Consumers Are Demanding Meat Despite the High Price Tag

Key Takeaways

With grocery prices substantially higher than their pre-pandemic levels, consumers generally are willing to deal with higher prices for necessities and are more likely to walk away from non-essentials.

Consumers are more likely to be surprised by the cost of meat, but are less likely to walk away entirely from meat purchases.

Low income consumers are more likely than higher earners to employ cost saving measures when buying meat

Sign up to get the latest global brand, economics, media and marketing news and analysis delivered to your inbox every morning.

Grocery inflation has come down from its high in 2022, but prices today are now 25% higher for groceries than they were pre-pandemic. When asked about what concerns consumers about the economy, groceries topped the list of concerns, with 90% of respondents saying that grocery prices made them either “somewhat” or “very” concerned. Meat prices are around 27% higher than they were pre-pandemic, and as a result, consumers are particularly worried about the cost of meat: nearly half of all consumers are “very” concerned about the cost of meat, more than any other food category.

Consumers Are Demanding Meat Despite High Costs but Are Less Willing To Pay for Other Non-Essentials

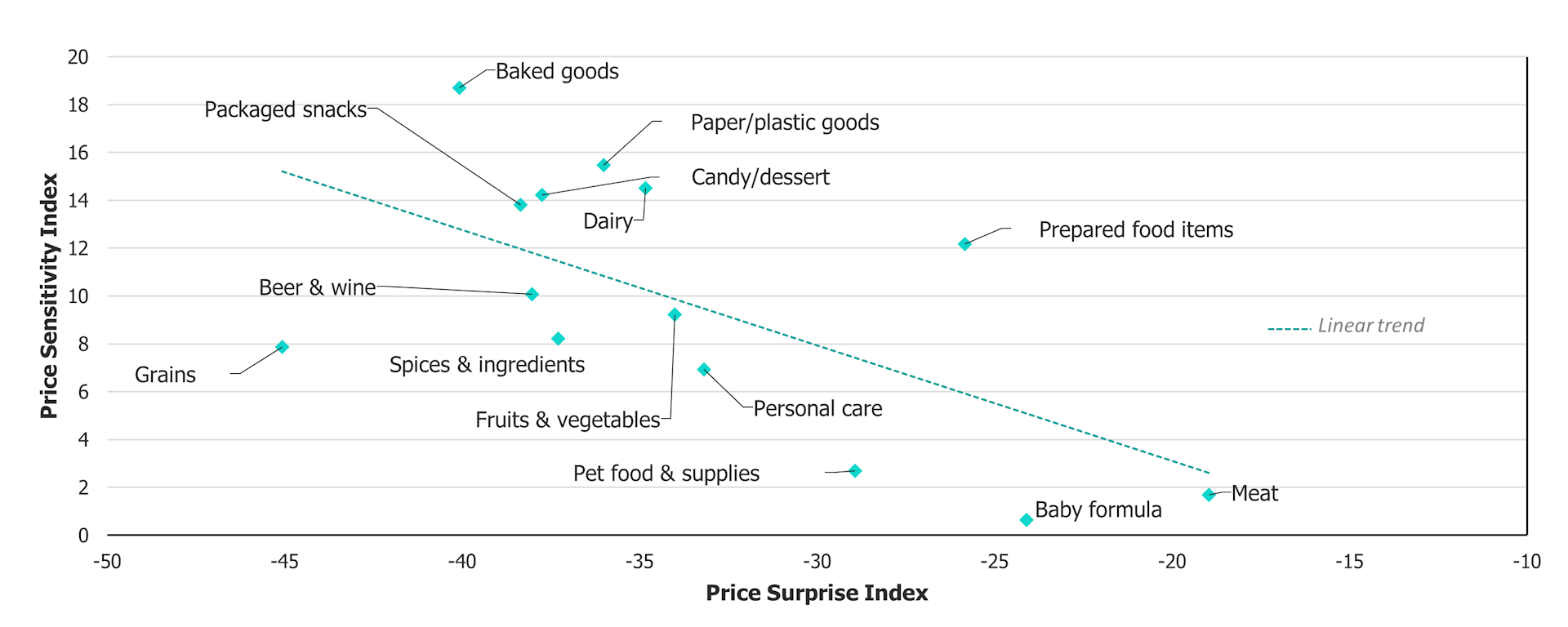

Not all grocery products are treated equally by consumers, in fact, many of the categories eliciting the most surprise about high prices are the same ones for which consumers are least price sensitive. Baby formula stands out with one of the highest levels of price surprise, but given the critical nature of this product, consumers are unlikely to walk away from buying it, thereby registering a lower price sensitivity score. Other discretionary categories, like packaged snacks or baked goods, with higher levels of price sensitivity, are being left out of grocery carts to save on costs, even though prices for these items aren’t causing as much surprise.

Meat may not be considered a necessity for some, but consumers’ behavior suggests otherwise: meat (poultry, beef, pork, etc.) has the highest level of price surprise, while at the same time, relatively low levels of price sensitivity implying high demand for meat no matter the cost.

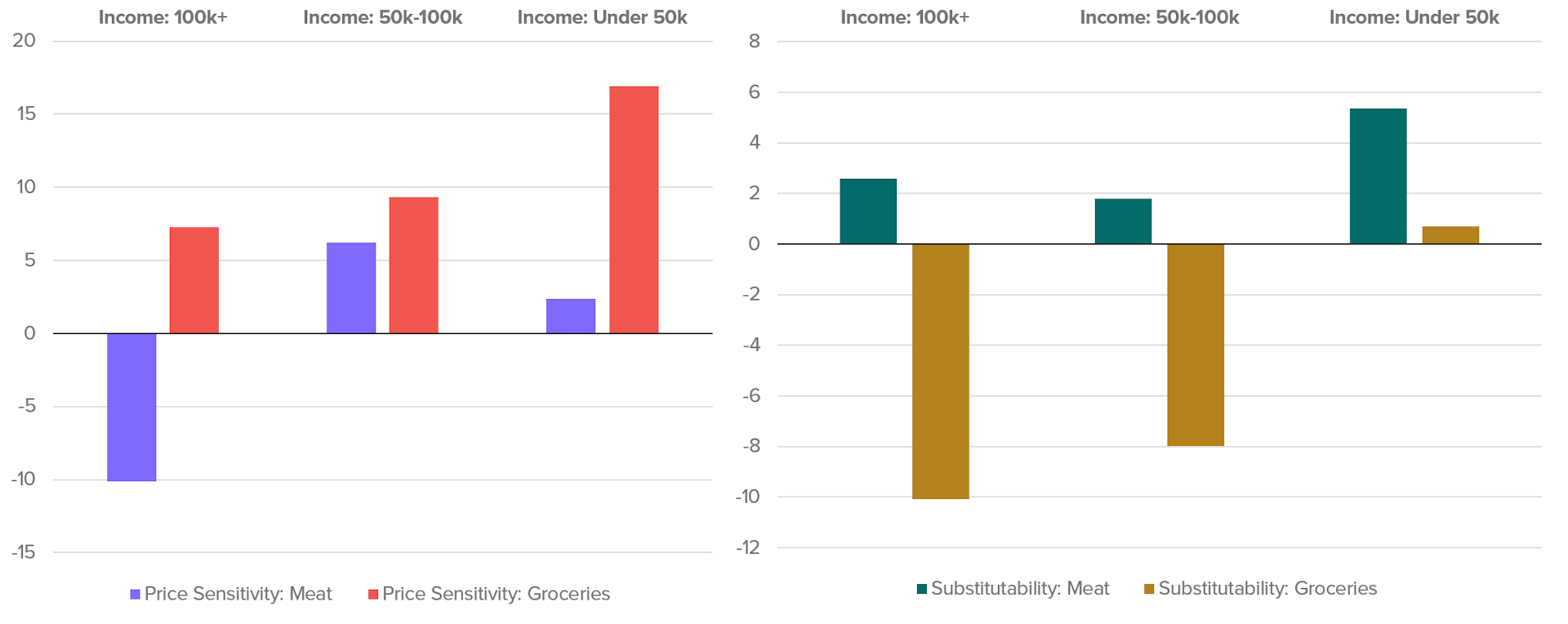

Consumers Are More Likely To Trade Down to Cheaper Alternatives for Meat Than Groceries in General, Especially Low-Income Households

Although on an aggregate level, adults’ demand for meat is rather inelastic compared to many other grocery categories, cost saving measures vary substantially by annual household income. Consumers of all income levels are more likely to trade down to cheaper substitutes when shopping for animal products versus groceries in general. Although high- and middle-income households also engage in substitution to save, lower earners are more than twice as likely to engage in trading down behavior than their higher earning counterparts. Meat is generally pricier than many other grocery items but has a wide variety of different options within the category. As a result, there are many ways consumers can trade down: Opting out of buying organic, choosing to buy lower quality cut meats, or ground meats, etc.

On the other hand, households at all income levels are less price sensitive when it comes to animal products than groceries in general. In other words, when faced with higher than expected prices, consumers are less likely to walk away from buying meat than they are with other pricy food items. High-income adults in particular have high demand for meat: high earners have a negative price sensitivity score, which implies they are more likely to purchase meat than not purchase meat even when the price is higher than expected. Both low- and middle-income consumers are more likely to walk away from higher-than-expected meat purchases, with middle-income earners being the most sticker shocked.

Despite grocery prices, and more specifically meat prices, being a major pain point for most American consumers, demand for products like beef, chicken, and pork is relatively high. Most consumers, especially those who are wealthier, are less likely to forgo meat purchases because of the price than the rest of the items in their grocery cart. However, in order to cut back on costs, consumers at all income levels engage in at least some substitution. Unsurprisingly, low-income consumers are most likely to employ savings tactics like trading down and sometimes even walking away from the purchase entirely.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]