Despite Signs of Life in the Housing Market, Housing Prices Will Push Top-Line Inflation Down This Year

This is the final of three memos in our What to Watch in Inflation series. Each one explores how different key sectors of the economy could affect the evolution of inflation in the coming months, how those developments may drive the Federal Reserve’s decision-making and what these factors imply about the probability of a recession. Additional insights on spending and inflation can be found in our January Consumer Spending & Inflation report.

Key Takeaways

Home prices have come down considerably since their height in mid-2022, largely driven by reduced demand due to rising mortgage rates.

After several consecutive months of cooling, the housing market is showing some signs of recovery, with Morning Consult data showing that interest in buying and selling activity is trending up.

The recent uptick in demand is unlikely to lead to overheating, with consumers becoming more sensitive to high prices and high interest rates continuing to keep buyers away.

In the first and second memo of this series, we discussed how recent trends in the nonhousing services and goods sectors could affect top-line inflation and the Federal Reserve’s policy response. This third and final memo in the series focuses on housing: As roughly a third of the top-line consumer price index, it’s a sizable and important portion of inflation.

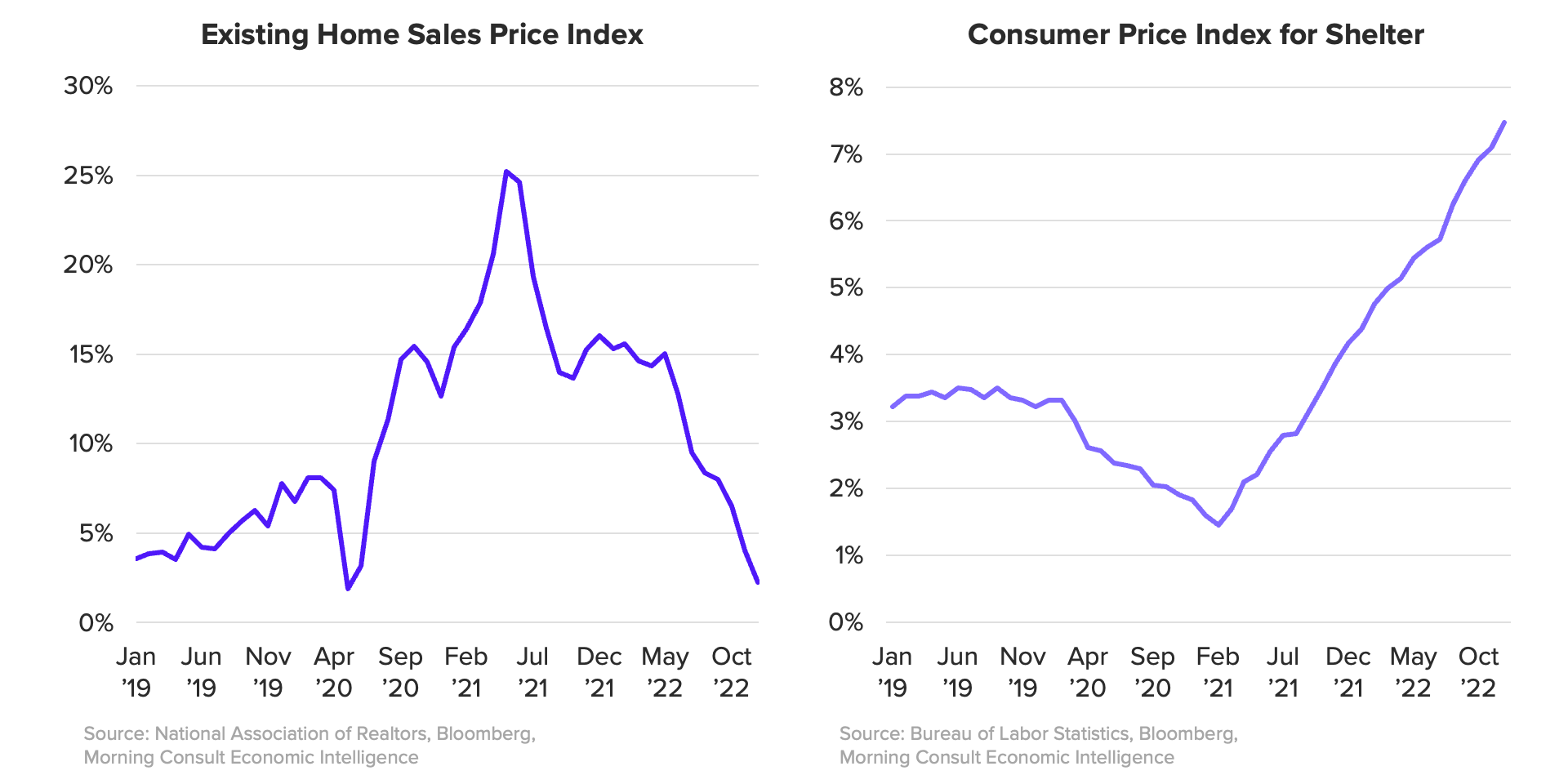

Housing prices rose sharply over the first half of 2022 and have steadily fallen since then as rising interest rates, and consequently mortgage rates, curbed homebuying demand. These recent price declines have yet to show up in the CPI, however, since new leases and contracts take time to roll over and therefore lag when it comes to inflation measures. In other words, CPI measures what people are currently paying today, whereas market prices measure how much people are agreeing to pay when leases and contracts begin.

Even as the CPI has yet to digest recent price declines, current housing dynamics offer an important indicator for the future trajectory of inflation.

(year over year)

In this memo, we explore the main drivers behind housing price declines and how, despite more recent signs of demand recovery, we do not expect a strong rebound in housing demand or prices in 2023.

What is driving price declines?

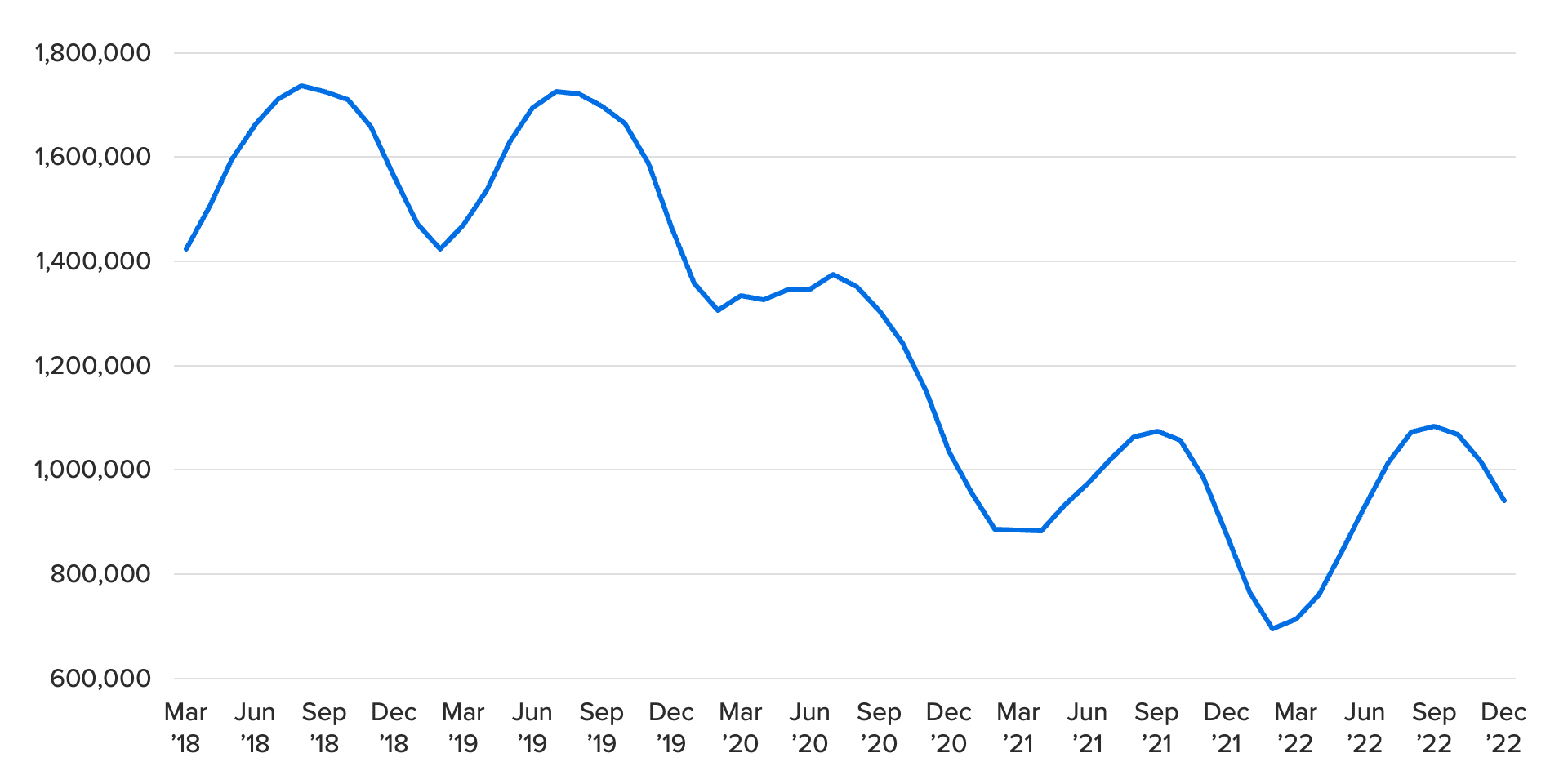

At a high level, price is ultimately a function of supply and demand. Housing inventory remains historically low, as shown in Zillow’s for-sale inventory data, suggesting that the recent price declines have not been driven by supply. Limited inventory gives sellers an upper hand against buyers, putting upward pressure on prices.

Therefore, declines are likely being driven by the demand side, where housing costs have become increasingly unaffordable for many consumers. The housing market is more sensitive than many other categories of goods and services to increased rates by the Fed because elevated rates lead to higher mortgage rates, increasing overall cost for homebuyers. Consumers could be deterred from making a large personal investment, such as a home, when a larger portion of the cost is going to interest. On top of high mortgage rates, home prices reached historic highs in mid-2022; the double punch of high rates and high home prices drive buyers away.

(3-month moving average)

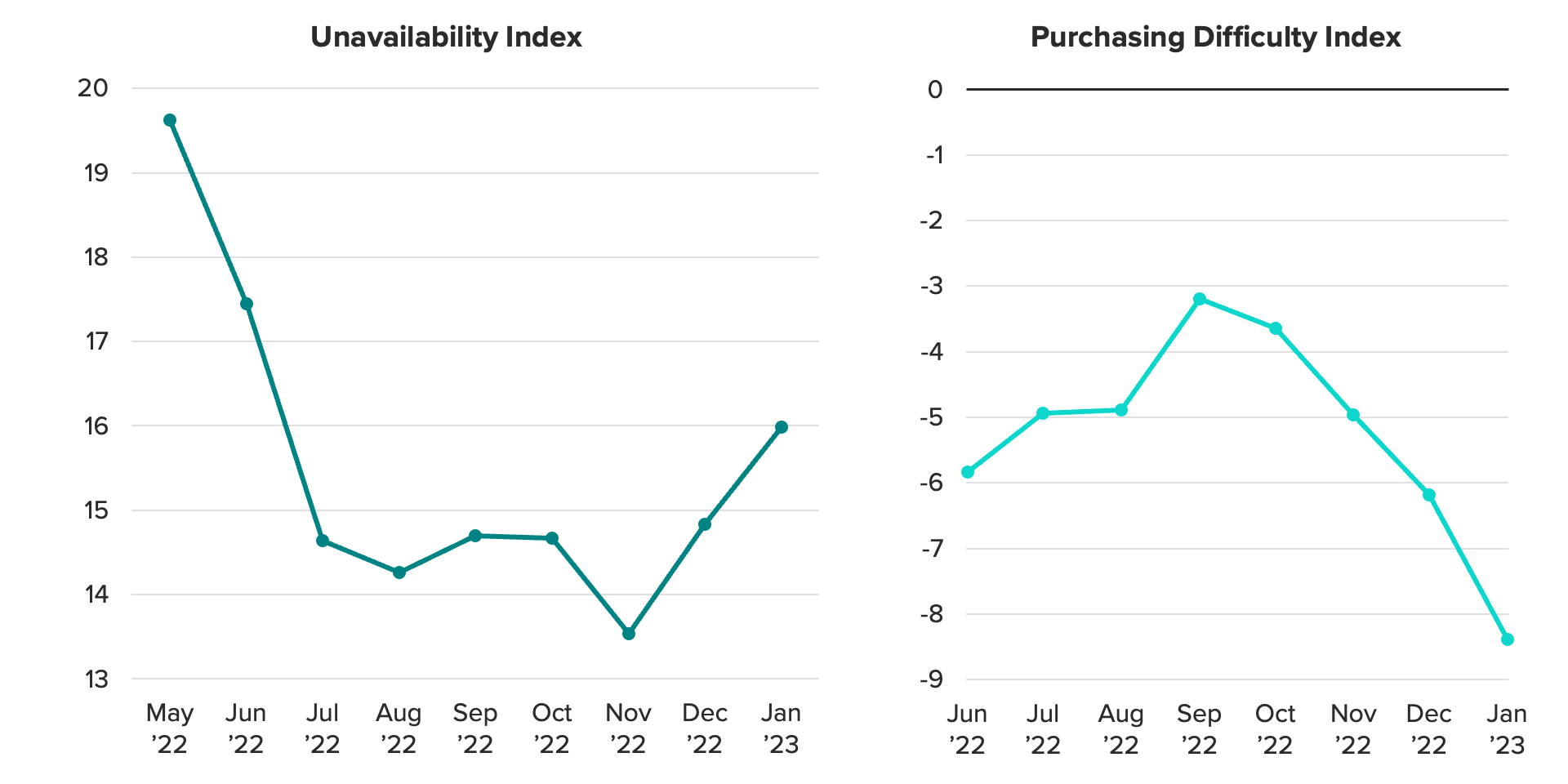

As housing demand cools, Morning Consult’s proprietary data suggests that prospective homebuyers are having an easier time procuring housing. Consumers have been reporting fewer stockouts (Unavailability Index) and less search effort (Purchasing Difficulty Index) than during their highs in 2022. The decline of these indexes indicates that competition for supply has waned and housing has become less difficult to find overall, demonstrating easing price pressure in the market.

After months of cooling, the housing market is showing some signs of recovery

Several measures of housing market demand have recently picked up. After a year of declines, the National Association of Realtors’ home sales index ticked up in December, and, according to the Mortgage Bankers Association, mortgage applications started rising again in January. Easing prices and recently declining mortgage rates could be pulling in buyers with pent-up demand who were previously priced out.

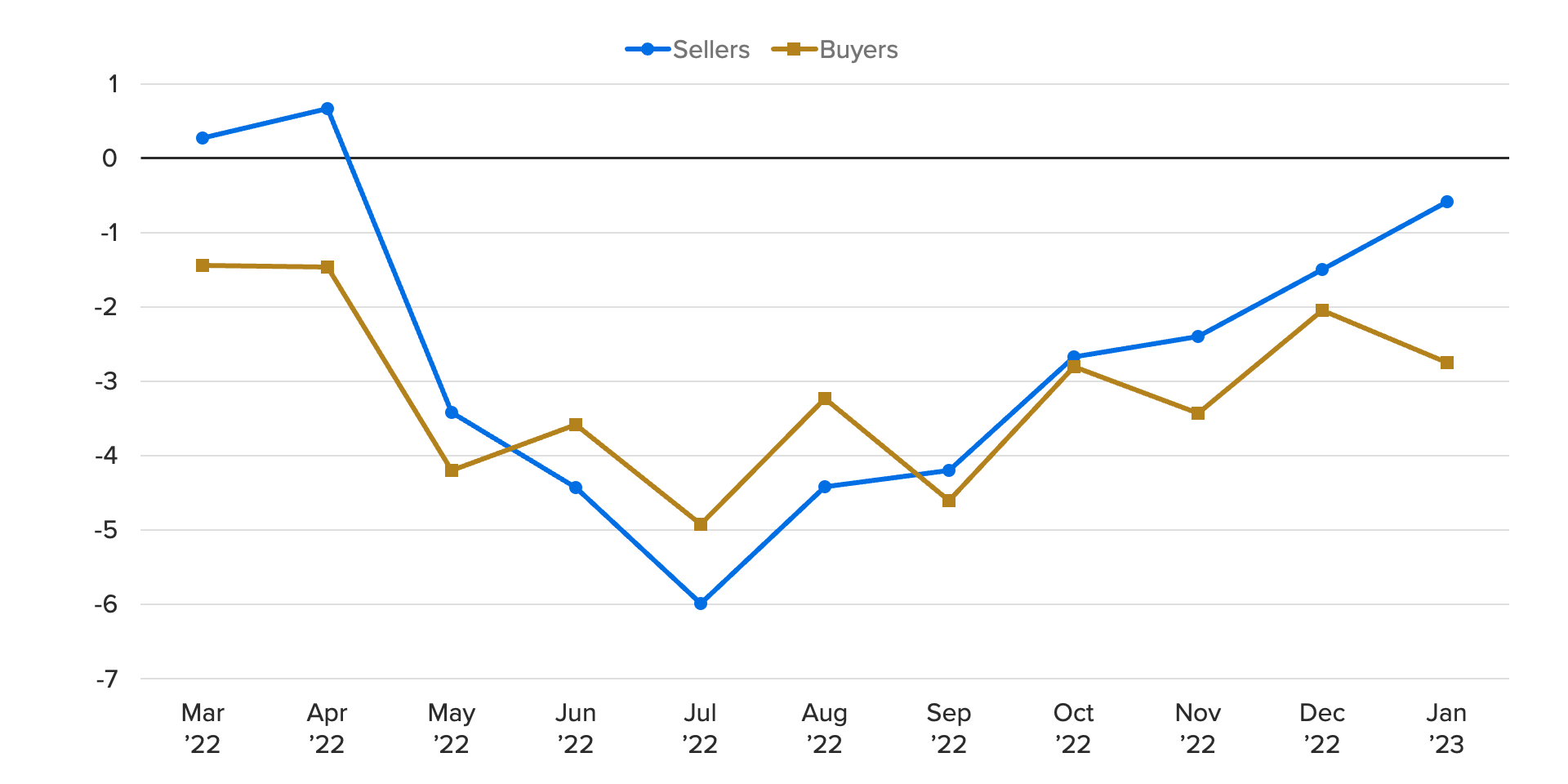

Morning Consult’s data is also showing signs of renewed interest from consumers in participating in the housing market. After hitting a low point in July 2022, the shares of consumers planning to buy or sell homes in the next 12 months have been steadily drawing closer to their year-ago levels.

(3-month moving average, in percentage points)

Housing inventory, as mentioned above, is still limited. Existing homes make up the majority of housing stock, so selling intentions offer a critical indicator for future supply. Despite the recent upward trend, the number of sellers remains below its level a year ago, suggesting a strong influx to supply over the next year is unlikely. Furthermore, inventory will likely become even tighter in the spring due to seasonal demand in the housing market. Recently increased demand, plus continuing tight supply, could either stabilize prices or make them rise slightly in the first half of 2023.

Downside risks to demand likely to limit price growth

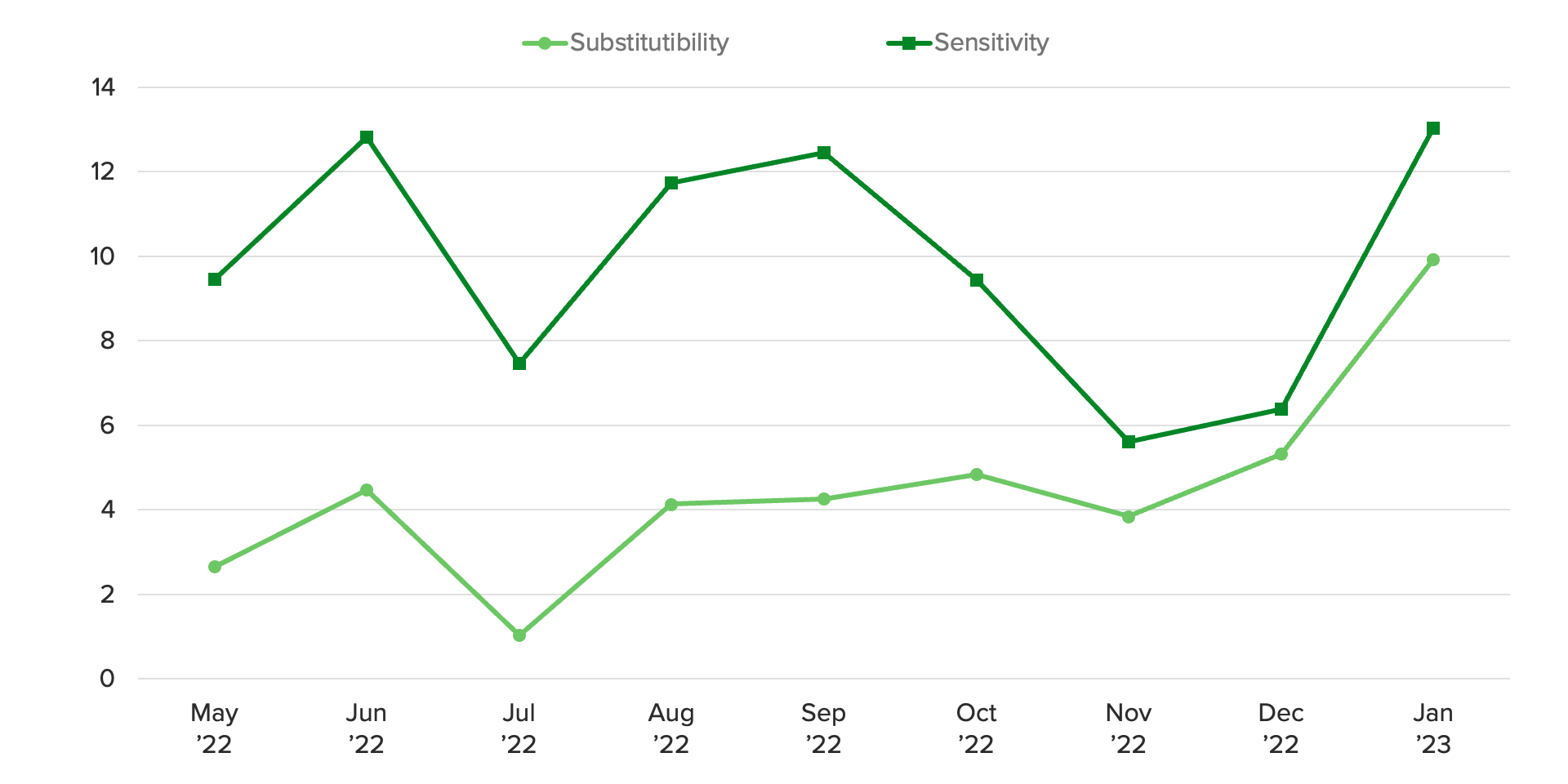

Although prices have declined steadily from their highs in 2022, unaffordability remains an issue for the consumer — home prices are still much higher than they were for most of 2021. In other words, prices may still be too high for most consumers. We have seen evidence of this in Morning Consult’s price indexes, with consumers being increasingly more likely to trade down to cheaper options (Substitutability Index) or walk away from high-priced homes (Price Sensitivity Index). In addition, if the Fed continues to raise rates, this will put pressure on mortgage rates and drive up overall homebuying costs even more.

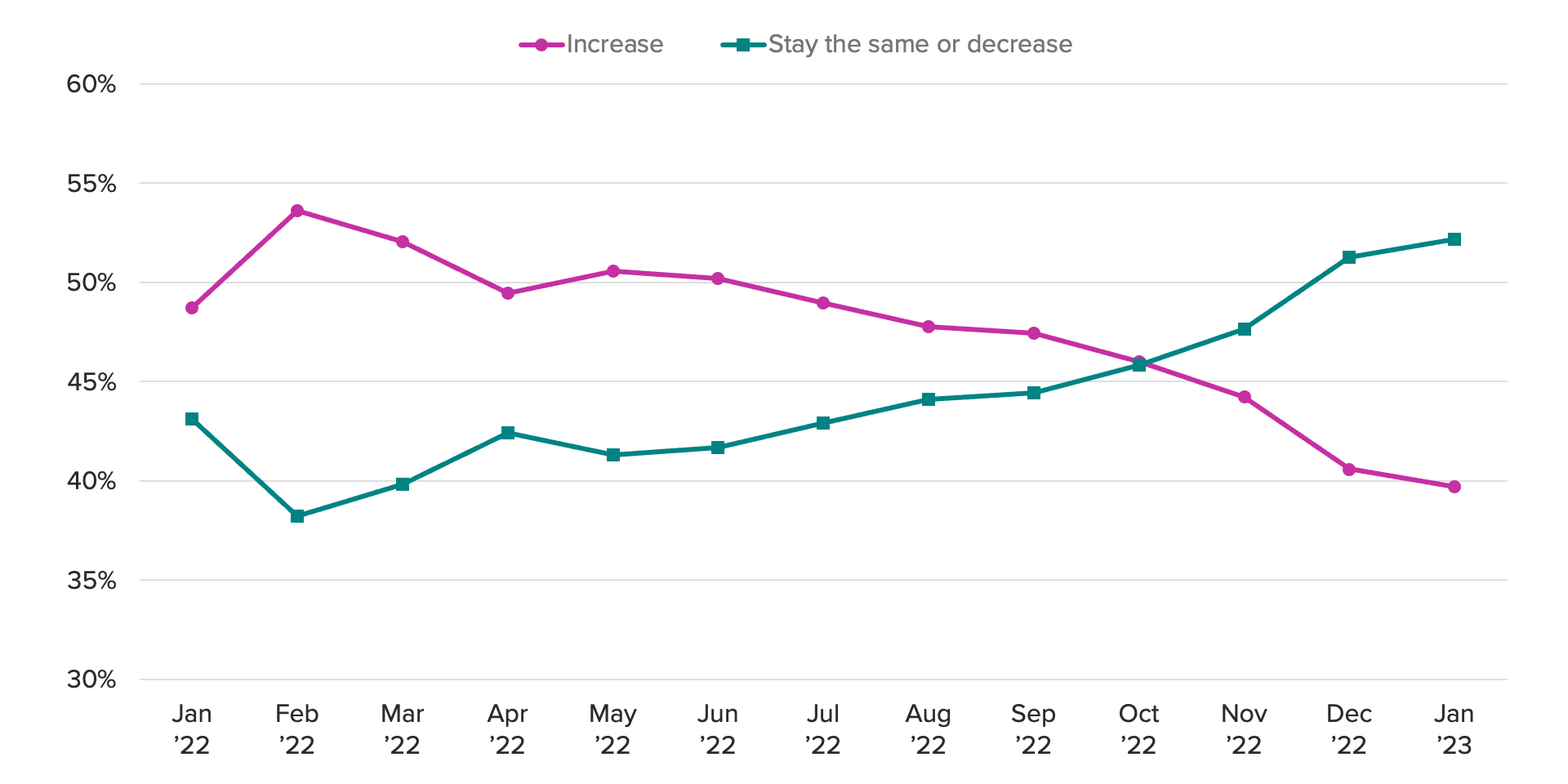

Consumer price expectations may also play a role in the trajectory of housing demand. Up until October 2022, consumers were more likely to expect home prices to increase than they were to expect them to decrease or remain the same. Since October, this view has started to shift, with more people saying they believe that home prices will either decrease or remain the same. If prospective buyers believe prices will decline further in the future, they may wait to buy later instead of now, indicating that there is not enough demand to cause near-term rapid price growth in the housing sector. On the seller’s side, if they expect prices to decline in the future, they may want to bring houses to the market sooner, increasing inventory and further suppressing competition and prices.

(3-month moving average)

Despite heating demand, lagging housing CPI will help top-line inflation later this year

Because the housing market shows up in CPI on a lagged basis, we expect declines from last year to show up in CPI in the second half of 2023. Tight supply and recent increases in demand could cause housing price declines to neutralize. However, it is unlikely that these changes in supply and demand would lead to a large rebound in the housing market. And it is even more unlikely that this would create enough demand to sharply increase prices, in large part because of consumers' rising sensitivity to home prices and the possibility of future rate hikes.

Housing is unique in that it is a store of wealth for households, so it is a positive sign for homeowners and the economy that price declines are starting to ease. However, like goods, if housing price declines fizzle out or reverse before top-line inflation has slowed, it becomes even more important for the core services portion of inflation to come down in order for the Fed to be comfortable pausing rate increases.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]