Food Insecurity Is on the Rise as Grocery Inflation Persists

Key Takeaways

In a May survey, 22% of households making less than $50,000 annually said they “often” or “sometimes” didn’t have enough food to eat in the past month, a 7 percentage point increase from January.

Inflation continues to put considerable strain on grocery budgets, driving down spending in the category, especially among lower-income households.

The trend of buying less, or only what’s necessary, will likely continue in the current environment. Consumers will welcome solutions from brands and retailers in the form of sales and discounts, or even direct aid for those experiencing food insecurity.

Sign up to get the latest analysis and data on food & beverage trends, grocery inflation, food spending and more delivered to your inbox.

Consumers have been grappling with sticky inflation for nearly two years, and while price increases have come down from record highs in 2022, household budgets remain strained. One essential category in particular is causing stress for many Americans: groceries. Prices in the category are up 18.4% since May 2021, and now more consumers are reporting that they at least sometimes did not have enough to eat in the past month. Many have turned to the Supplemental Nutrition Assistance Program to help, but pullbacks in the program’s pandemic-era aid mean fewer dollars for recipients at a time when those dollars don’t stretch nearly as far.

Food inflation is driving down grocery spending for lower-income households

Although food inflation has come down from its 2022 highs, it is still running hot at 6.7% year over year. Additionally, it’s been nearly three years since food prices have declined from one month to the next. As a result, grocery prices are up substantially compared with May 2021, when top-line inflation started to make headlines.

Lower-Income Households Have Pulled Back on Grocery Spending

This prolonged price growth is driving down spending in the grocery category as people buy fewer items to save money. While grocery spending for middle- and high-income households has partially rebounded following dramatic pullbacks in March, low-income households have continued to steadily reduce their grocery spending since February.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer and spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

Households across the income spectrum have changed their spending behaviors in different ways to cope with high food costs. Middle- and low-income groups are more likely to say they buy fewer items overall, buy generic brands, buy less meat or eat less food than those making at least $100,000 annually.

Food insecurity is on the rise

As grocery spending has gone down, food insecurity has gone up. The share of U.S. adults who said they “often” or “sometimes” did not have enough food to eat in the past month increased 5 points between January and May.

The increase has been particularly steep among those making less than $50,000 annually and households with children under 18. Among the latter group, for instance, the share who said they often or sometimes did not have enough food to eat increased 12 points, from 15% in January to 27% in May. For both demographics, grocery spending likely makes up a larger share of their monthly expenditures, and inflation has been applying steady pressure.

Food Insecurity Is Highest Among Low Earners and Households With Children at Home

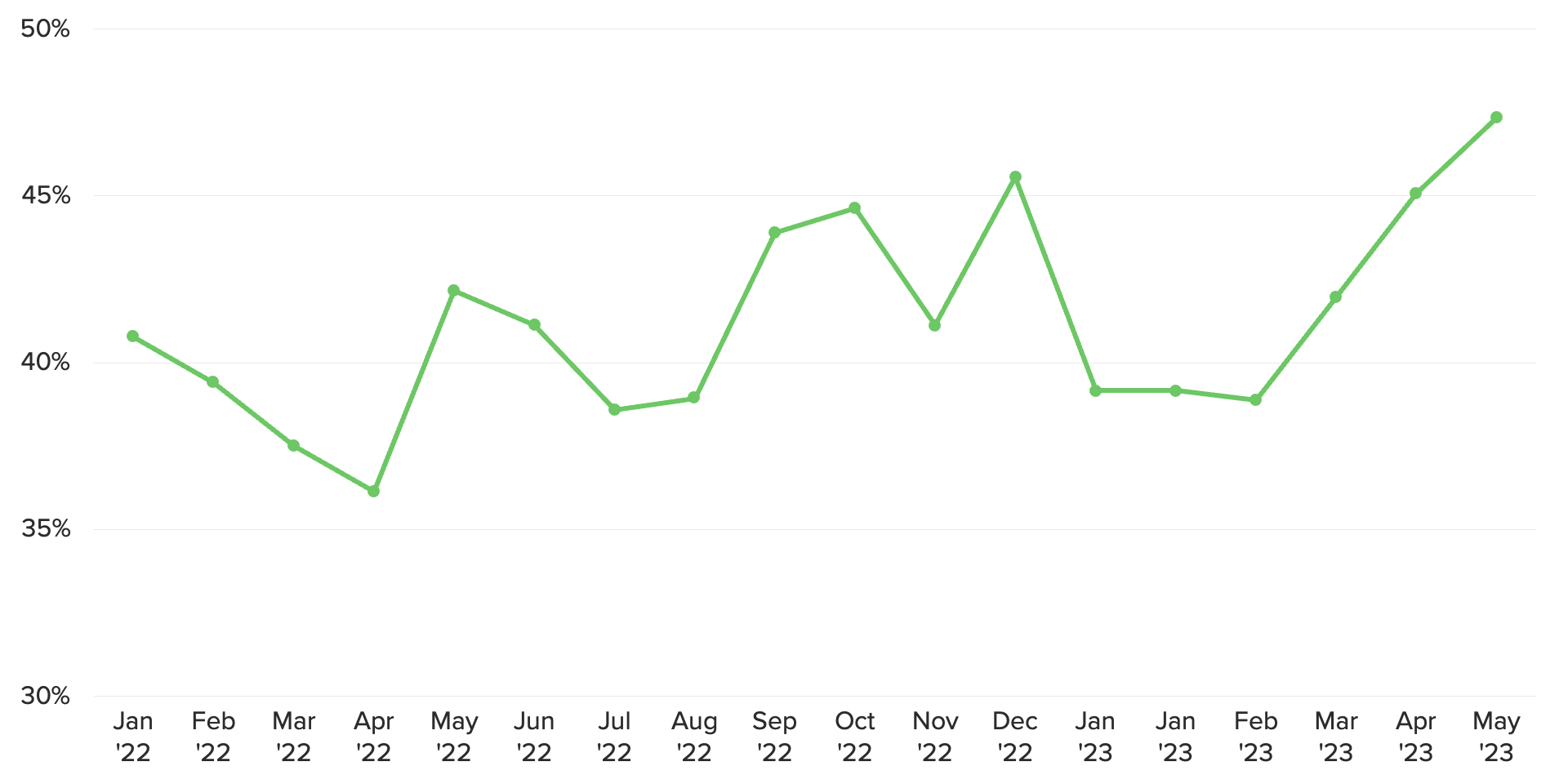

An increasing share of low-income households report receiving SNAP benefits

As lower-income households report more food insecurity and pull back on grocery spending, an increasing share are reporting that they received SNAP benefits in the past month. This increased reliance comes at a time when the benefits themselves are changing, as pandemic-era provisions expired in March. The expiration resulted in a cut of at least $95 a month in the 32 states that were still paying the additional benefits. Before the pandemic, the national average household SNAP benefit was $239, so $95 of supplemental benefits was a nontrivial amount of the total. This means that while an increasing share are receiving food stamps, they’re getting less money and, given the persistent price growth, it’s not stretching as far at the store.

Nearly Half of Low-Income Consumers Reported Receiving SNAP Benefits in May

Rising food insecurity will create opportunities for brands to provide support

Groceries are the second-largest spending category in the average consumer’s budget, according to Morning Consult data, so high food prices put considerable strain on household budgets. With more lower-income adults relying on SNAP benefits to subsidize their grocery spending amid high food prices, reduced spending on food will likely continue.

Given the magnitude of price growth in the category, consumers will need support. Brands and retailers have an opportunity to provide resources in the form of discounts, sales and promotions — or even direct donations — for those who are food insecure.

This memo cites data and analysis from Morning Consult’s June U.S. Consumer Spending & Inflation Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Emily Moquin previously worked at Morning Consult as a lead food & beverage analyst.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]