Consumers Are Increasingly Using BNPL Debt to Support Spending

Key Takeaways

Amid elevated interest rates, U.S. consumers are increasingly reluctant to take on credit card debt.

More consumers leaned into “buy now, pay later” services in 2023 to cover holiday spending.

High-spending groups like millennials, parents and high-income adults are among those most inclined to replace credit card spending with BNPL.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

As inflation cooled and the labor market remained resilient through the end of 2023, real personal disposable income grew modestly. However, several years of elevated price growth have left their mark on consumers, who remain highly sensitive and challenged by the higher cost of living. Savings buffers have worn thin for many adults after several years of sustained price growth, leading consumers to more often supplement their income with debt to cover purchases. In the context of high interest rates, however, consumers’ preferred means of debt usage is evolving — and the added pressure to spend on holiday shopping has accelerated adoption of BNPL as an alternative to credit card debt.

High interest rates are discouraging credit card spending

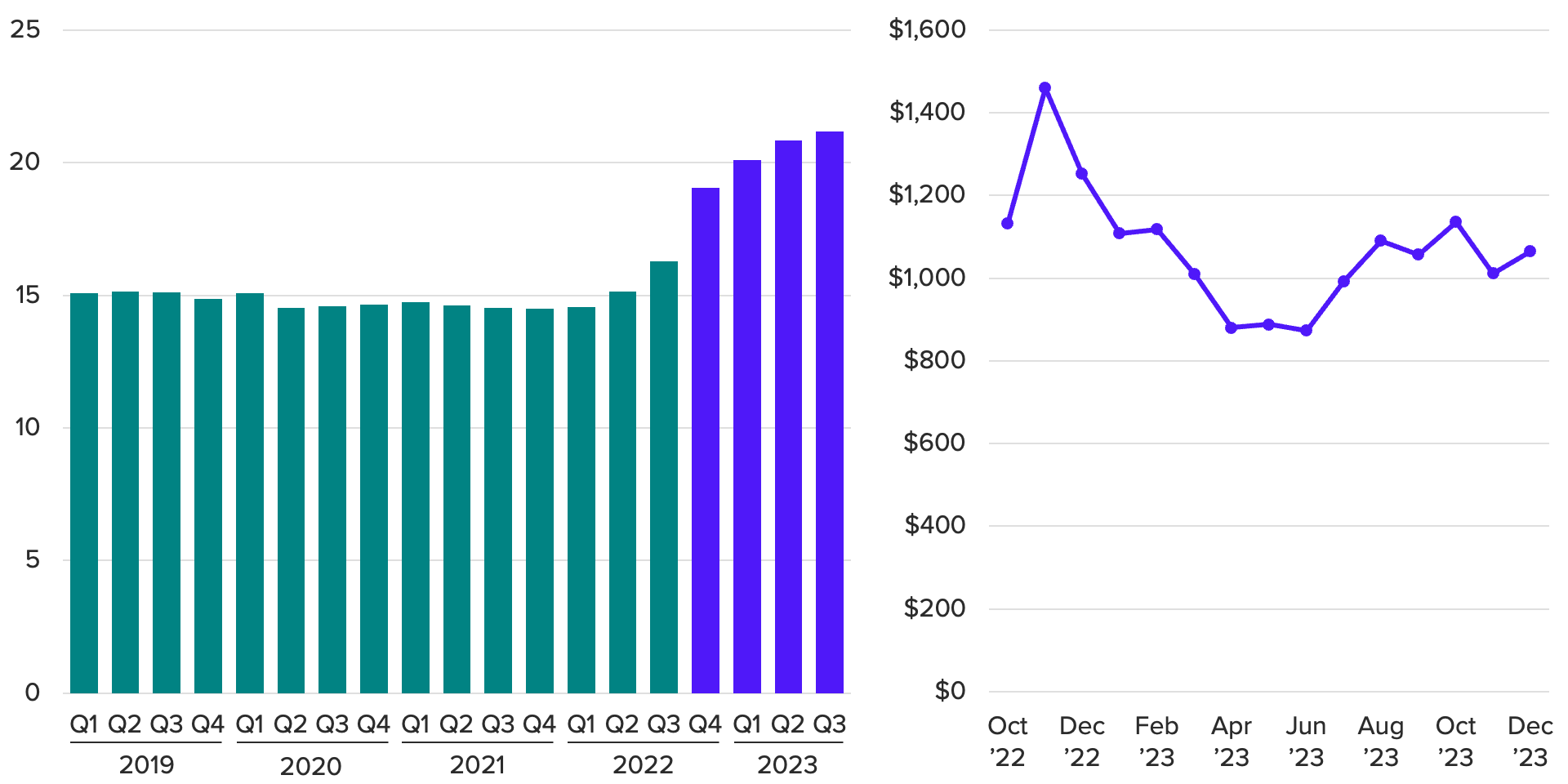

Over the past year, credit card interest rates have jumped as ripple effects from the Federal Reserve’s fight against inflation trickled down to consumers. As carrying debt balances became more expensive, consumers have cut back on credit card debt compared with a year ago. November 2022 saw a spike in credit card debt, coinciding with the holiday shopping season. In late 2023, however, credit card balances remained relatively stable, suggesting that fewer purchases were paid for with credit cards during the holiday season.

U.S. Adults Pare Back Credit Card Balances Amid Elevated Interest Rates

BNPL makes up a growing share of consumer debt

Lower credit card balances don’t necessarily mean consumers are avoiding all types of debt. BNPL has become an increasingly important payment strategy for U.S. households, especially for holiday purchases. As higher interest rates discourage more consumers from swiping their credit cards, BNPL provides an alternative for paying off purchases over time, without the added cost of interest in most cases.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

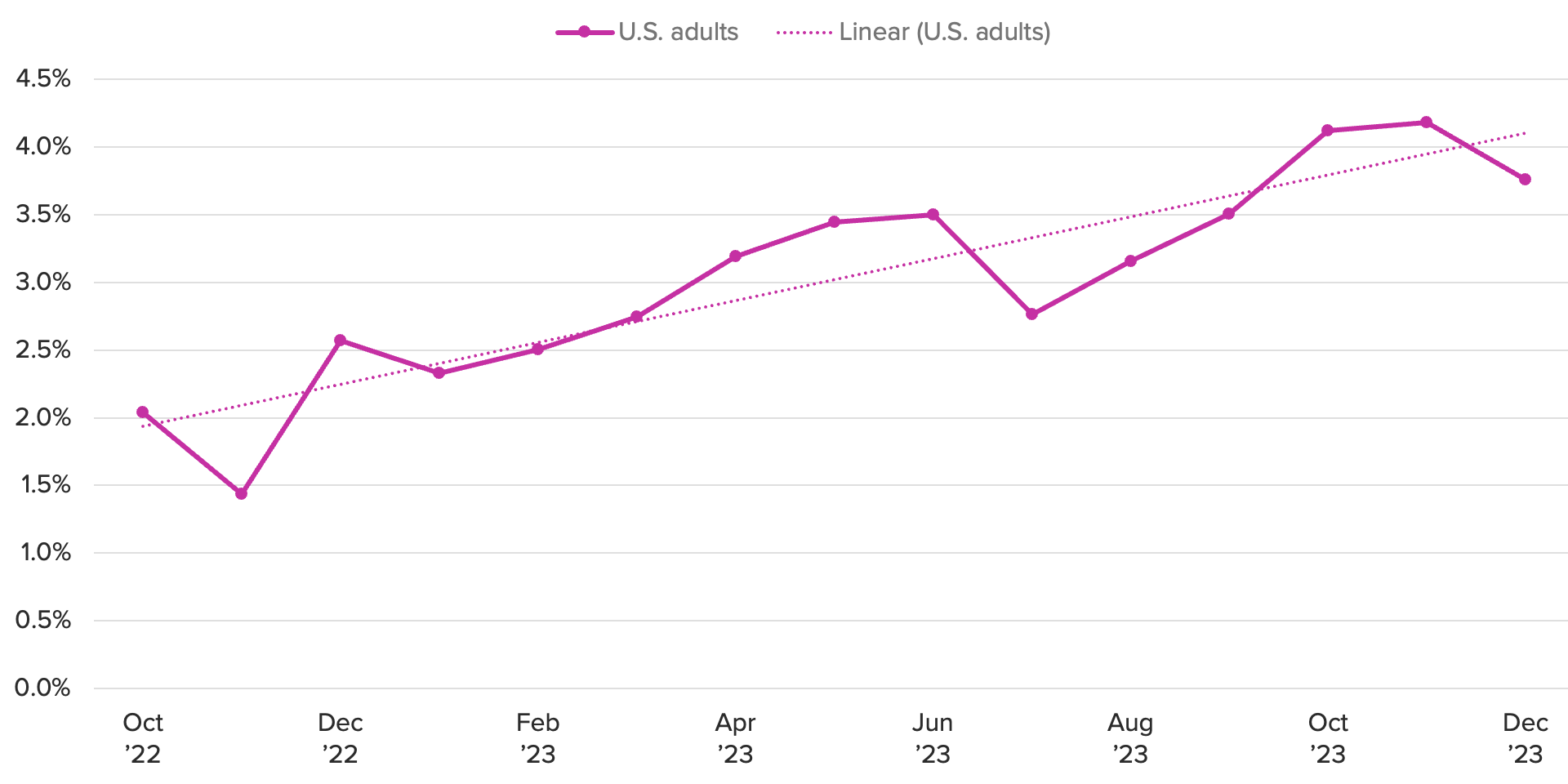

Overall, the impact of BNPL usage on consumer budgets remains dwarfed by credit card payments for the average American. In December 2023, 14% of U.S. adults reported having BNPL debt, compared with 40% who reported holding credit card debt, according to Morning Consult’s consumer credit data. Across all U.S. households, monthly BNPL payments averaged about $11 in December, compared with $273 in monthly credit card payments. Among only those who have BNPL debt, monthly payments averaged $86 in December, but this group had higher average credit card payments as well ($385). However, BNPL is making up a rising share of debt: Average BNPL payments among all adults were 32% higher in December than they were a year ago, and BNPL’s share relative to credit card debt has nearly doubled since Morning Consult began tracking in October 2022.

Consumers Are Increasingly Supplementing Credit Card Debt With BNPL

High-spending groups are most inclined to shift from credit cards to BNPL

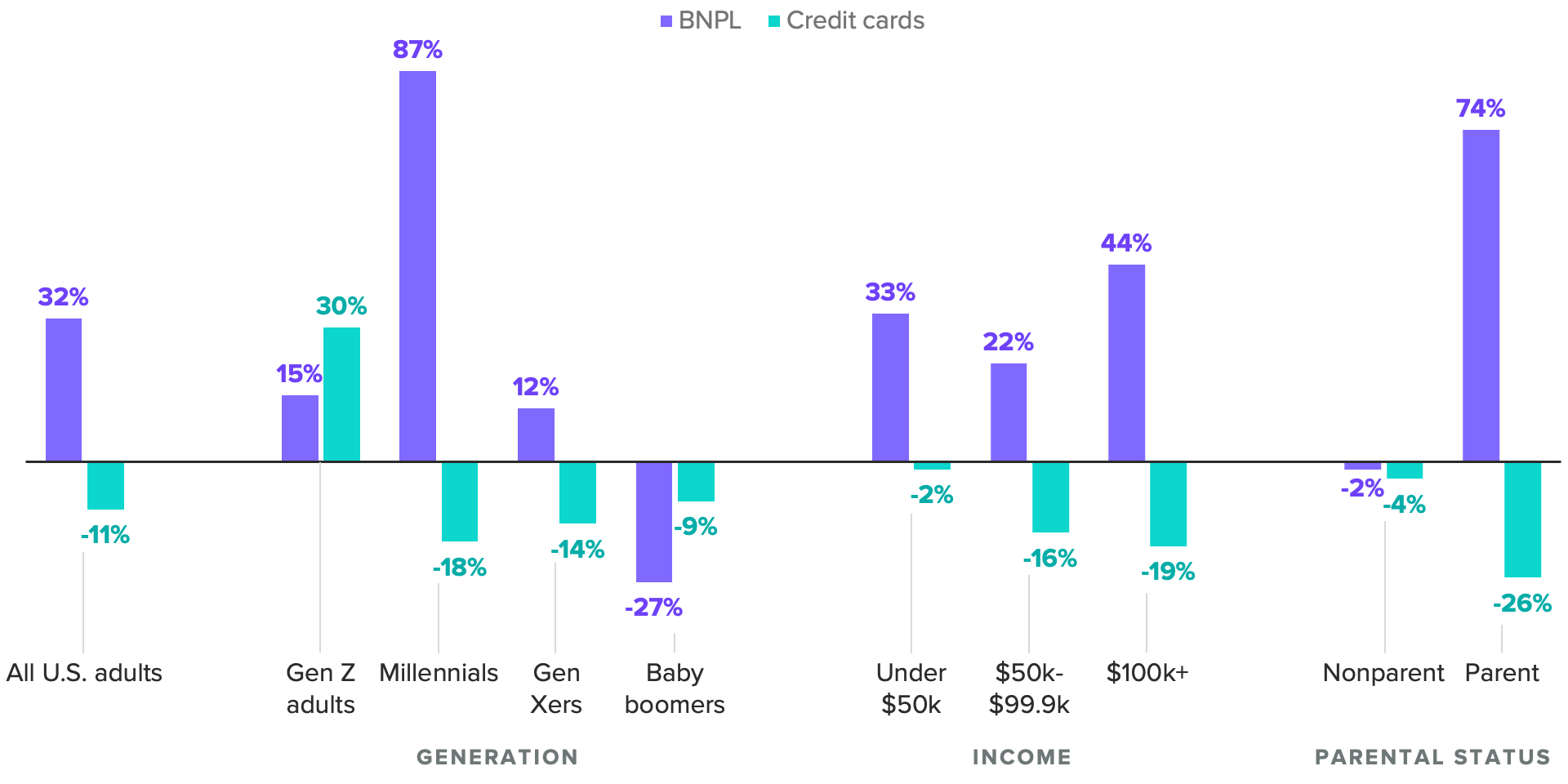

While the move from credit card debt to BNPL holds true for U.S. adults overall, high-spending groups are more likely to exhibit this behavior shift. From December 2022 to December 2023, millennials, high-income households and parents all registered larger increases in BNPL payments and more sizable reductions in credit card payments than other generations, income groups and nonparents.

Millennials, Parents and High Earners Are Most Likely to Cut Back on Credit Cards and Lean Into BNPL

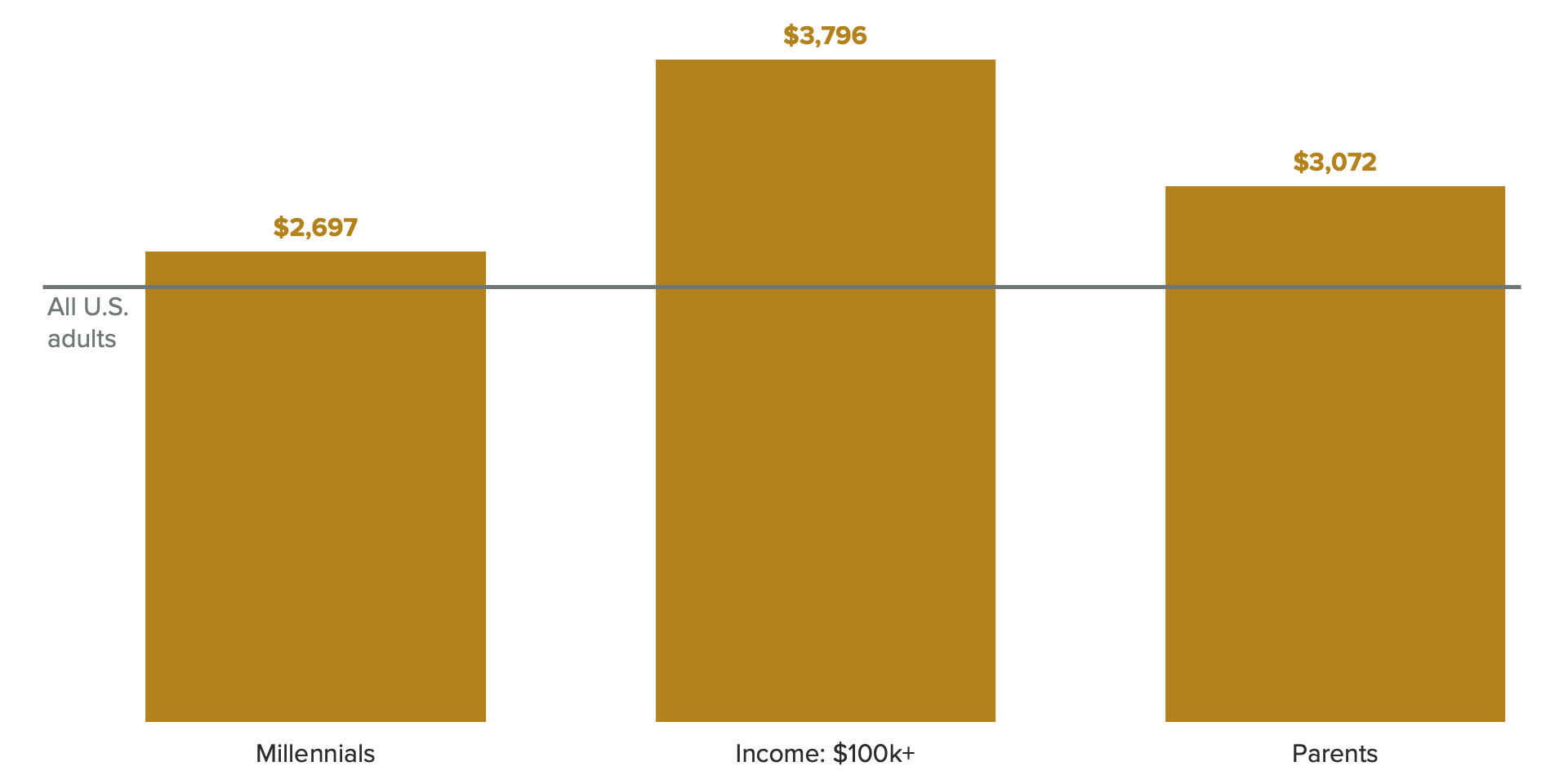

There is considerable overlap among these groups as well: Many millennials have young children and are entering their prime earning years. Higher incomes and parenthood are associated with higher-cost lifestyles — these groups are more likely to own homes and cars and be financially responsible for dependents, all of which confers both higher fixed monthly costs (such as mortgage and auto loan payments) and variable costs (such as unexpected repairs or doctor’s visits for kids). Discretionary spending also tends to be stronger among high earners and younger adults. Consequently, these same groups tend to report higher monthly spending than adults overall.

The Groups Trading Credit Card Debt for BNPL Tend to Be Higher Spenders

Higher interest rates discouraged consumers from adding to credit card balances during the 2023 holiday season. However, debt continues to play an important role in supplementing income and savings, with BNPL taking up some of the slack from lower credit card usage. The groups that have propped up spending levels in recent months are the same ones leaning most heavily into BNPL usage and pulling back on credit card debt. Given the importance of these groups to top-line spending, their rising preference for noninterest-bearing debt alternatives suggests that as long as interest rates remain elevated, spending growth in the coming months is unlikely to be fueled by credit cards.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]