fewer Chinese Gen Z adults are comfortable with brands selling their profile information relative to U.S. Gen Zers. In both countries, this young cohort is comfortable with brands using their data as long as it directly benefits them, such as with personalized experiences.