Consumer Demand Was Strong in December as Inflation Moves Toward the Fed’s Goal

Key Takeaways

Morning Consult’s price surprise measure ticked down again in December, suggesting inflation could continue to ease.

Supply remains plentiful, while consumer demand strengthened through the

end of 2023.Gen Zers and parents fueled much of the increased demand through the

holiday season.

This memo offers a preview of Morning Consult’s January Inflation & Price Pressures Report. Morning Consult Economic Intelligence subscribers can access the full report here.

After a temporary uptick driven by rising energy prices earlier this year, annual inflation decreased in November to 3.1%, appearing to be back on track toward the Federal Reserve’s 2% target. Supply for most products continues to be plentiful, contributing to easing price growth. Consumer demand was strong in December, fueled in large part by demand for durable goods and services, as well as holiday spending.

Parents were willing to swallow higher prices for goods this holiday season

In the final months of the year, parents exhibited decreasing price sensitivity for several goods categories. The divergences between parents and nonparents were particularly sharp for electronics and furniture: Sticker shock dropped sharply for parents while nonparents held relatively steady for both product categories. Holiday shopping could have added more pressure to parents to follow through with high-priced purchases compared with those without children. The divergence between parents and nonparents occurred earlier in the year for clothing, with the gaps widening even more in recent months.

In Morning Consult’s data, parents have also been leaning more on “buy now, pay later” loans compared with their nonparent counterparts, which could be partially fueling their decision to follow through with high-priced purchases even if they are not comfortable with the price tag.

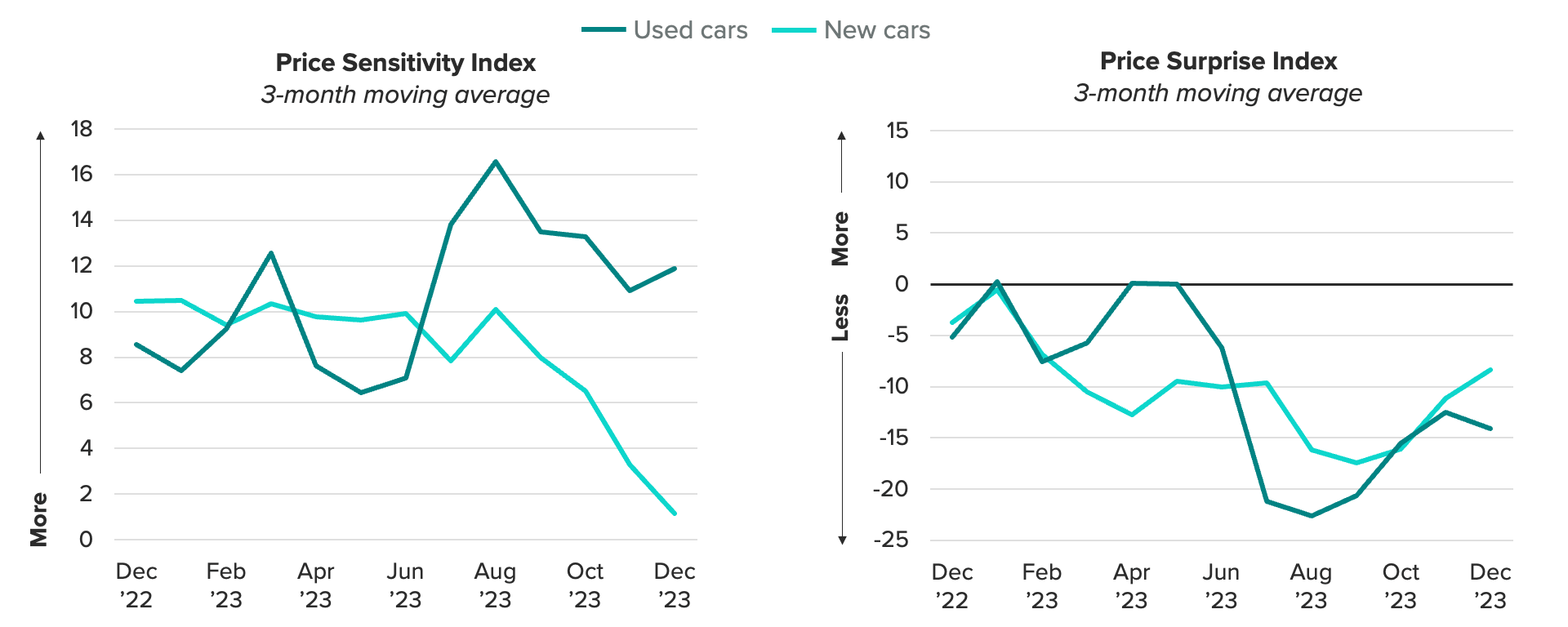

Despite being increasingly surprised about high prices, consumers demand new cars

Prices for used cars have been volatile since the start of the pandemic but have come down substantially from their highs in 2022. At the same time, prices for new cars were on a fairly steady upward climb until October and November 2023 gave consumers some relief. However, consumers have been reporting slightly higher levels of price surprise for new and used cars in recent months. Consumers’ gauge on prices for durable goods can be less consistent than for other goods and services that are more frequently purchased — for example, most people purchase groceries on a regular basis, and may have a better grasp on those price changes, but with durable goods like cars, consumers may be out of the market for years.

Demand Is Increasing for New Cars

As a result, increased price surprise here could be a sign of activity in the car market — more consumers are re-entering the market but surprised about the level of prices. In addition, price sensitivity has tanked for new vehicles in recent months, suggesting that demand is high, since consumers are willing to follow through with purchases on new cars even when prices are higher than they expect.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]