Rising Fast Food Prices Hit Consumers Where It Hurts

Key Takeaways

Inflation at fast food restaurants has outpaced that of full service establishments in recent years, undermining affordability of quick-service meals.

Core customers of fast food chains skew low-income and are more likely to have kids – two groups that have shown the most rapidly increasing price sensitivity for restaurant purchases.

Even as these consumers buckle under price pressures, fast food meals are more likely to be traded down rather than cut from budgets.

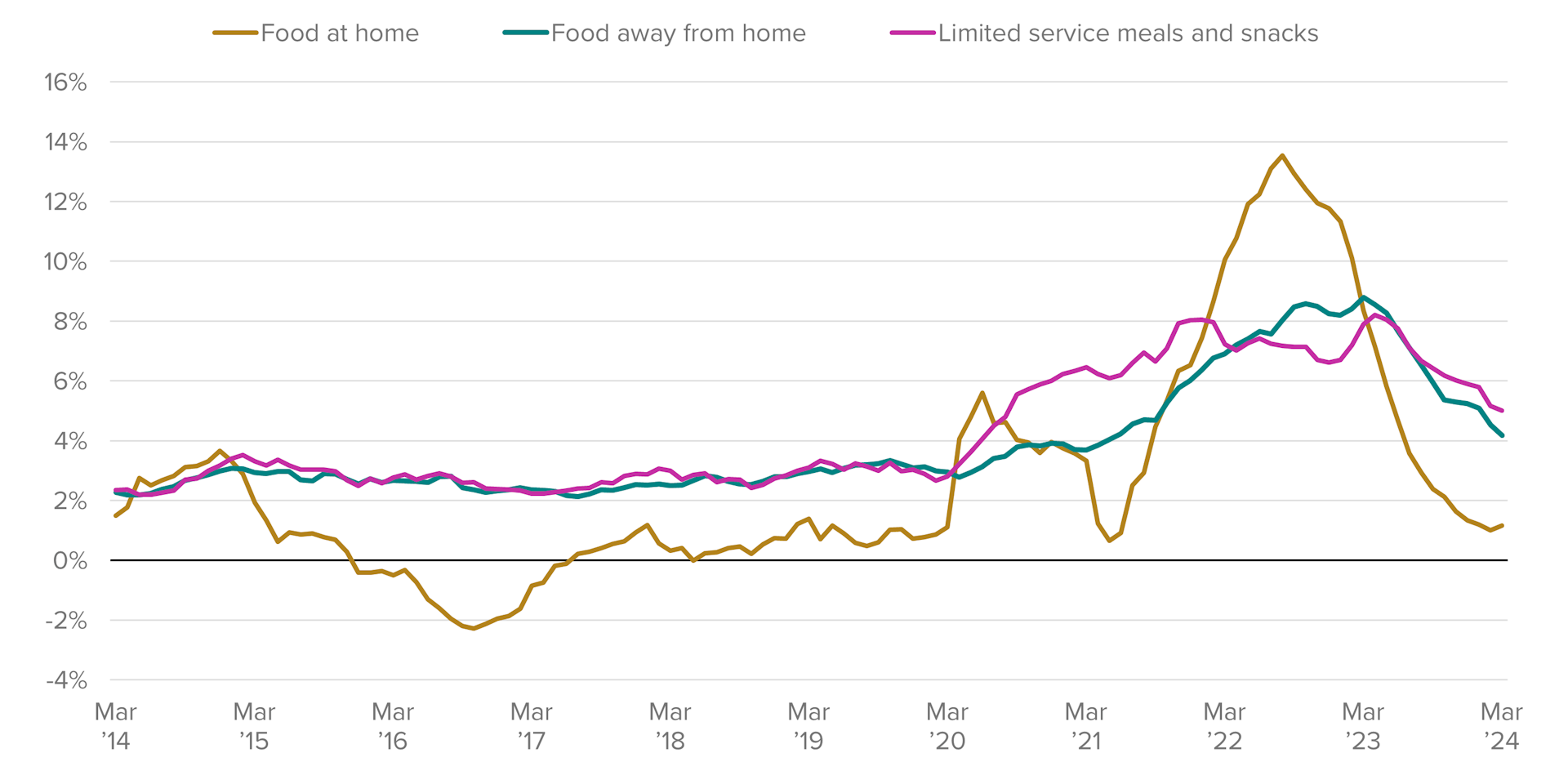

Over the past few years, elevated inflation has persistently weighed on U.S. consumers, but concern over food prices has stood out compared with other categories. Since peaking in 2022, price growth has steadily cooled for groceries, with annual inflation for food at home cooling to just 1.2% in March 2024. Restaurant price growth, however, remains elevated at 4.2% as food service places seek to pass on higher input costs for ingredients and labor to consumers. Quick service meal prices are growing even faster than the restaurant segment overall, with 5.0% growth as of March. Fast food is a major contributor to this category, and chains within this sector have been making headlines for rapid price gains.

Restaurant inflation remains elevated after surge in food prices

Morning Consult’s research suggests that faster price growth for traditionally “cheaper” restaurant meals is especially painful to consumers, as this segment’s core customer base is likely to be more financially vulnerable and cost-burdened than the general population. Our findings underscore previous research suggesting that inflation continues to strain consumers despite its slower pace, and that there is a widening gap between how lower and higher income households are experiencing the current economy.

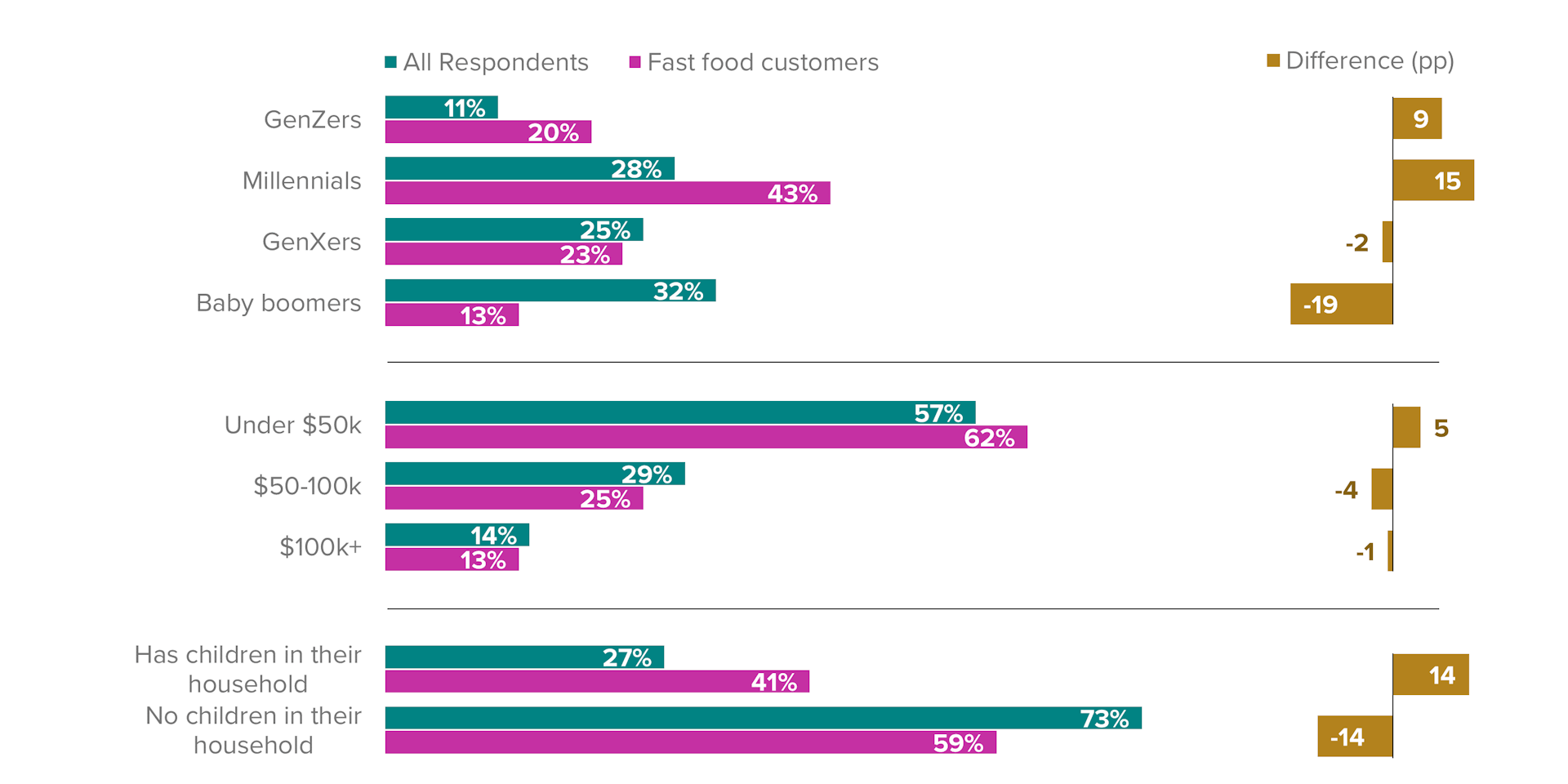

Fast food purchasers skew low income, with kids

Rising fast food prices may show up in the overall CPI basket, but the consumers most impacted are those who frequent these establishments. Proprietary data from Morning Consult Intelligence tracking brand usership sheds light on who these customers are: Consumers who make purchases at some of the top fast food chains in the U.S. more than once a week are more likely to be lower earning, younger, black or Hispanic, and to have children than the population at large.

Fast food customers skew younger, lower income and more likely to have kids

Morning Consult Intelligence customers can access the platform here. If you are interested in learning more about our audience profile data, reach out to your Morning Consult contact or email [email protected].

Many of these same demographic indicators are associated with greater financial strains. In previous analysis, we’ve reported on how lower earning cohorts are falling behind their high income peers in their perceptions of the strength of their household finances and the economy at large. Elevated food prices may play a role in this, as we’ve previously reported that these prices above all else weigh heavily on consumer sentiment. Debt is another factor exacerbating financial vulnerability, with low earners reporting monthly debt-to-income ratios that are higher and rising faster than those of high earners. Furthermore, weaker credit scores among this group is potentially making these debts more expensive to service.

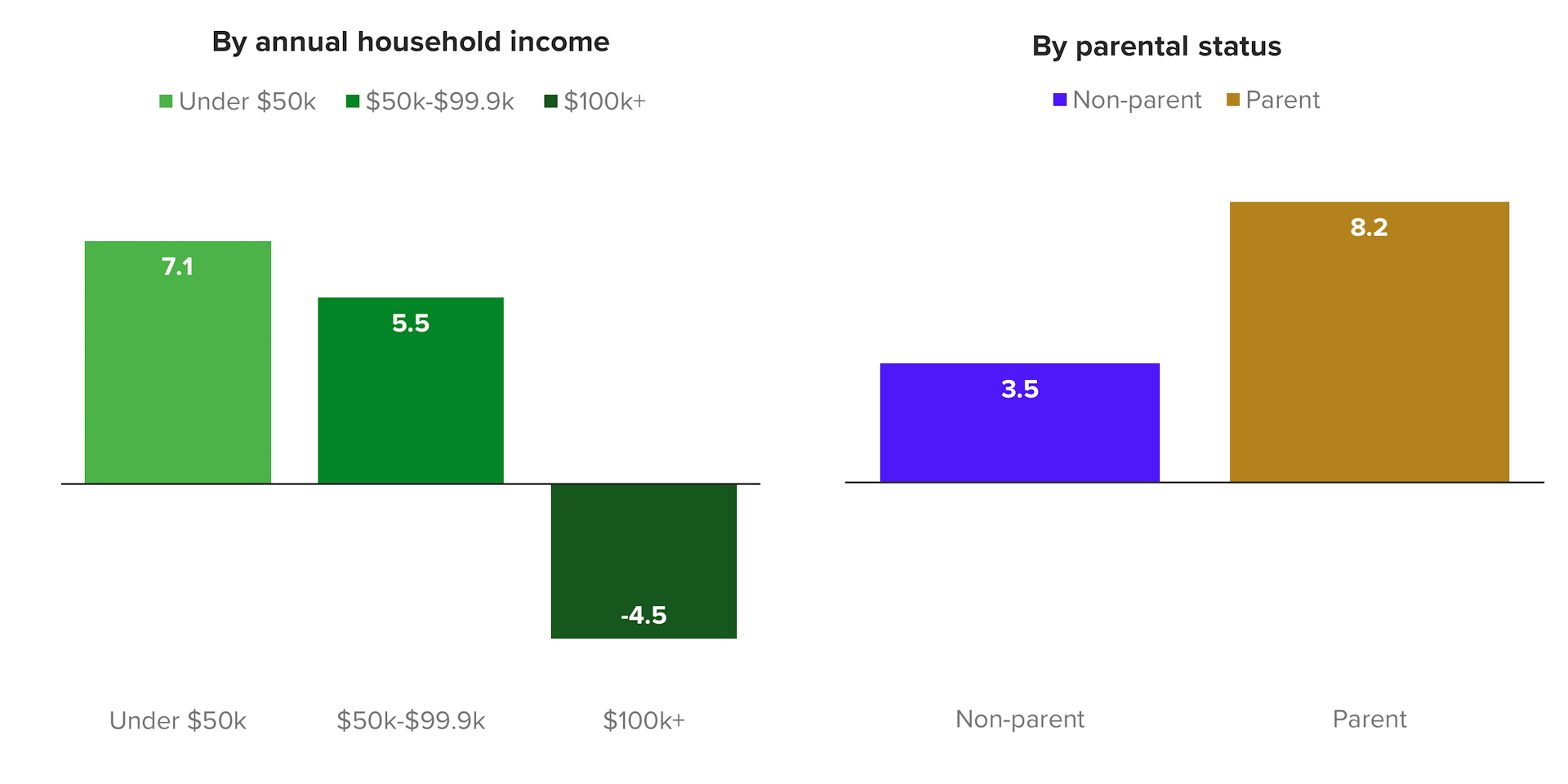

Parents on average tend to report higher household incomes than nonparents, however their reported monthly debt burdens are also much larger and faster-growing than those of non-parents. With kids effectively acting as a cost multiplier when it comes to restaurant meals, soaring fast food prices may feel like salt in the wound for parents when it comes to keeping up with the rising cost of living.

High inflation may be weighing on fast food purchases

Rising prices are discouraging restaurant purchases among fast food chains’ core customers. Morning Consult’s data on Price Sensitivity at restaurants, which tracks the prevalence of consumers walking away from prospective meal purchases due to high prices, has jumped in the past year for low earners and parents.

Price sensitivity jumped most for low earners, parents

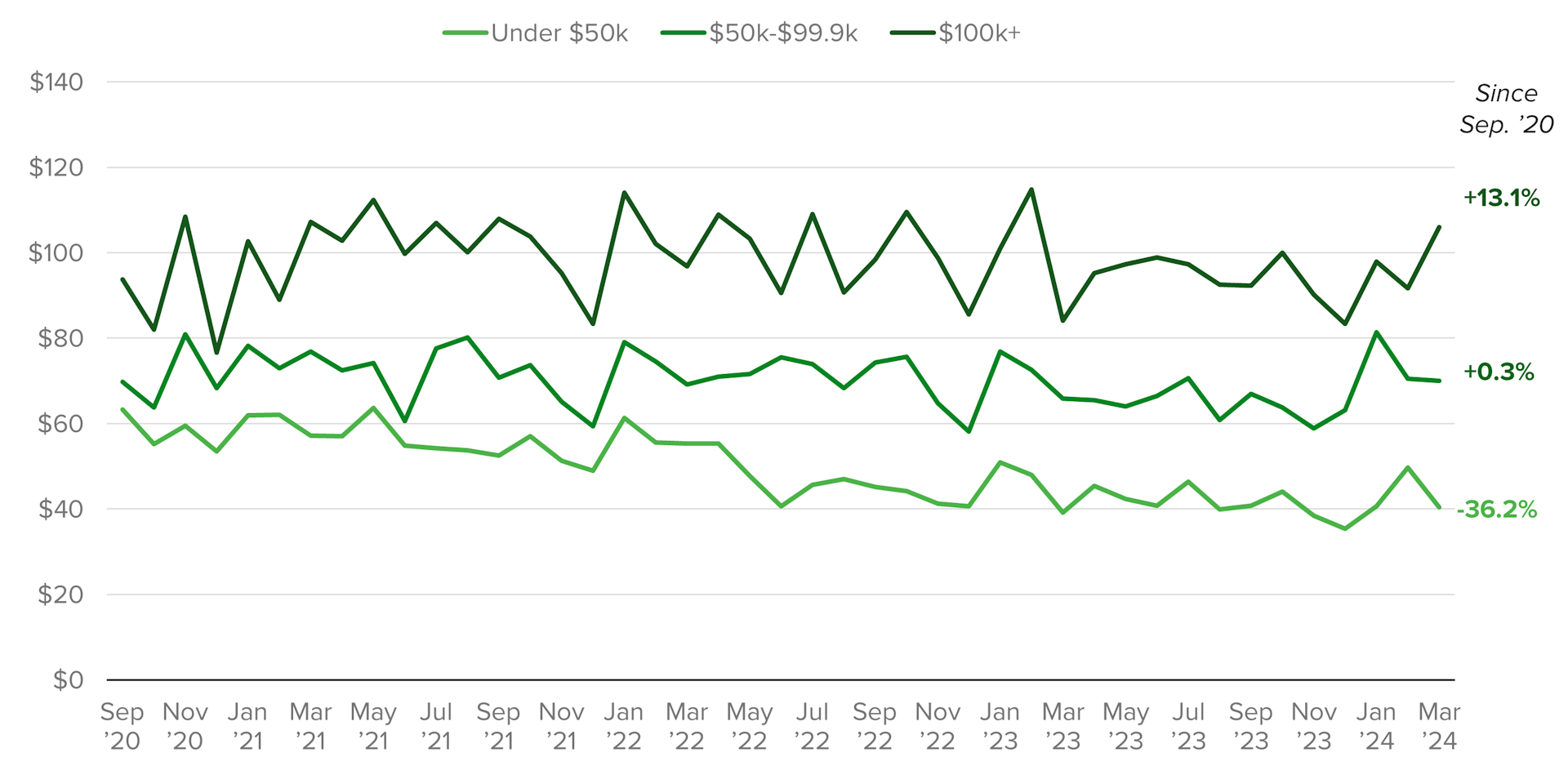

Restaurant spending overall has followed starkly different trajectories for low earners compared with high earners over the past few years. After adjusting for inflation and seasonal factors, adults from households earning less than $50,000 per year reported spending 36% less on restaurant purchases in March 2024 compared with September 2020 when tracking began. Comparatively, adults earning $100,000 or more said they spent 13% more at restaurants, while the middle income group’s spending trended flat.

Low-income households have slashed total restaurant spending

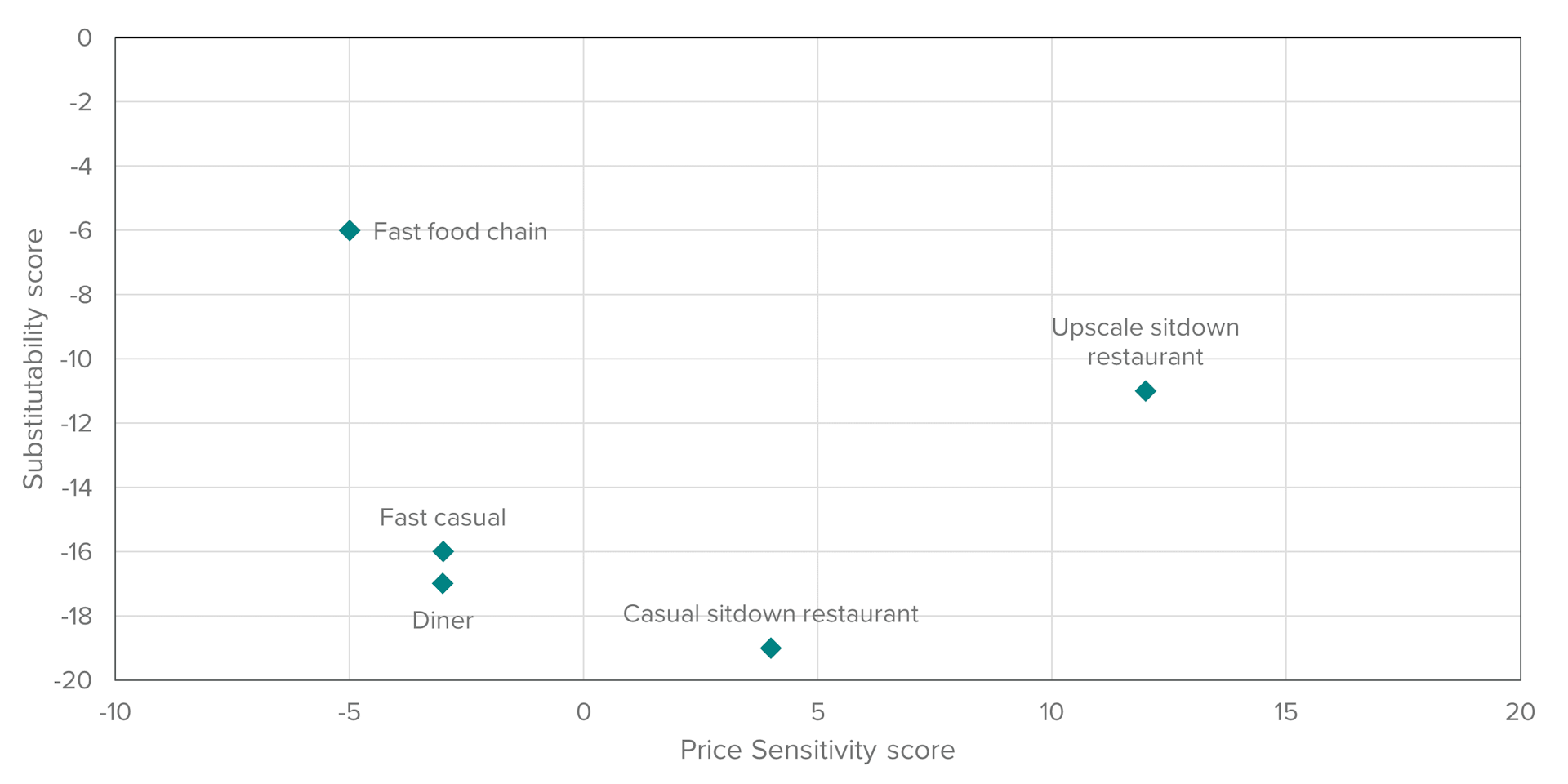

For fast food restaurants specifically, Morning Consult’s research suggests that cost cutting is likely to take the form of trading down. Relative to other restaurant categories, fast food–the cheapest option–had the lowest Price Sensitivity score, but the highest Substitutability score, meaning consumers were most likely to opt for cheaper alternatives at these establishments. In practice, this could mean fast food customers are choosing cheaper menu items or eliminating extras like sides, drinks or desserts.

With fast food purchases, consumers cut back rather than eliminate

Food is an essential purchase, and for those seeking to optimize affordability, groceries or fast food are likely the top options. On a cumulative basis, grocery prices increased just as much as restaurant prices did over the past three years, so for fast food customers the cost benefit from cooking at home may not be sufficient to outweigh the convenience benefit of a drive-through meal. Even so, fast food’s customers are enduring tighter financial conditions than the population at large, potentially hurting their willingness and ability to spend freely on ready-made meals.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]